What is the meaning of Bank Reconciliation?

Bank Reconciliation is an important process in accounting in which organizations match their bank statements with the transactions that are recorded in their general ledger. Preparing a bank reconciliation statement helps businesses to eliminate possible errors in transactions or bookkeeping.

What is Deposit Date in Bank Reconciliation?

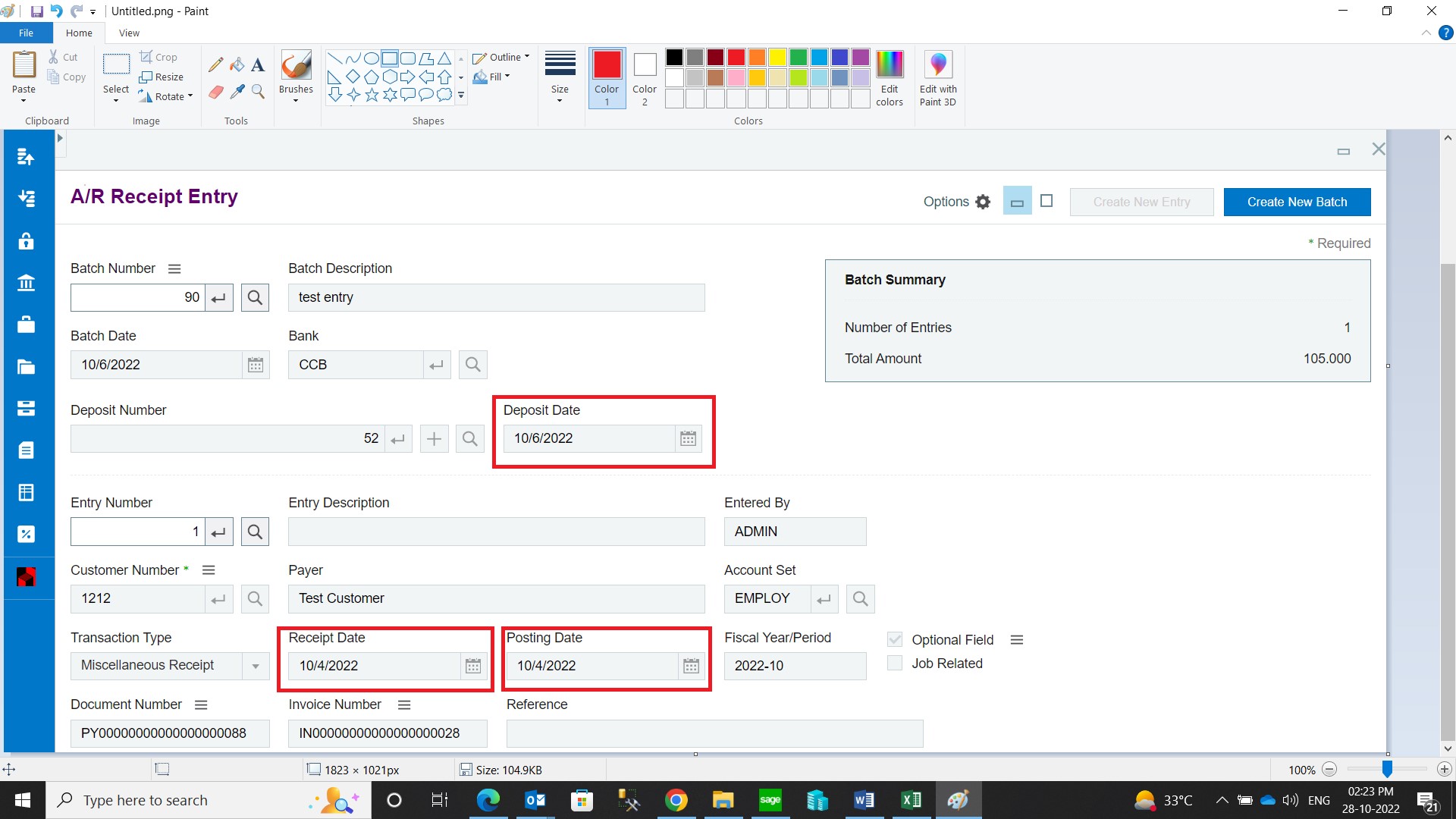

The Deposit date is the date you deposit receipts for a particular deposit number at the bank. In Sage 300 we have the option to enter the Deposit Date along with the Deposit number in the AR Receipt entry screen.

How Can we use the Deposit Date option in Sage 300 ?

As in the below Receipt Entry screen, you can see the Deposit Date is different from the Receipt Date and Posting Date.

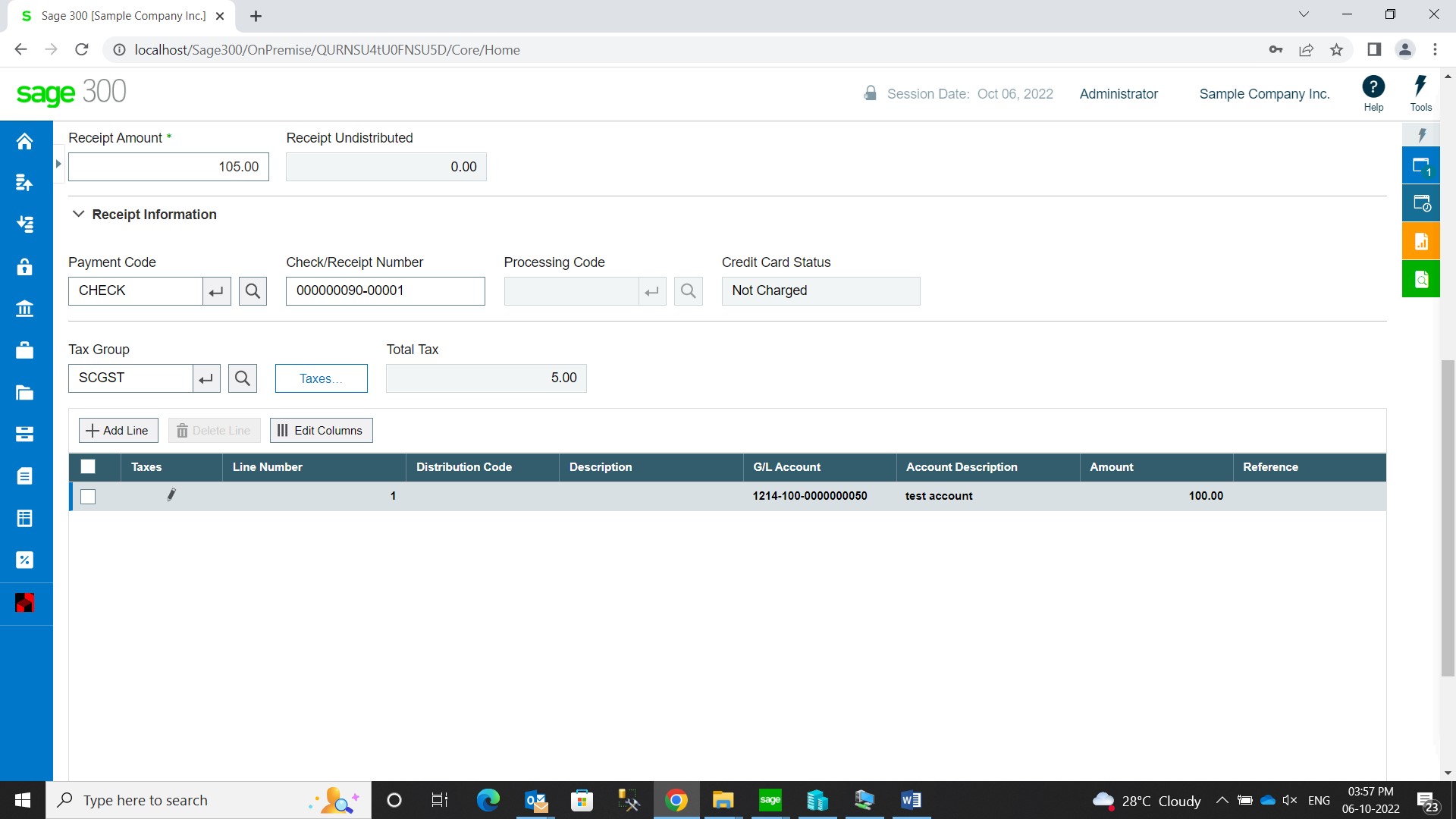

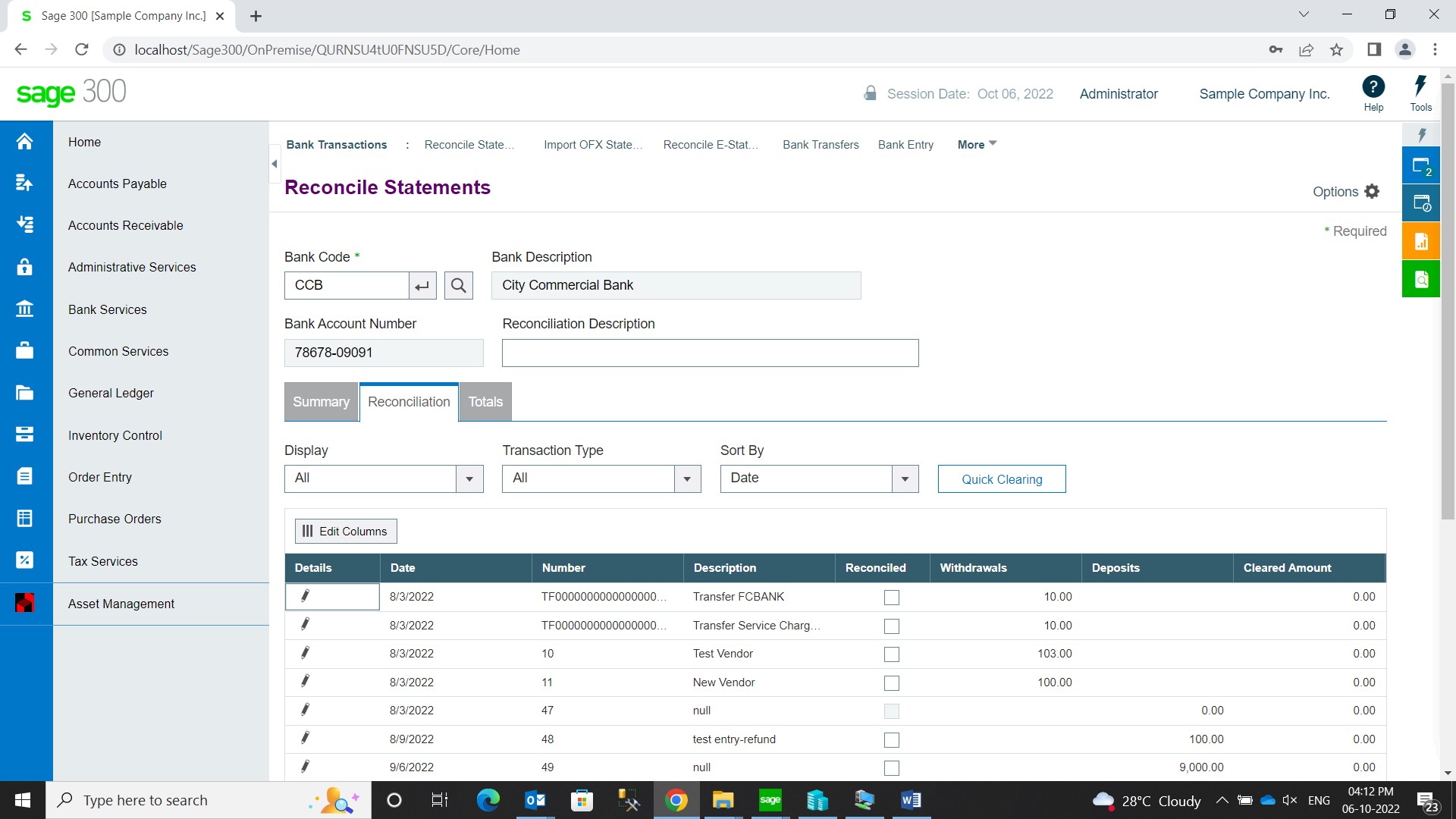

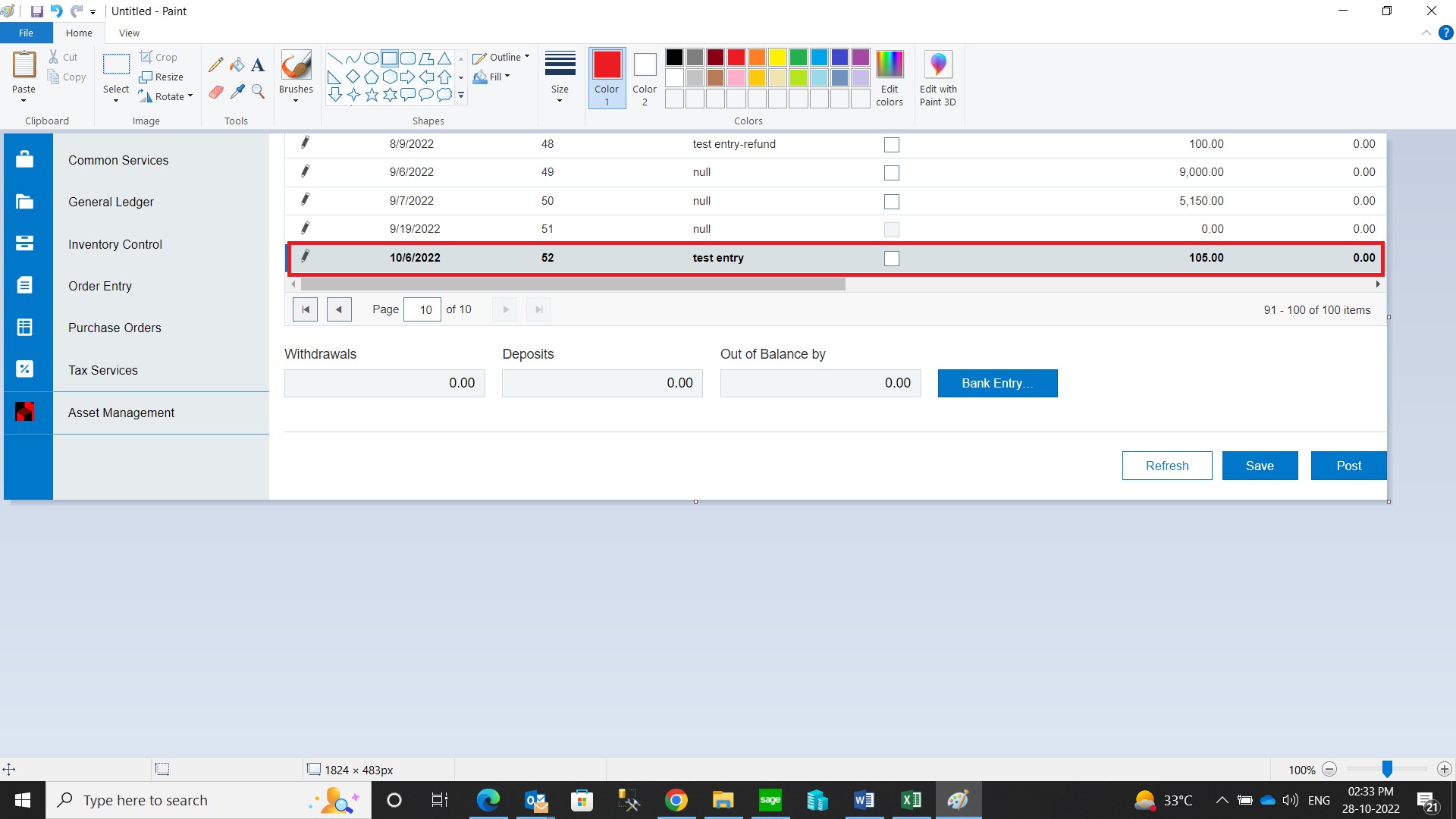

Here in the below screen, you can see in Bank Reconciliation Statement Receipt entry has been reflected based on the Deposit Date

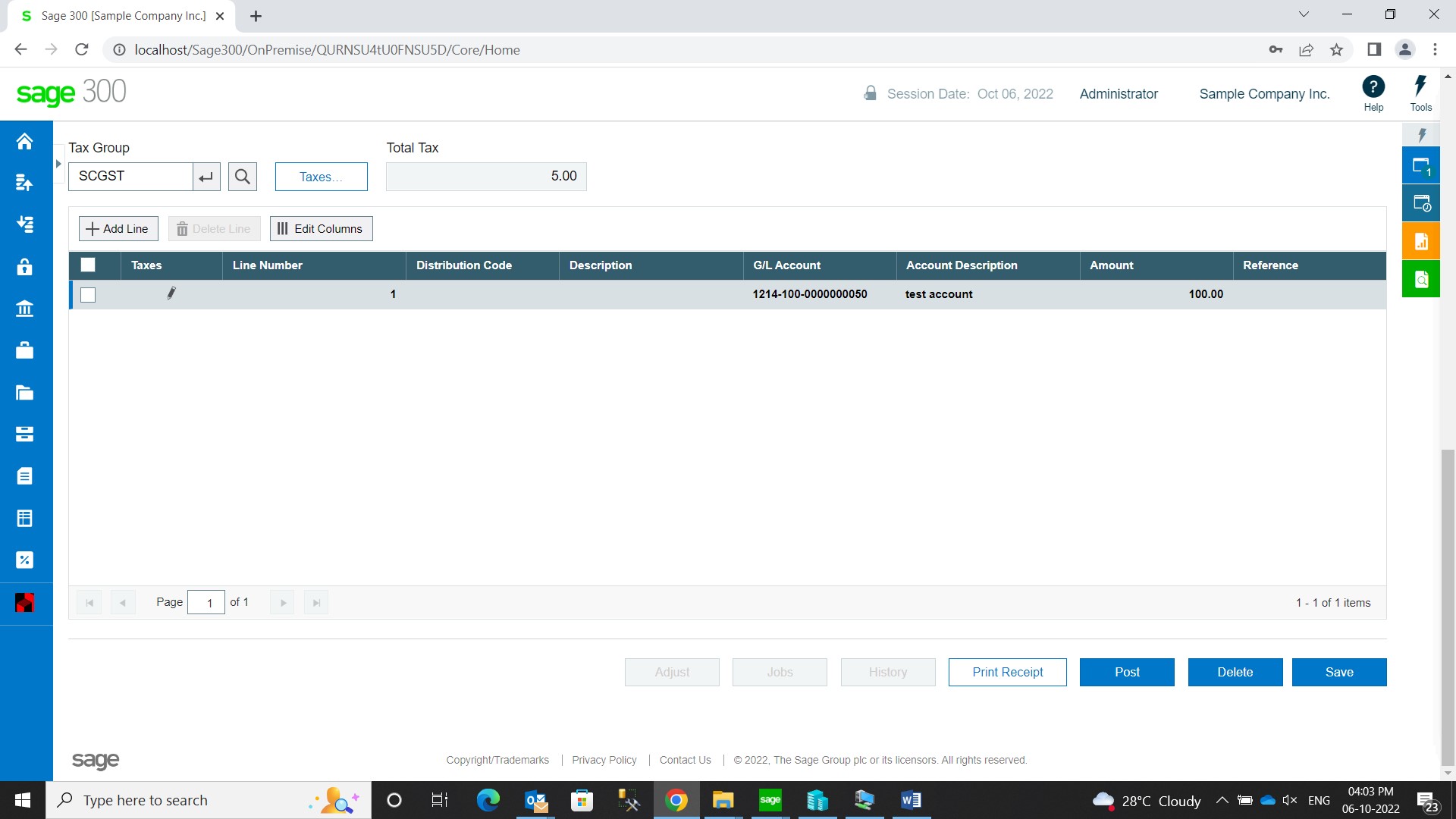

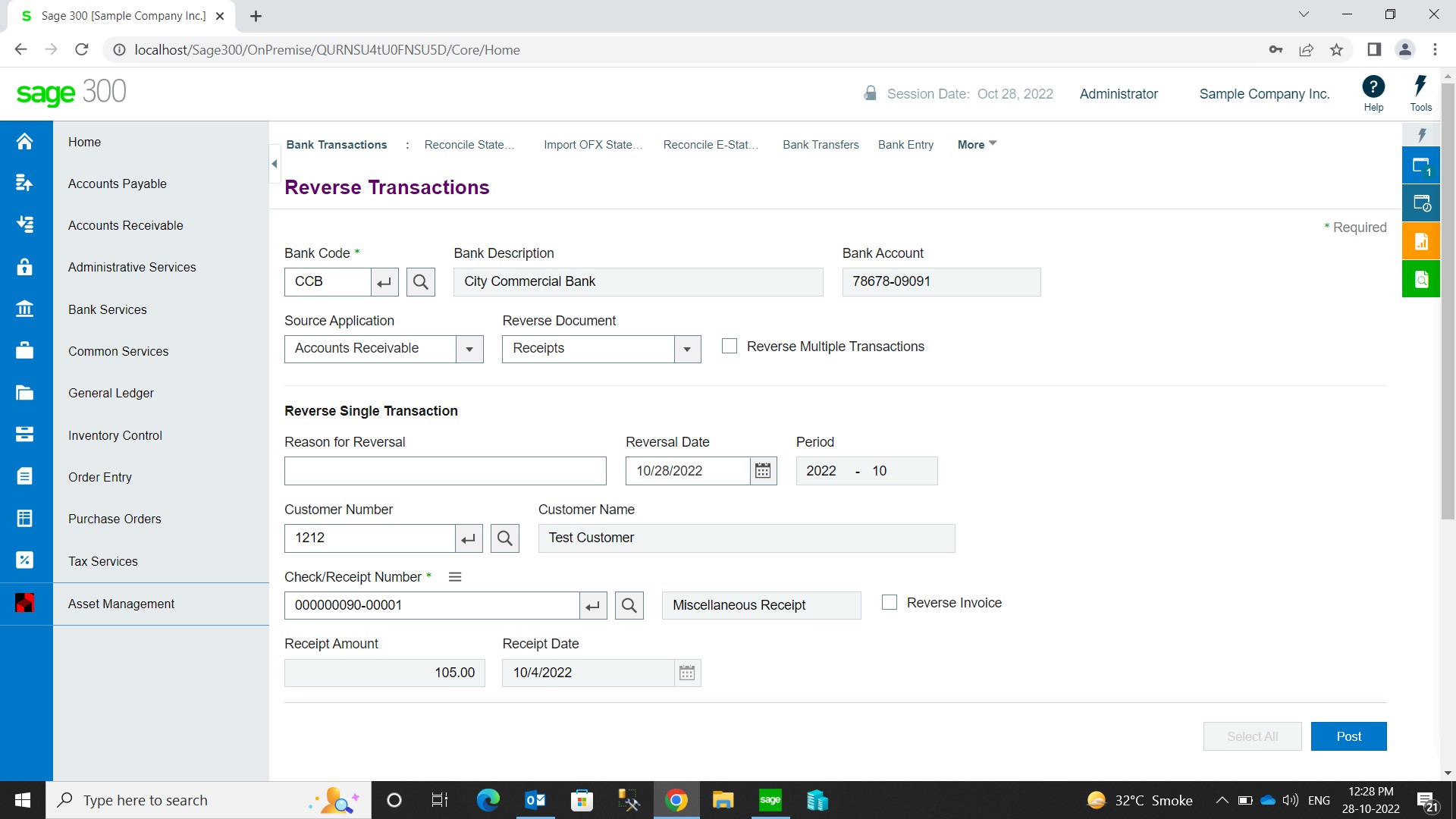

You can reverse the Receipt Entry through Bank Module from the Reverse Transactions screen (In case of a wrong deposit date entered or any other specific reason)

So, basically in the Bank Reconciliation Statement screen, all receipt entries will be reflected based on the Deposit Date.

Sage Software Solutions is a leading IT company with an array of advanced ERP Software solutions. Our proprietary products — Sage X3 and Sage 300 will help you cut your operational expenses, improve business productivity, increase operational efficiency, forge robust customer relationships, and strengthen association with vendors, suppliers, and distributors. So, if you are looking to reinforce your business fundamentals and emerge as an industry leader, then please schedule a call with one of our sales representatives.