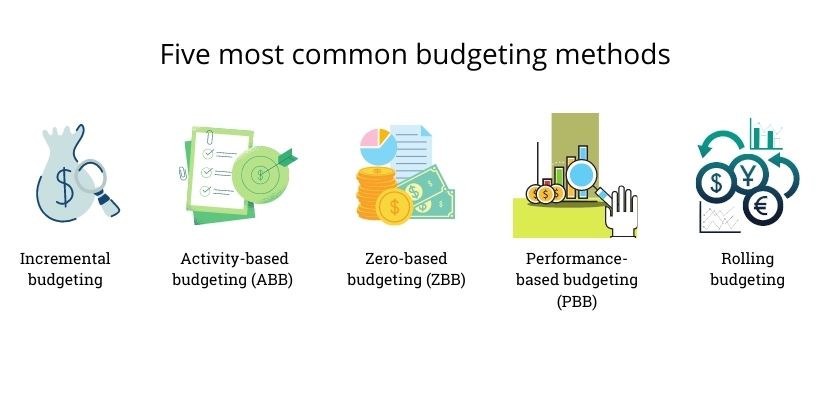

Summary: Choosing a suitable budgeting method for your business can be challenging. Finding what fits best to your business model and needs requires paying attention to numerous factors — operational, financial, supply chain & logistics, market trends, and customer preferences. This article will focus on the five most common budgeting methods that companies across industries implement and shed light on their benefits and drawbacks.

1. Incremental budgeting

In this method, the current year’s budget is obtained by adding or subtracting a percentage from the last year’s actual figures. It’s one of the easiest ways to calculate the budget and is used by most companies. This method makes sense if the primary cost drivers don’t change every year.

Advantages of Incremental budgeting

- Very simple to calculate: Companies have access to the financial records of previous periods, which makes it reasonably easy to use this method.

- Simple to standardize: You only have to add or subtract a proportion of the percentage to the previous period’s data. Therefore, this method takes less time than other methods and requires less hands-on training.

- Ensures continuity: This method ensures that each business function receives a steady flow of funds that helps resolve inconsistencies.

Disadvantages of Incremental Budgeting

- Resource allocation is compromised: Incremental budgeting focuses on increasing the share of funds and the distribution of resources systematically for all departments. Therefore, sometimes resources are allocated even to those business functions that are no longer functional or provide very little output.

- May lead to overspending: Managers might tighten their department’s budget if the senior management reduces the budget allocation for their department. This step ensures that they get access to a substantial fund after a few years.

- Foul number play: Managers might overstate expenditures and understate revenues so that the difference between the two turns the scale in their favor.

- Antagonistic to innovation: Incremental budgeting is a very conservative statistic that fails to encourage and reward innovative ideas.

2. Activity-based budgeting (ABB)

As the name suggests, this method determines the total cost required to achieve the anticipated level of activities in a particular duration. It takes a top-down approach for identifying and analyzing the activities that drive cost. This rigorous analysis allows allocating resources for achieving activities that were planned beforehand.

For example, you are a washing machine manufacturer. Your next year’s forecast projects a cumulative sale of 1,000 units. Each washing machine has the same Cost of Goods Manufactured (COGM) of Rs. 10,000. Then, according to ABB, you should compute a budget of Rs. 1,00,00,000 (1,000 * Rs. 10,000).

Advantages of Activity-based budgeting

- Manages expenses: ABB accounts for each activity that incurs a cost, which helps improve the bottom line.

- Improved efficiency: ABB provides a comprehensive view of the overall business expenses by linking each department and function with their spending. Organizations can identify and fill performance gaps and capture new opportunities using this data.

- Reduce redundancy: ABB identifies functions or activities that don’t add value to the companies’ output. Thus, such processes can either be removed or corrective measures can be taken against them.

Disadvantages of Activity-based budgeting

- Doesn’t focus on long-term strategy: ABB focuses on short-term goals, but it fails to brainstorm activities that may help the company earn profits in the long run.

- Drains significant resources: ABB expands the workload and requires a substantial amount of time and resources.

3. Zero-based budgeting (ZBB)

Companies that adhere to the ZBB method of budget accounting build a budget from scratch. They start from the baseline of “zero,” meaning that analysts can examine and justify expenses of all sizes — big or small.

ZBB helps determine which activity adds real value to the business and is worth keeping and which ones can be discarded.

Advantages of Zero-based budgeting

- Enhanced efficiency: ZBB focuses on existing needs and future goals instead of past results, ensuring that each business activity adds value to the business in the long run and is aligned with the overall business strategy.

- Increased accuracy: ZBB ensures that each business department gets the required amount of funds they need.

- Judicious use of resources: ZBB identifies and eliminates bad organizational habits, thereby freeing up resources that could otherwise be used for other critical functions.

Disadvantages of Zero-based budgeting

- Requires considerable training: Companies need to conduct rigorous hands-on training sessions to learn how to use this method.

- Requires substantial time and resources: Organizations might see their stockpile of resources draining because ZBB involves creating and maintaining massive amounts of reports and paperwork.

- Fails to assign variable budgeting: ZBB fails to allocate a budget for business functions or departments, such as Sales & Marketing and Research & Development, that have intangible outcomes.

4. Performance-based budgeting (PBB)

In performance-based budgeting (PBB), specific goals are identified and marked. Then budgets are defined for each of those activities, and a set of actions are planned.

This methodology focuses on the objectives and goals that an organization wants to achieve, and therefore it helps build a result-oriented culture. Companies also design Key Performance Indicators (KPIs) to facilitate this practice.

Advantages of Performance-based budgeting

- Identify activities of critical importance: This budgeting method helps the management identify which functions/activities are more aligned with the business goals. Thus, the management can prioritize resources for those activities and leave the rest.

- Assign ownership: PBB identifies and holds accountable the entities responsible for carrying out a specific function.

Disadvantages of Performance-based budgeting

- Stimulates subjectivity: This method forces decision-makers to make decisions based on intuition instead of logic and rationale.

- Increases engagement: PBB conducts bottom-up and top-down buy-ins that reduce employee engagement.

5. Rolling budgeting

In this method, companies continuously add a new budget period after the previous one expires. The rolling budget methodology involves the gradual extension of the existing budget model. Therefore, a business that follows this methodology always has a budget that extends 12 months in the future.

Advantages of Rolling budgeting

- Forecast better: Stay informed about the strengths, weaknesses, opportunities, and challenges of your business.

- Eliminate risk: This methodology supports scenario planning that helps improve decision-making.

- Enhance performance: Polish your financial plans and brainstorm better business strategies.

- Stay relevant to your business goals: Ensure that your budgeting and planning processes are aligned with your business objectives.

Disadvantages of Rolling budgeting

Drains a lot of time: Budgeting becomes a monthly or quarterly activity instead of a yearly function.

STAY UPDATED

Subscribe To Our Newsletter