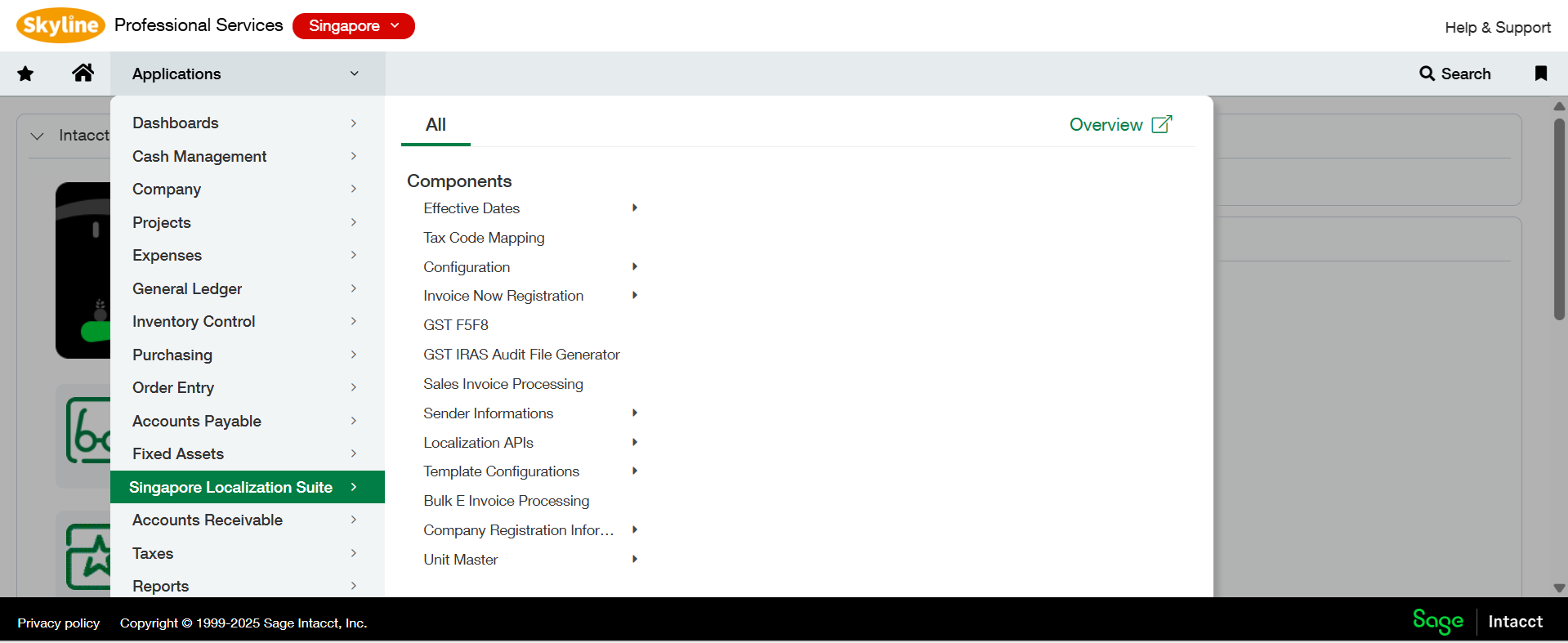

Singapore Localization Suite for Sage Intacct

Take control of tax and invoicing compliance with an intelligent, scalable, and fully integrated suite for Sage Intacct, specifically built for Singapore.

Get in touch

The Simpler Way To Manage GST and e-Invoicing Compliance

Singapore Localization Suite is a GST and invoicing compliance module for Sage Intacct that enables you to manage accounting and compliance requirements in line with Singapore’s statutory regulations. Built specifically for the Singapore market, this suite ensures that your financial processes — from GST management to e-invoicing — comply with IRAS standards while maintaining automation, accuracy, and efficiency. With our end-to-end implementation and consulting services, organizations can seamlessly navigate Singapore’s tax environment while leveraging Sage Intacct’s global capabilities.

Key Features of Singapore Localization Suite

Scale your local operations with confidence, as our Singapore localization suite offers powerful features to meet IRAS and SFRS requirements while automating core financial processes through various Sage Intacct modules.

GST Compliance and Reporting

Automate GST calculation with built-in tax configurations that support multiple GST codes, tax rates, and reporting requirements.

Peppol E-Invoicing Integration

Send & receive e-invoices through the InvoiceNow network, built on the Peppol standard, for faster, error-free billing.

Localized Financial Reporting

Generate IAF (IRAS Audit File), financial statements, and tax reports in formats tailored to local statutory requirements.

Multi-Entity and Multi-Currency Support

Operate across entities, regions, and currencies with centralized financial visibility and control, supported by our expert Sage Intacct implementation.

Automated Tax Validation & Audit Trail

Ensure data accuracy with automated tax validations, preconfigured tax templates, and maintain a complete audit trail.

Why choose Sage Intacct Singapore Localization Suite?

Aimed at empowering businesses in Singapore, the suite ensures strict and timely compliance with the local regulations within Sage Intacct’s intelligent cloud platform. By replacing manual, error-prone processes with automation, it helps you save time, minimize compliance burdens, and gain real-time financial insights for better decision-making.

➡️ IRAS-Compliant Tax & E-Invoicing:

Stay aligned with Singapore’s GST and Peppol e-invoicing requirements.

➡️ Automated Compliance:

Reduce manual effort with system-driven tax calculations and validations.

➡️ Localized Financial Insights:

Access real-time, Singapore-specific reports for accurate decision-making.

➡️ Global & Local Integration:

Manage Singapore entities alongside global operations with ease.

➡️ Scalable & Future-Ready Platform:

Stay compliant as regulations evolve and business expands with Sage Intacct’s scalable ecosystem.

Why Businesses Trust Sage Software for Singapore Compliance?

⏩ Hands-on experience with Singapore market requirements and regulatory frameworks

⏩ Proven capability in compliance-focused Sage Intacct implementation

⏩ Cater to unique business requirements and develop results-driven strategies

⏩ Certified consultants and implementation specialists dedicated to client success

Comprehensive Services For Client Success

We provide end-to-end support to implement Singapore legislation with our Sage Intacct services, primarily through system configuration, customization, integration, and process design. These services ensure your business meets all compliance requirements set by local regulations.

✔️ Implementation & Configuration

✔️ Compliance & Localization

✔️ Customization & Integration

✔️ Process Design & Optimization

Industries Served by Sage Intacct in Singapore

FAQs

What is Sage Intacct Singapore Advanced Tax Suite?

The Singapore Advanced Tax Suite is an add-on module designed to help businesses comply with IRAS regulations. It automates GST calculation, reporting, and Peppol e-invoicing, ensuring accuracy, speed, and full compliance with Singapore’s tax laws.

What Type of Businesses Can Benefit From the Singapore Tax Suite?

The suite is beneficial for both SMEs and large enterprises that operate in Singapore or manage Singapore entities, as it provides a unified, transparent, and efficient method to simplify compliance.

Can Sage Intacct Generate GST Return Reports Automatically?

Yes. The system generates IRAS-compliant GST Return (F5) reports automatically based on posted transactions, saving time and eliminating manual data entry.

Does Sage Intacct Support Electronic Tax Filing to IRAS?

Currently, Sage Intacct prepares IRAS-compliant tax reports and files that can be uploaded directly to the IRAS portal. Direct electronic submission integration is under future consideration.

Which industries in Singapore can benefit from Sage Intacct?

Sage Intacct serves a wide range of industries, including Professional Services, Financial Services, SaaS & Technology, and Nonprofits — providing flexibility for businesses of all sizes.

Schedule Product Tour

"*" indicates required fields