At first, we will see what is E-invoicing?

E-Invoicing is a process in which invoices are validated electronically through GST Network (GSTN) for further use on the common GST portal. In this process, an identification number will be issued for every invoice which is selected for E-invoicing by the Invoice Registration Portal (IRP) to be managed by the GST Network (GSTN). All invoice information will be transferred directly from IRP to the GST portal.

Invoice details will be uploaded via API integration, either directly or through a GST Suvidha Provider (GSP).

Benefits of E-Invoicing:

- Automating the tax return filing process, saving time and cost for filing the invoices manually.

- Real time integration with IRP portal/government portal, which generates IRN number and QR code for respective sales invoices in a fraction of seconds.

- E-invoice details like QR code and IRN number are displayed on the tax Invoice print.

- Reduces mismatch and data entry errors.

- Eliminates frauds.

- Improves account reconciliation.

- Information about each transaction is stored, helping reduce the surveys required by the tax authorities.

Sage X3 provides an automated solution for filing E-Invoices with a single button click, eliminating the manual filing of invoices.

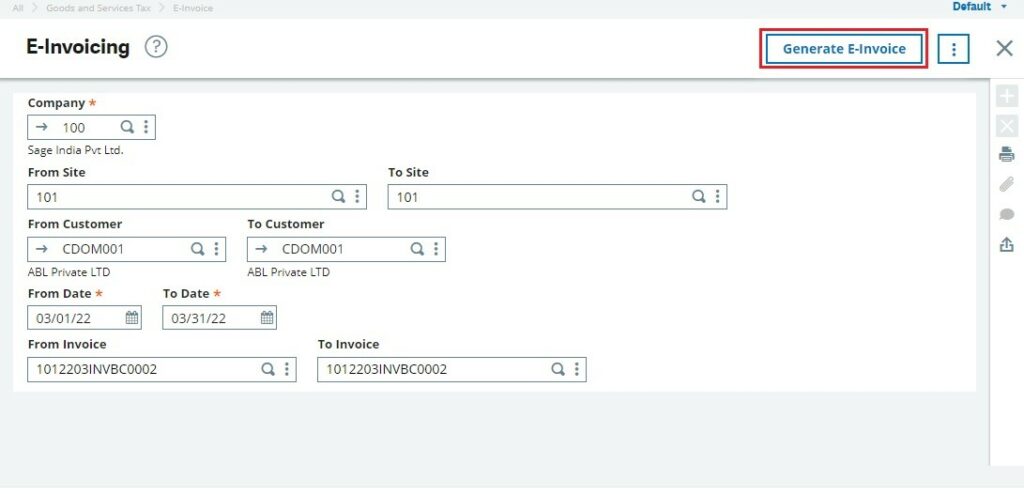

Path: Goods and Services Tax à E-Invoicing

As soon as Sales invoice is booked in the system, user can directly do the E-invoicing for specific Sales Invoice from sales invoice screen itself or user can generate E-Invoicing for bulk of invoices from separate E-invoicing screen which is available under GST module in Sage X3. Once, E-invoice is generated by user, IRP system (government portal) returns, IRN number and QR code of the sales invoice which get automatically captured in GST module to the specific Sales Invoice.

[E-Invoicing Screen]

1. User has to select desired invoice by entering the required parameters on the E-invoice screen – Company, Site, Customer, Date and Invoice Number in E-Invoicing screen.

2. On clicking ‘Generate E-Invoice’ button, selected invoices will be sent to govt. portal/IRP System and in response to that ‘IRN’ (Invoice Reference Number) along with digitally Signed ‘QR code’ will be received from IRP system/government portal which will be capture in the Sage X3 against each sales invoice and the same will get printed in the respective report.

3. After generating E-Invoice successfully, one pop-up message will be displayed.

[E-Invoice Generation – Successful]

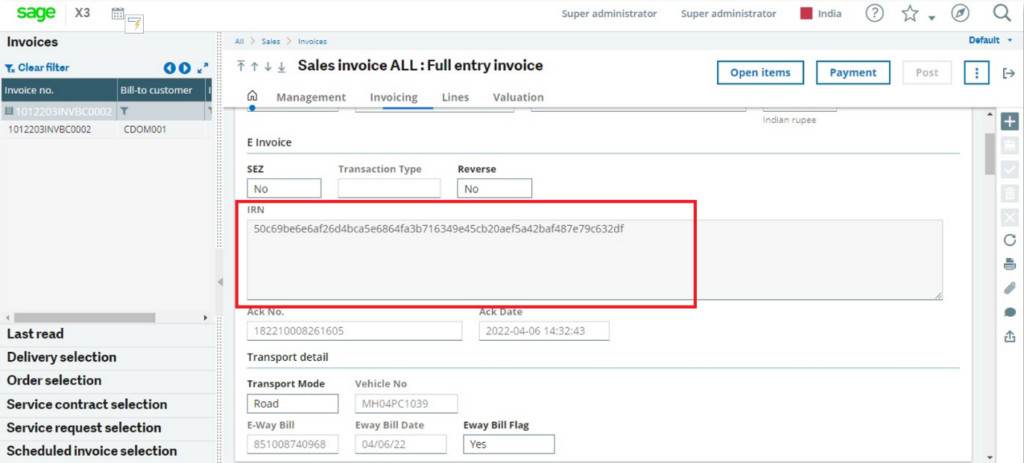

And IRN Number will be captured on the Sales Invoice screen. Refer below screenshot:

[Invoice Entry after E-Invoice generation]

IRN (Invoice Reference Number): After uploading the E-invoice on the GSTN portal, a unique number is generated by GSTN which will be referred as IRN Number.

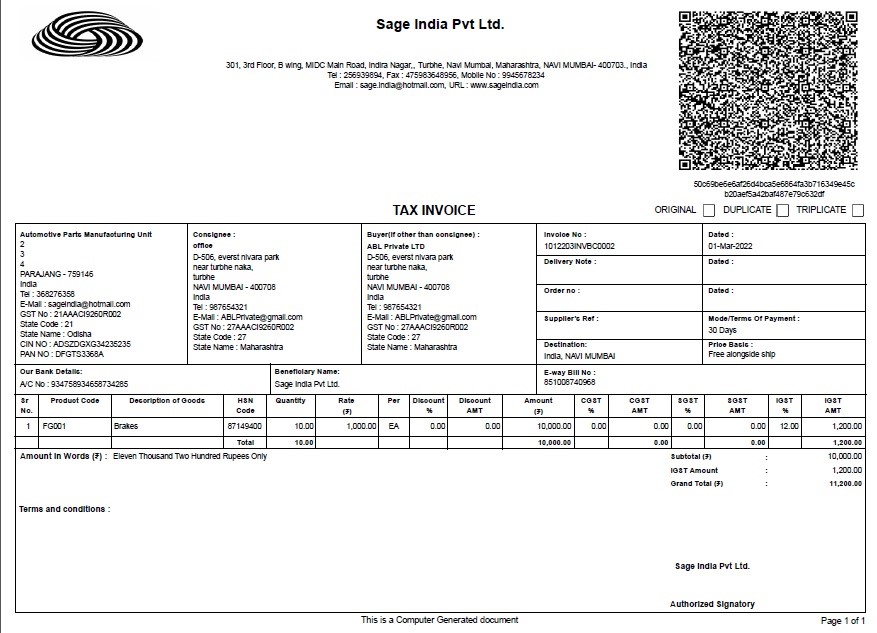

How does the Tax invoice prints look like along with E-invoice details?

Below screen shots shows the TAX INVOICE form where IRN and Signed QR Code which is received from IRP system is printed:

[Tax Invoice report with IRN and QR code details]

In this way, users can easily do the E-invoicing process in Sage X3.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.