Summary: Ensuring high business efficiency requires an interplay of diverse forces. For example, procuring raw materials at a minimum price, understanding changing market conditions and customer preferences, building excellent customer relationships, and distributing the best quality finished products to customers at the earliest. Measuring business success requires valuable data that enables:

- Identifying the pros and cons of your existing business strategy.

- Analyzing business performance through easy-to-read graphs and pie charts.

- Building better business blueprints based on new market challenges and changing customer demographics.

What are Success metrics?

Success metrics are a collection of Key Performance Indicators (KPIs) that determine whether a business is achieving its targets. While each company has a different set of success metrics based on industry-specific challenges, target audience, compliance requirements, and business priorities, effective metrics are measurable, actionable, and result-oriented.

Remember that preparing a list of success metrics becomes easy once you identify your industry challenges. And it also becomes simple to communicate them to business stakeholders without providing much context.

7 types of metrics to measure business success

This blog will shed light on the different types of success metrics that will help you measure business efficiency.

1. Break-even point

A Break-even point refers to the minimum amount a company must earn in a particular period to cover all its expenses and keep itself afloat.

For example, if your total expenses for March 2022 = USD 500,000

And suppose you earn USD 500,000 in the next quarter (April, May, and June). Then, it means you took three months to reach your break-even point.

Tracking and measuring whether your company can meet the break-even point is necessary as it enables:

- You to have enough cash to pay vendors, suppliers, and distributors.

- You have the financial ability to repay your debts.

- Angel investors to understand your financial situation and make up their minds to invest in your company.

For conglomerates, meeting break-even points might be the lowest achievable target. But for startups and new ventures, recovering their expenses is one of the most important targets to achieve.

2. Monthly recurring revenue

Monthly Recurring Revenue (MRR) is a crucial metric for businesses whose primary source of income constitutes service subscriptions. This metric tracks and measures a company’s monthly revenue based on:

- New products bought & services subscribed in a month

- New customers added to the customer database

- Number of customers who abandoned their subscriptions

MRR enables businesses to identify changes in customer behavior and track individual spending over time.

3. Net income ratio

The net income ratio is the resultant profit you get after subtracting expenses from your revenues.

For example,

Revenue = USD 500000

Expenses = USD 200000

Net income ratio = USD 500000 – USD 200000 = USD 300000

This metric allows the senior management to comprehend their current financial situation and check how close they are to achieving their economic targets.

Most companies correlate an increase in net income ratio with better financial performance. But startups and newly established companies might have to wait for a few months (or years) before seeing any positive net income ratio.

Also, remember that it’s essential to factor in the company’s historical financial performance and trends while analyzing the net income ratio.

4. ROI and ROAS

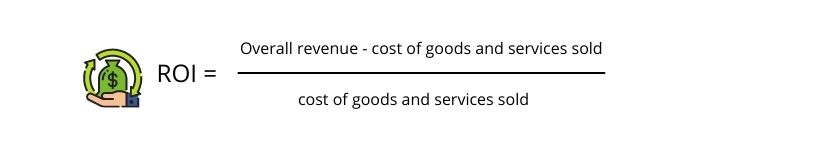

ROI stands for Return on Investment, a ratio between investment and income. You can calculate ROI by subtracting the cost of goods and services from your revenue and dividing the result by the cost of goods and services. The formula below shows how ROI is calculated:

In marketing parlance, ROI measures the money a company makes after spending a particular sum on running a marketing campaign. When used with conversion rates and lead generation metrics, it helps calculate a customer’s average value.

ROI is one of the best metrics to measure your business’ worth. If your organization’s ROI is higher, you have made a worthy investment. If not, you might want to brainstorm better strategies to increase your revenue.

Return on ad spend (ROAS) is critical if you significantly depend on advertising expenses to generate sales. It tracks the precise amount of revenue your ads generate over a specific period.

5. Conversion rate, leads, and bounce rate

Do you have a big marketing budget?

If yes, then you should track the following three metrics:

-

Number of leads generated:

Calculate the total number of potential prospects reached.

-

Number of leads converted:

Calculate the total number of potential prospects converted into full-time paying customers.

-

Calculate the conversion rate:

Lead conversion percentage tells how effective your marketing strategies are in reaching potential clients and converting them into loyal customers.

Bounce rate is the converse of conversion rate. It measures the number of customers who land on your company’s website but leave immediately without scrolling down or making a purchase. The number of bounces against leads generated identifies gaps in advertising, marketing, and user experience.

6. Customer-focused metrics

An expanding or shrinking customer base is the best way to identify the performance of your marketing campaigns. If your customer base is expanding, your marketing efforts are paying off, and people are showing tremendous interest in your products and services. If not, you need to brainstorm effective marketing campaigns to regain the interest of lost customers.

Many companies rely on customer-focused metrics to build sustainable practices and forecast what products customers would most likely purchase.

Here’s a list of the essential customer-focused metrics to measure:

-

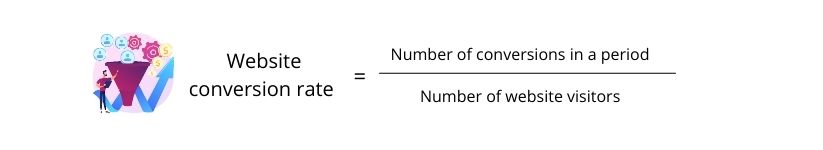

Conversion rate

This metric measures how many customers have done any of the following:

- Filled out a website form

- Downloaded an eBook/guidebook/case study

- Purchased a product

- Subscribed to a service

- Subscribed to the email newsletter

For example, if you want to calculate your website’s conversion rate, stick to the following formula:

-

Customer Health Score

Customer Health Score can be measured by tracking the number of new and old customers and identifying varying customer purchase habits. In addition, this score lays down the foundation for calculating other business-critical parameters, such as and customer retention cost, net promoter score, and customer lifetime value.

-

Customer Satisfaction Score (CSAT)

CSAT measures how satisfied customers are with your products and services and how likely would they spread excellent word-of-mouth to others. Different methods to calculate CSAT include:

a. Customer satisfaction survey

b. Focus groups

c. Post-service

d. In-app surveys

e. Social media monitoring

f. Customer Relationship Management (CRM) surveys

-

Customer Lifetime Value (CLV)

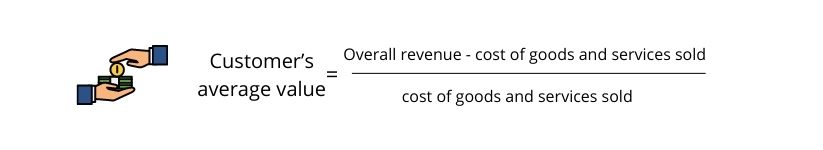

This metric helps determine how much profit a business can generate from a particular customer over a definite period. You can calculate CLV using the following formula:

CLV = Customer’s average value of purchase * Customer’s average frequency of purchase * Customer’s average lifespan

-

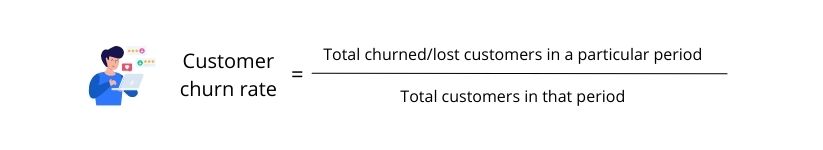

Customer churn rate

This metric determines how often customers abandon doing business with your company. It’s also known as customer attrition rate and provides the number of customers who have:

a. Canceled your subscription

b. Stopped purchasing your products

c. Closed accounts

7. Employee satisfaction

Are your employees satisfied working in your organization?

If yes, then your employee satisfaction rate is high. It means that your employees care about their position and are satisfied doing their job.

Do you know that employee satisfaction corresponds to high customer success?

A customer satisfaction study conducted by combining data from the American Customer Satisfaction Index (ACSI) and Glassdoor employee reviews revealed that each one-star improvement in a company’s Glassdoor rating increased 1.3 points out of 100 customer satisfaction scores.

So, ensure that your employees get a supportive ecosystem as it:

- Decreases employee turnover rate

- Reduces employee training costs

- Increases customer retention rate

How Sage X3 will help you increase your business efficiency?

Sage X3 is an industry-leading ERP software that helps companies across industries to increase their efficiency, improve productivity, reduce administration costs, build robust customer relationships, forecast changing market conditions and customer preferences, and provide real-time insights. It has various modules for managing critical business functions like finance & accounting, sales & marketing, inventory & warehouse, supply chain & distribution, and customer relationships.

The infographic below shows how Sage X3 can multiply your business efficiency.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.