Malaysia Localization Suite for Sage Intacct

Meet the highest standards of tax compliance and ensure faster e-invoicing with a centralized and connected Sage Intacct localization suite built for Malaysia.

Get in touch

Your Key to Malaysia Compliance is Here

Malaysia localization suite for Sage Intacct is an advanced functional module designed to help companies effortlessly comply with Malaysia’s applicable tax and e-invoicing requirements. As a fully integrated part of your Sage Intacct solution, it enables error-free compliance with local obligations and helps maintain financial reporting precision across business units.

The suite is pre-configured with Malaysian tax logic, so you don’t have to manually calculate SST or worry about MyInvois formats. Our deep expertise in Sage Intacct implementation strengthens your core processes and minimizes compliance risks, while enabling you to consolidate financials across multiple entities within Malaysia & outside.

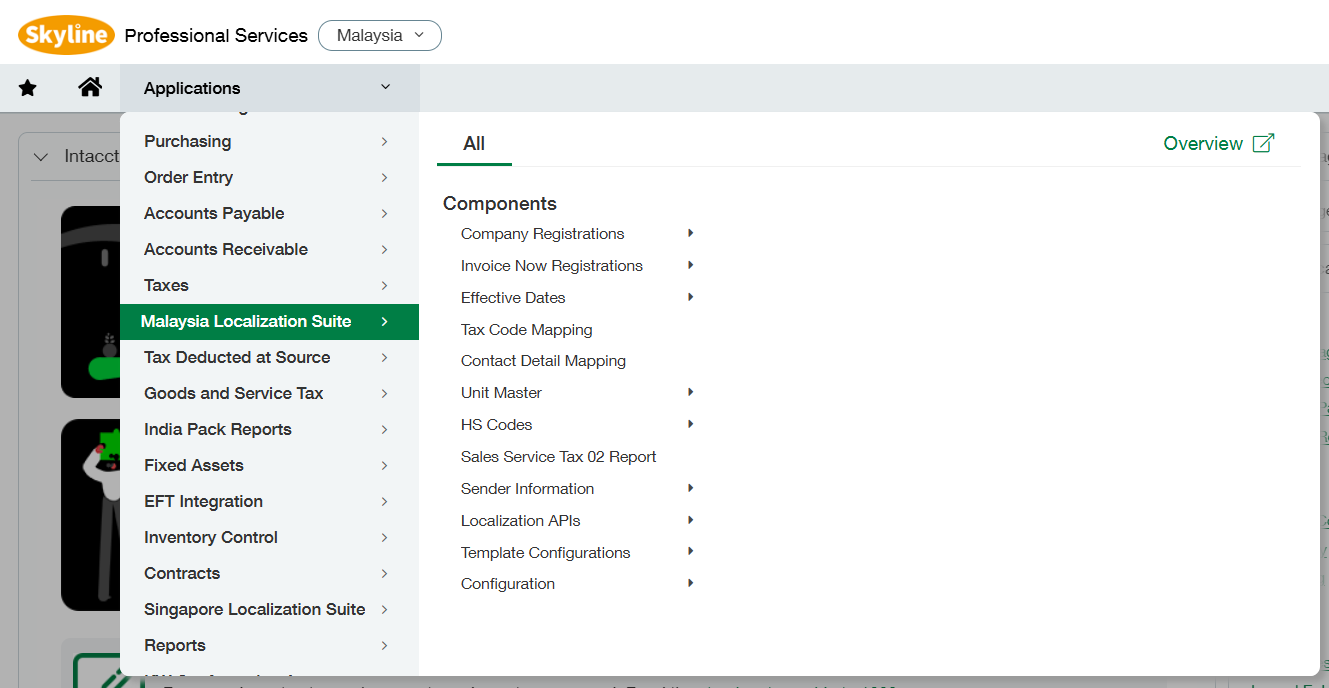

Primary Features of Malaysia Localization Suite

The Malaysia localization suite for Sage Intacct automates tax calculations and invoice processing, ensuring accuracy and transparency. Local compliance capabilities, complemented by other Sage Intacct modules, drive immediate value for your organization.

Sales & Service Tax Compliance

Map SST tariff codes for precise tax application and quickly produce SST-02 returns, with dedicated templates for both Sales Tax and Service Tax.

Withholding Tax Management

Automate withholding tax application in line with LHDN/IRBM regulations. Ensure correct and automatic tax deductions, track tax liability, and maintain a clean ledger.

Compliant E-invoicing

Seamlessly generate, submit, and receive e-invoices through the MyInvois portal under the LHDN framework, supporting faster processing and full tax compliance.

Configurable Tax Framework

Easily adapt to evolving Malaysian tax regulations with a flexible and configurable framework that continuously updates following regulatory changes.

Audit-ready Reports

Access audit-ready reports in a format that meets the requirements of Malaysian tax authorities and auditors, and enable informed decisions with real-time financial insights.

Audit Trails & Access Controls

Prevent unauthorized transactions and incorrect entries with built-in access controls & validations, and ensure financial transparency with an audit trail of your transactions.

Manage all your Compliance from a Single Platform

Save time and stay worry-free with the Malaysia Localization Suite that automates all your compliance processes within the simple, unified interface of Sage Intacct.

➡️ Built for Malaysian Regulations

Align with local tax and e-invoicing requirements while maintaining global compliance.

➡️ Automated Compliance Processes

Minimize manual effort through intelligent tax calculations and standardized workflows.

➡️ Stronger Financial Control & Visibility

Gain real-time financial insights to make informed and timely business decisions.

➡️ Risk-free Operations

Eliminate the complexities of Malaysian regulations with a controlled and auditable system.

➡️ Scalable Cloud Platform

Grows with your business while ensuring security, performance, and operational flexibility.

Sage Software, Your Trusted Partner for Malaysia Compliance

⏩ Specialized in the deployment of end-to-end Sage Intacct services

⏩ Hands-on experience to meet Malaysia’s compliance requirements & tax regulations

⏩ Implementation experts and certified consultants dedicated to your success

⏩ Tailored solutions to meet specific business needs for faster adoption & scalability

Expert Services For Every Stage of Your Growth Journey

We deliver end-to-end support for implementing Malaysia localization through our comprehensive Sage Intacct services. From system configuration to advanced integrations, we ensure your operations achieve global-standard efficiency while remaining 100% compliant with statutory LHDN regulations.

✔️ Implementation & Configuration

✔️ Compliance & Localization

✔️ Customization & Integration

✔️ Process Design & Optimization

Industries Served by Sage Intacct in Malaysia

FAQs

What is included in the Malaysia Localization Suite?

The suite includes localized support for Malaysian statutory requirements, such as Sales & Service Tax (SST), Withholding Tax, and e-invoice processing.

Does the Solution Support Both Sales Tax and Service Tax?

Yes, it supports accurate handling of both Sales Tax and Service Tax based on transaction type, ensuring consistent tax application and reporting.

Can it Support Multiple Entities Operating in Malaysia?

Yes, the suite is designed to support multi-entity and multi-location operations in Malaysia while maintaining standardized local compliance and centralized visibility.

How does the Suite Help with Regulatory Compliance?

By automating tax calculations and invoice validation, the suite delivers audit-ready transparency, ensuring total LHDN compliance while eliminating manual errors.

Which Industries typically use Sage Intacct in Malaysia?

Industries such as professional services, technology, manufacturing, healthcare, nonprofits, retail, and education commonly use Sage Intacct in Malaysia.

Schedule Product Tour

"*" indicates required fields