Definition: Absorption cost accounting is an accounting method to help the business in determining the total value of the inventory. It is crucial for the business to understand its value and how to use it. In this blog, let’s learn more about its advantages, disadvantages and how it works.

What is Absorption costing?

Absorption costing is also known as full costing. It is an accounting method to value inventory and includes factors such as the cost of the materials, direct labour and also variable and fixed manufacturing overhead costs.

In the absorption costing method, anything that is a direct cost used to manufacture a finished product is included. It also encompasses fixed overhead costs which is a segment of product cost. Product manufacturing also includes other costs such as employee wages(physical labour involved in the making of the product), the raw materials used in the production process and the entire overhead costs used in the production(utility costs).

Components of Absorption costing

The following costs comprise the overall absorption costing and it goes into the product costs. They are listed below —

- Direct material (DM)

- Direct labour (DL)

- Variable manufacturing overhead (VMOH)

- Fixed manufacturing overhead (FMO)

The period cost comes under the absorption costing which is listed below. And it does not go with the cost of the product, rather they are expensed in the period that occurred.

- Variable selling and administrative

- Fixed selling and administrative

Direct costs are those directly related to the expenses of a particular product or a service. The costs include expenses related to raw materials, labour and any other direct expenses that are incurred during the processes.

Indirect costs are also expenses, but they cannot be directly traced to a particular product or a service. These expenses are also known as overhead costs. Utilities, rent and insurance are included as indirect costs. It is assigned to a product or service depending on any product or service such as the total number of units produced or the number of direct labour hours needed to manufacture the product.

As mentioned earlier, the absorption costing includes both direct and indirect costs. So it means that the cost per unit includes both direct and indirect expenses of that unit. The formula for absorption costing is given below. Here the total production costs are divided by the number of units produced to determine the expense of each unit.

Absorption Cost = (Direct labour costs + Direct material costs + Variable manufacturing overhead costs + Fixed manufacturing overhead) / Number of units produced.

Also Read : Inventory Valuation with Multiple Costing Methods

Example of Absorption Costing

ABC Enterprises has a large-scale plant with a production capacity of 1 lakh units per year. They produce a high-demand product for various industries. The fixed and variable costs for the previous year are given below.

Fixed Costs:

Manufacturing overhead = Rs. 50,00,000

Variable Costs per unit:

Direct materials cost = Rs. 500

Direct labor cost = Rs. 100

Variable manufacturing overhead = Rs. 50

They fully utilized their production capacity, producing 1 lakh units per year. Keeping 5000 units as safety stock, they sold the remaining inventory of 95000 units at a per unit price of Rs. 200.

Let’s calculate the cost of production per unit using the absorption costing formula.

Production cost per unit = (Fixed manufacturing overhead + direct material cost + direct labor cost + variable manufacturing overhead) / Total Units Produced

Production cost per unit = (50,00,000 + 500 + 100 + 50) / 1,00,000 = Rs. 50

Therefore, ABC Enterprises has to spend approximately Rs. 50 per unit to produce 1 lac units, using the absorption method of costing.

Types of Absorption Costing

Absorption costing can be divided into two types : Full absorption costing and Partial absorption costing.

1. Full absorption costing – This is related to all the expenses associated with manufacturing a product or providing a service. And it includes fixed manufacturing overhead and variable manufacturing overhead costs. In this type, the total expense of a product or service is either absorbed or spread out, over the manufactured units. The cost per unit manufactured comprises both fixed and variable costs related to that particular unit.

2. Partial absorption costing – Here, only some of the costs are included with manufacturing a product or providing a service. And only a small portion of fixed assets are included in the cost of per unit produced. Plus, the remaining fixed overhead costs are regarded as the period cost and are expensed in the period in which it is incurred.

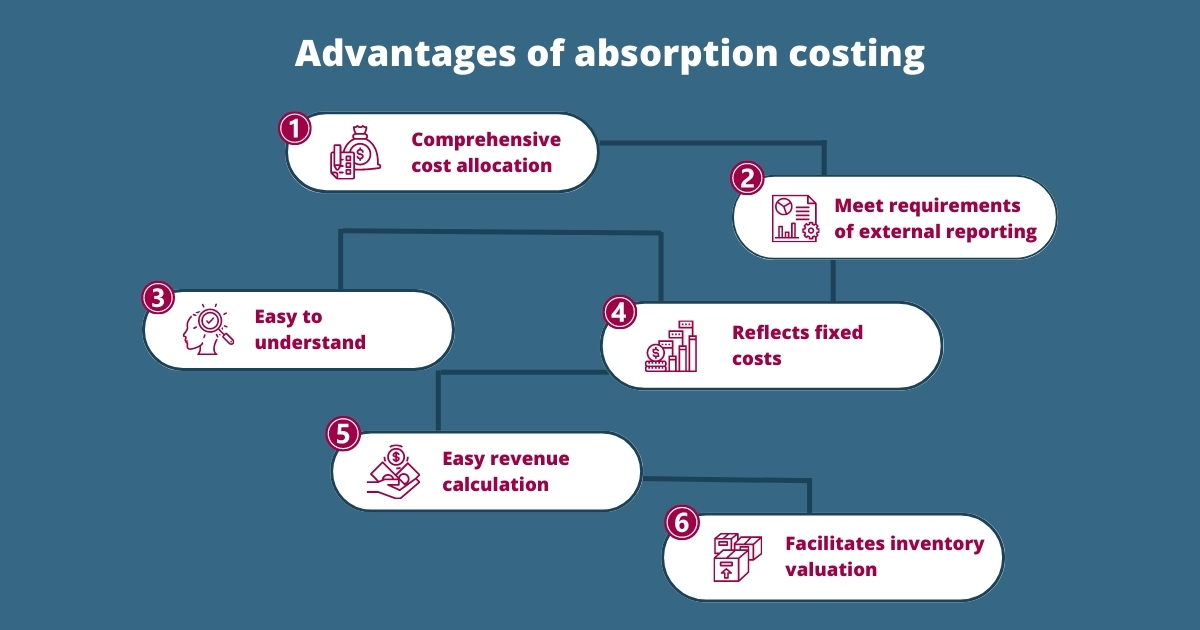

Advantages of Absorption Costing

Absorption costing is one of the methods of costing to determine the value of the inventory. Here, it gives more accurate accounting for the ending inventory as the cost associated with it are associated with the full cost of the inventory. Enumerated below are some of its benefits.

1. Comprehensive cost allocation

Absorption costing covers all product costs, which include both variable and fixed costs. So it offers a more accurate reflection of the total cost of manufacturing a product or providing a service that allows better decision-making.

2. Meet requirements of external reporting

Absorption costing is vastly accepted for external reporting purposes, such as financial statements. Regulatory bodies require and accept absorption costing for compliance and transparency.

3. Easy to understand

It is a straightforward method which is simpler and makes it accessible to a wide range of businesses, despite their size or complexity. The absorption costing method assigns all costs to units produced, providing a clear view of the total costs per unit.

4. Reflects fixed costs

For the absorption costing method, fixed costs are necessary for production. It allocates fixed costs to units produced and ensures that these costs are accounted for and absorbed by the products. So it allows a just distribution of costs across the product range.

5. Easy revenue calculation

In the absorption costing method, the variable and fixed costs are incorporated to facilitate accurate profit calculation. All the expenses are allocated to the units produced and the profit derived from each unit comprises an equal share of fixed costs. The absorption costing method provides a more detailed view of the profitability of products and services.

6. Facilitates inventory valuation

A portion of fixed manufacturing overhead costs to the ending inventory. And this method aligns with the general accounting principles by providing a more accurate value of the inventory. So Including fixed costs in the inventory value, absorption costing can reflect the total cost of production.

Disadvantages of absorption costing

- If there are major changes in the production volume, absorption costing can lead to distorted cost data.

- It may not provide sufficient information for the decision-making process, unlike other methods such as variables.

- It comprises fixed overhead costs that do not differ from the production volume. So, it is possible that the absorption costing method may not accurately reflect the incremental costs related to manufacturing an additional unit of a product.

Absorption Costing vs Variable Costing: What’s the Difference?

Absorption costing and variable costing are two methods of valuing inventory. In absorption costing, the product cost includes both variable and fixed manufacturing costs. On the other hand, in variable costing, only variable manufacturing costs are assigned to the products, such as direct labour and material costs. Both methods serve a different purpose in accounting.

Comparison Between Absorption Costing And Variable Costing

| Comparison Factor | Absorption Costing | Variable Costing |

|---|---|---|

| Core Definition | Method for determining the total cost of production by allocating both fixed and variable costs to the units produced. | Method where only variable costs are considered for determining the cost of producing goods. |

| Cost Treatment | Both fixed and variable costs are considered as direct costs of the product. | Variable costs are treated as direct product costs. |

| Focus on | Net Profit per unit for comprehensive financial reporting | Contribution per unit for short-term decision-making |

| Profitability Analysis | Calculated after deducting both fixed and variable costs from revenue | Assessed using Contribution Margin (Sales Revenue – Variable Costs) |

| Overhead Categorization | Overheads are classified into Production Administration, Selling & Distribution | Overheads are categorized into Fixed (e.g., factory rent) and Variable (e.g., direct labour linked to production) |

| Impact on Unit Cost | Fluctuates based on changes in opening and closing inventory levels, as costs are spread across units produced | Unit cost remains consistent, irrespective of changes in opening or closing stock levels. |

Conclusion

The absorption costing method comprises all manufacturing costs – fixed and variable costs, in the product cost. It is also referred to as full costing or full absorption costing. It is used to determine the cost of goods sold and ending inventory balances in the income statement and balance sheet. In addition, this method is applied to calculate the profit margin of each unit of product and to decide the selling price of the product. Advanced technology such as an ERP system is a comprehensive solution to help with the absorption costing method.

FAQs

1. What Is The Meaning Of Absorption Costing Method?

Absorption costing is a technique for assigning costs to the inventory by absorbing or including both fixed and variable costs in the product cost.

2. Why Is Absorption Costing Required By GAAP?

Absorption costing is required by GAAP due to the matching principle in GAAP, according to which the business records expenses associated with the manufacturing of products only after selling them. As a result, revenue and the costs associated with earning it are aligned within the sales period.

3. What Is The Key Difference Between Absorption Costing And Standard Costing?

Absorption costing allocates all fixed and variable manufacturing costs to calculate product value, while in standard costing, we value products by using predetermined standard costs for all inputs such as material, labour and overhead.

4. What Is The Absorption Costing Formula?

Production cost per unit = (Fixed manufacturing overhead + direct material cost + direct labour cost + variable manufacturing overhead) / Total Units Produced