Selecting the right cloud accounting software for better financial management is a crucial decision, as it has a direct impact on your business outcomes. Sage Intacct is a leading cloud-based ERP solution that dramatically improves your finance team’s productivity with AI-enabled accounting processes and advanced reporting features.

Through our interaction with hundreds of buyers considering deploying this solution to manage their financial operations, we have put together a list of the most asked questions about Sage Intacct to help you make an informed purchase decision.

Top 9 Sage Intacct Questions, Answered

1. Can I Migrate Data From My Existing Accounting Software into Sage Intacct?

All your existing general ledger (GL) and journal entries can be smoothly migrated to Sage Intacct. To ensure the migration process is error-free, the financial data must be converted into a compatible format, including the date and field format. This requires your existing data to be mapped with the Sage Intacct data structure. Our implementation services team helps you in data migration and testing, ensuring your financial reports, invoices, accounts payable, and more are all in place.

2. What are the Core Modules Offered in Sage Intacct?

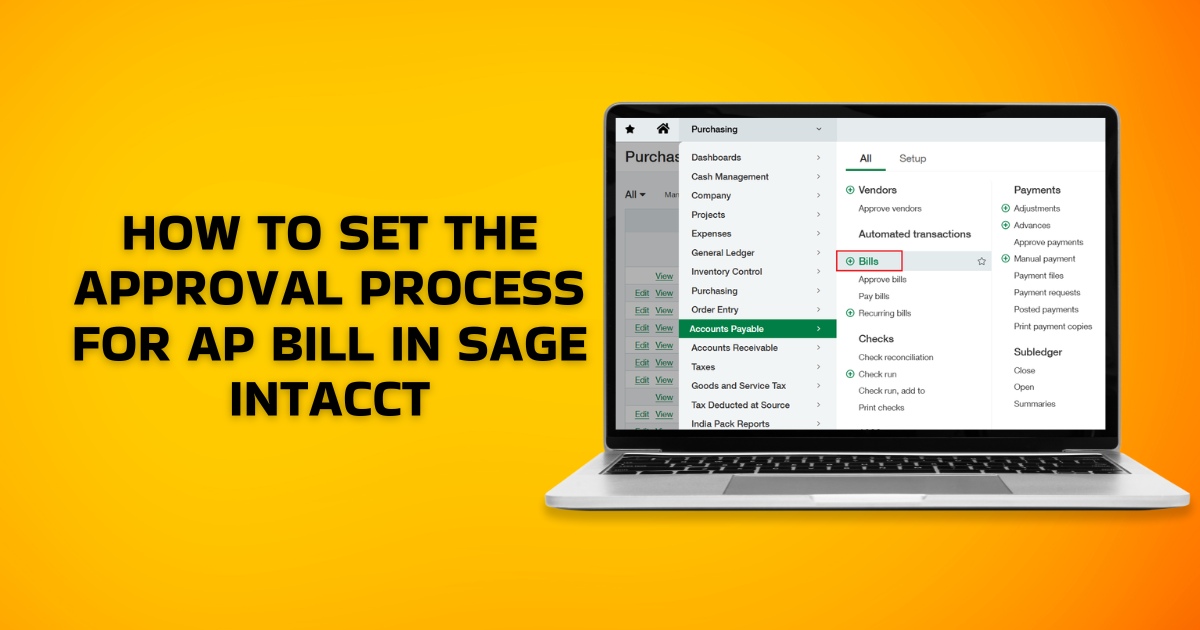

At its core, Sage Intacct is built to streamline financial management. Keeping finance in focus, there are various modules included as part of the standard offering, such as purchasing, order management, cash management, general ledger, accounts receivable, accounts payable, financial reporting and dashboards. Some advanced modules include multi-entity consolidations, project accounting, and time and expense management, among others.

3. Is Sage Intacct Suitable for Multi-entity, Multi-location Businesses and for those that Deal in Multiple Currencies?

Sage Intacct offers a centralised platform to consolidate multi-entity, multi-location operations. Whether you want to fetch reports from a specific location or compile financial data from multiple business units, Intacct enables rapid consolidation of transactions. For businesses operating globally in various currencies, the system automatically handles conversions and generates consolidated reports.

4. Does Sage Intacct Manage Payroll?

Sage Intacct allows real-time access to data on payroll, employees, and related financial records to help you make better decisions. You can instantly view payroll liability on a single dashboard and gain faster insights without the hassles of manual data entry and data duplication efforts and errors.

5. Do I Have to Pay Extra When Intacct is Updated?

Software updates are part of maintenance and improvement services, and they are included in your subscription costs. Since Sage Intacct is a cloud-based solution, the updates occur seamlessly over the internet without causing any disruption to your operations.

6. How will Sage Intacct Improve My Financial Operations?

Sage Intacct gives you complete control over your finances by keeping your spending within budget. You can track expenses vs. budget, automate bank reconciliation, and monitor spending status. Besides, you can set custom spend validation rules and get instant alerts if spending exceeds a pre-defined limit. This minimises variances so that all your purchases are within budgeted range. Stay updated on cash inflow and outflow with real-time dashboards.

7. Can I Automate Reporting Using Sage Intacct?

Sage Intacct has 150 pre-built reports, customisable dashboards, besides the ability to generate quick custom reports. With its AI-embedded platform, the software can post transactions to the GL account in real time. It classifies invoices, extracts essential data, and is equipped to meet the diverse financial reporting requirements of company stakeholders. It also ensures the timely detection of errors and fraudulent transactions while helping you predict cash flow and identify financial risks in advance.

8. Is Sage Intacct Compatible with Other Software Systems?

Sage Intacct cloud accounting software uses open APIs and web services for seamless integration with other cloud-based software services. From accounts receivable automation and payments to HR and payroll integration, the system is compatible with various cloud services and ERP software like Sage X3, enabling easy extension of your organisational capabilities.

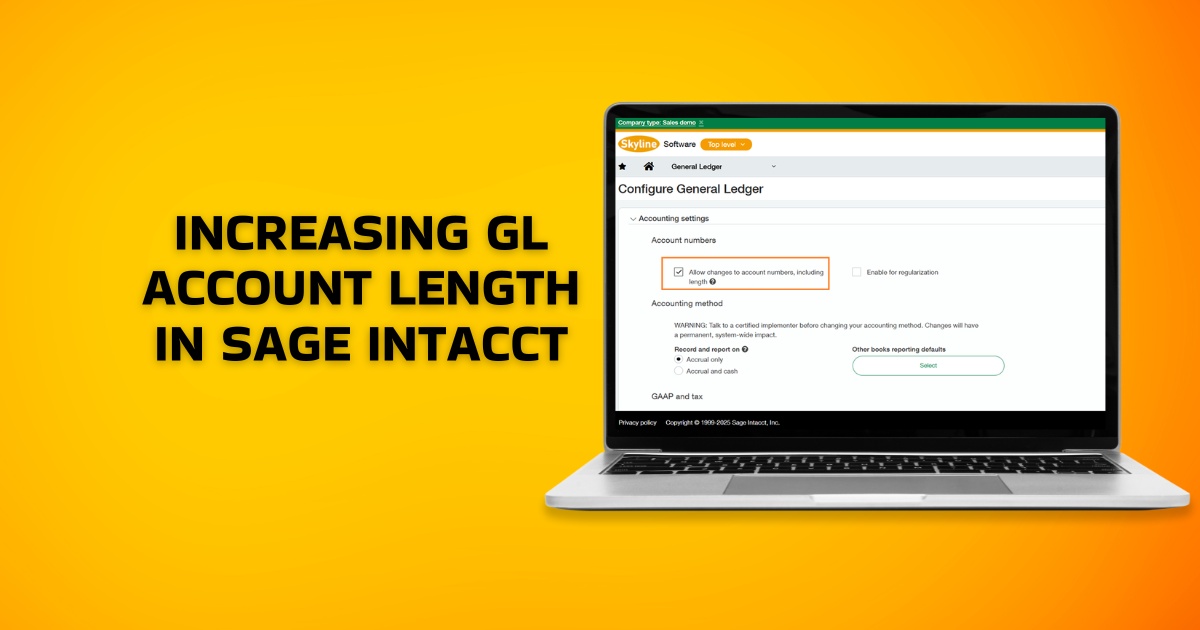

9. Can Sage Intacct Streamline the Chart of Accounts?

The Chart of Accounts primarily consists of five accounts, including assets, liabilities, equity, income, and expenses. As businesses grow, new revenue sources or asset classes can make the chart of accounts complex. Cloud and AI-based Intacct reduces complexity in your accounting processes by intelligently organising your GL codes. Its multi-dimensional reporting simplifies cost analysis across multiple projects, departments, and locations.

Conclusion

Before you choose a cloud finance solution for your business, it is crucial to get answers to the questions most important to you. If you are planning to implement Sage Intacct or compare similar solutions, we hope the above questions have answered your queries.

As an AI-powered cloud accounting software, Sage Intacct is built to offer you better financial clarity, data-driven insights, and advanced reporting capabilities. To get more information on how it can benefit your business, please visit us at Sage Intacct.

Other Sage Intacct FAQs

1. How Much Will Sage Intacct Cost Us?

The costing of Sage Intacct depends on multiple factors, such as the number of users, the modules opted for, the level of customisation, integration, and automation required by your organisation. When you on-board with a trusted Sage Intacct partner, you get transparent costing and ongoing support for existing operations and expansion.

2. Which Industries Can Use Sage Intacct?

Sage Intacct is deployed across various industries. Some of the common sectors where it is used include financial services, hospitality industry, non-profit organisations, professional services, franchise operations, and healthcare.