What Is Actual Cost?

Think of actual cost as the true amount you spend on a project or task—no guesses involved. Unlike estimates, which are like guessing the cost of a shirt, actual costs are the real deal, like the price you see at the checkout. It’s the money you actually hand over to make something happen, giving you a clear picture of what it really costs to get things done.

What is Actual Cost Formula?

Calculating the actual cost involves summing up all the expenses associated with a specific task, project, or operation. The formula for determining the actual cost can be expressed as:

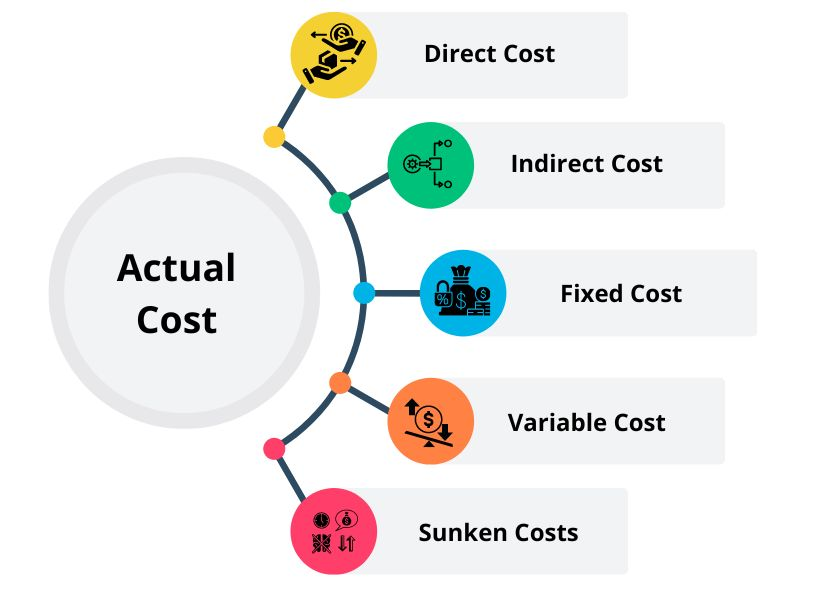

Actual Cost = Direct Costs + Indirect Costs + Fixed Costs + Variable Costs + Sunken Costs

Direct costs are charges that are directly related to the manufacturing of products or services. These might include the cost of inventory, labor, and manufacturing supplies. Indirect costs, on the other hand, are costs that are not directly related to a specific product or service but are required for general business operations. These may include overhead costs like as rent, utilities, admin salaries, and depreciation of assets.

What are the Components of Actual Cost?

1. Direct Costs:

These are the expenses directly linked to making a product or delivering a service. For instance, if you’re baking a cake, the direct costs would be the ingredients like flour, sugar, and eggs.

2. Indirect Costs:

These are expenses that aren’t directly tied to a specific product or service but are still necessary for running your business. Examples include rent, utilities, and administrative salaries.

3. Fixed Costs:

These are expenses that stay the same regardless of how much you produce or sell. Rent for your store or office space is a fixed cost.

4. Variable Costs:

These are expenses that change based on how much you produce or sell. For example, the more cakes you bake, the more you’ll spend on ingredients.

5. Sunken Costs:

These are costs that have already been incurred and can’t be recovered, regardless of future decisions. If you’ve already spent money on advertising for a product that flopped, that money is considered sunk costs.

Calculating Actual Cost with Example:

Calculating actual cost is like solving a puzzle with two main pieces: direct costs and indirect costs. Direct costs are the things you spend on to make something, like materials and wages. Indirect costs are other necessary expenses, like bills and administrative salaries, that help your business run smoothly. Let’s see actual cost example below:

Suppose you run a small bakery and want to calculate the actual cost of producing a batch of cupcakes. Here’s how you might break it down:

Direct costs:

- Ingredients (flour, sugar, eggs, etc.): ₹500

- Packaging materials (boxes, wrappers): ₹100

- Labor (wages for the baker): ₹300

Indirect costs:

- Rent for the bakery space: ₹2000

- Utilities (electricity, water): ₹500

- Administrative expenses: ₹200

Total actual cost = Direct costs + Indirect costs Total actual cost = ₹500 (ingredients) + ₹100 (packaging) + ₹300 (labor) + ₹2000 (rent) + ₹500 (utilities) + ₹200 (administrative) Total actual cost = ₹3600

So, the actual cost of producing one batch of cupcakes is ₹3600. This calculation helps you understand the true cost of your production and pricing decisions.

Benefits of Actual Cost:

1. Informed Decision-Making:

Understanding how much your projects actually cost gives you the power to make smart choices. It’s like having a secret weapon that helps you decide where to spend your money wisely, ensuring you get the most bang for your buck in business.

2. Cost Control:

Keeping track of your expenses helps you keep a tight grip on your spending. It’s like having a budgeting buddy who helps you identify where your money is going, so you can cut back on unnecessary expenses and make every dollar count towards running your business smoothly.

3. Accurate Pricing:

When you know exactly how much it costs to make something, you can set the right price to make sure you’re not losing money. It’s like putting the correct price tag on your product to make sure you’re making enough to cover your costs and still make a profit.

4. Budget Accuracy:

Actual cost data acts like a mirror for your budget, showing you the real picture of your finances. It’s like a wake-up call that prevents you from dreaming about money you don’t have. By comparing actual costs to your budget, you stay grounded and avoid financial surprises.

5. Performance Evaluation:

Comparing how much you thought you’d spend to how much you actually spent gives you a clear picture of how your business is doing. It’s like checking if you’re on track with your spending plan and seeing if your business is hitting its financial goals.