A company tracks its financial transactions by following three golden rules of accounting. They help review, summarize, and report financial transactions to tax collecting authorities, finance watchdogs, and regulators. But remember that financial accounting is much more than book-keeping.

Each financial transaction has two entries, namely credit (what goes out) and debit (what comes in). Financial institutions must know which account needs to be credited and which one should be debited. Moreover, it’s also essential to remember the three golden rules of accounting that create an easily understandable set of book-keeping principles ensuring all financial transactions are recorded systematically.

Types of Accounts

The golden rules of accounting enable financial companies to document financial transactions in ledgers safely. Each financial transaction has two entries — credit and debit, and it belongs to any of the following three types of accounts:

- Real account

- Personal account

- Nominal account

Let’s study them one by one :

1. Personal Account

A personal account is a general ledger account for a firm, person, or association. It can be further subdivided into three categories:

a. Natural Personal Account

These accounts are held by humans, including creditors, debtors, capital accounts, and drawing accounts.

b. Artificial Personal Account

These accounts are not held by humans but by various legal entities. For example, cooperatives, companies, partnerships, banks, hospitals, government bodies, non-governmental organizations, etc.

c. Representative Personal Account

Natural or artificial people hold these accounts. Transactions in these accounts belong either to the former or the following year. Therefore, they are called representative accounts because they represent financial transactions. For example, outstanding salary, meaning salary that hasn’t been paid since the last year. Similarly, prepaid rents represent the rent that has already been paid in advance for the following year.

2. Real Account

A real account is an account that represents an organization’s total assets. It appears in the balance sheet and helps critically examine a business’s financial position.

These organizational assets can be further divided into categories :

a. Tangible assets

This category consists of assets that can be seen, touched, and measured. For example, buildings, machinery, land, furniture, and a cash account.

b. Intangible assets

This category contains assets that can’t be measured, seen, or touched but felt. However, these assets have monetary value and, therefore, are essential for the company. For example, patents, copyrights, goodwill, and trademarks.

3. Nominal Account

A nominal account is an account that records incomes, losses, profits, and expenses. The adjustments in the nominal account are made using the loss and trading & profit account at the end of a particular financial period.

Examples include Salary, Interest, and Rent accounts, and commissions received.

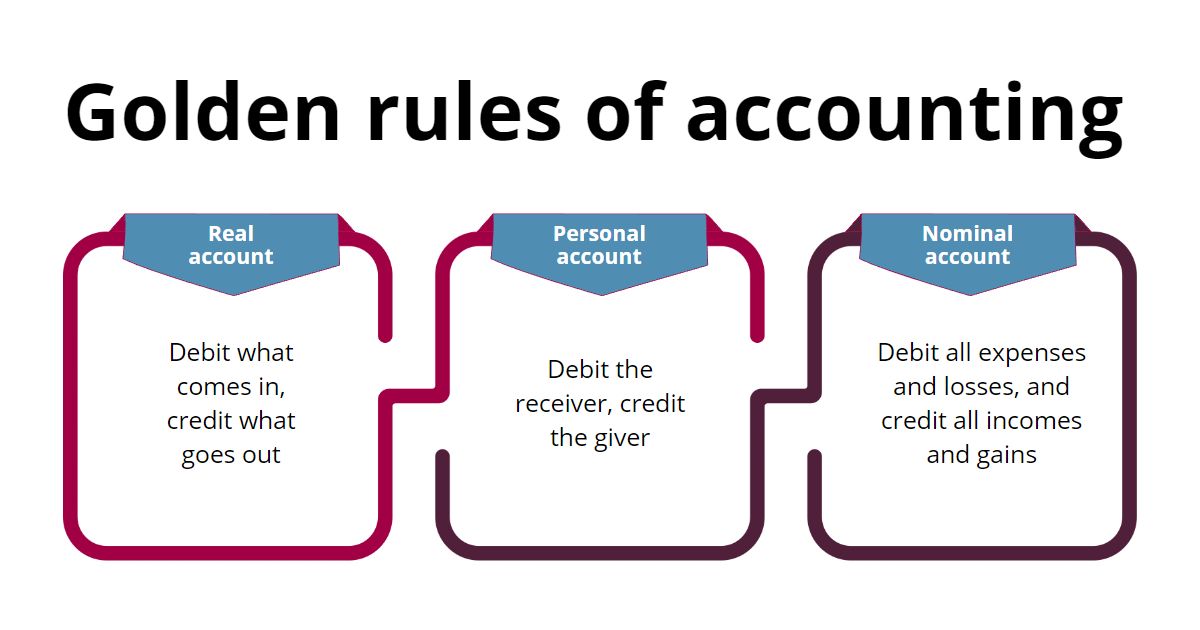

⇒ 3 Golden Rules of Accounting –

1st Golden rule of accounting :

Debit the Receiver, Credit the Giver

This rule works for personal accounts. For example, when a person or a business donates something to another organization, it becomes an inflow for the latter. As a result, the creditor must be mentioned in the records. Similarly, the recipient must be debited in the same records.

2nd Golden rule of accounting :

Debit what comes in, Credit what goes out

This rule applies to real accounts, including soil, machinery, buildings, furniture, land, and much more. The things mentioned above have a debit balance by default. Therefore, debiting the assets purchased by the company increases the existing account balance. Similarly, crediting the assets that move out of the company decreases the account balance.

3rd Golden rule of accounting :

Credit all profits and incomes, Debit all expenses and losses

This rule applies to a nominal account. A firm’s money has a negative credit balance because it’s a responsibility. Remember that capital decreases when deficits and liabilities are debited. On the other hand, it increases when profits, gains, and incomes are credited.

The following table explains the three golden rules of accounting in a better way :

| Accounting rules | Personal Accounts | Real Accounts | Nominal Accounts |

| Credit | The giver | What goes out | Profits and incomes |

| Debit | The receiver | What comes in | Loses and expenses |

Modern Accounting Approach

The modern approach classifies all accounts into five categories :

- Liability Accounts

- Expense Accounts

- Revenue Accounts

- Capital Accounts

- Asset Accounts

Let’s analyze them :

-

Liability Accounts

These are accounts of creditors for goods, lenders, and outstanding expenses.

-

Expense Accounts

These accounts record all expenses and losses incurred while performing the daily activities of a business. Examples include salary, wages, discounts, rent, depreciation, etc.

-

Revenue Accounts

These accounts store profits and incomes. Examples include bad debts recovered, sales, discounts received, interest earned, etc.

-

Capital Accounts

These accounts belong to proprietors, angel investors, and partners who have invested their money in the business. Capital accounts include the Drawings account and Capital account.

-

Asset Accounts

These accounts relate to the tangible assets held by a firm, including furniture, machinery, buildings, plant, bank accounts, cash, etc.

⇔ The following example will help you understand the three golden rules of accounting in a better manner :

Here’s the list of transactions that will form the basis of our calculations.

- Firm A begins its operations with an initial capital of INR 1,00,000.

- “A” rents a property worth INR 20,000 for conducting business activities.

- “A” purchases products worth INR 40,000 from firm B on credit.

- “A” sells products worth INR 80,000.

- “A” pays in cash for the products bought from firm B.

- “A” pays salaries/wages worth INR 40,000 to its workforce.

Before moving forward, let’s identify various accounts and the type of accounts for each transaction mentioned above. This exercise will simplify the application of the golden rules of accounting.

| Transactions | Accounts involved | Types of accounts |

| Capital worth INR 1,00,000 | Captial A/c; Cash A/c | Personal Account; Real Account |

| Rent of INR 20,000 | Cash A/c; Rent A/c | Real Account, Nominal Account |

| Purchase of products worth INR 40,000 | Purchases A/c; Company Y A/c | Nominal Account, Real Account |

| Sell products worth INR 80,000 | Sales A/c; Company Y A/c | Nominal account, Real account |

| Pays in cash for the products bought from B. | Cash A/c; Company Y A/c | Real account, Personal account |

| Pays salaries/wages worth INR 40,000 to its workforce | Cash A/c; Salary A/c | Real account, Nominal account |

Applying the golden rules of accounting

Now, let’s determine the journal entries using the golden rules of accounting :

→ Company A starts with an initial business capital worth INR 1,00,000.

→ Cash is a tangible asset and is, therefore, part of a real account. On the other hand, capital is a personal account.

→ Based on the golden rules of accounting (for personal and real accounts) :

- Credit the giver

- Debit what comes in

| Account | Cr | Dr |

| Capital A/c | 1,00,000 | |

| Cash A/c | 1,00,000 |

♦ Company A rents a property worth INR 20,000 for conducting business activities.

Rent is considered an expense and is, therefore, a part of the nominal account. On the contrary, cash is a part of a real account.

Based on the golden rules of accounting (for nominal and real accounts):

- Credit what goes out

- Debit all expenses and losses

| Account | Cr | Dr |

| Cash A/c | 20,000 | |

| Rent A/c | 20,000 |

♦ Company A purchases products worth INR 40,000 from firm B on credit.

Purchase transactions are part of a nominal account because they are taken as an expense. Whereas, firm B is a part of the personal account.

Based on the golden rules of accounting (for nominal and personal accounts) :

- Credit the giver

- Debit all losses and expenses

| Account | Cr | Dr |

| Firm B A/c | 40,000 | |

| Purchases A/c | 40,000 |

♦ Company A sells products worth INR 80,000.

A business generates income by selling products and, therefore, it’s a part of the nominal account.

Based on the golden rules of accounting (for real and nominal accounts):

- Credit all profits and incomes

- Debit what comes in

| Account | Cr | Dr |

| Sales A/c | 80,000 | |

| Cash A/c | 80,000 |

♦ Company A pays in cash for the products bought from firm B.

Firm B is a personal account and cash is a part of the real account.

Based on the golden rules of accounting (for personal and real accounts):

- Credit what goes out

- Debit the receiver

| Account | Cr | Dr |

| Cash A/c | 40,000 | |

| Firm B A/c | 40,000 |

♦ Company A pays salaries/wages worth INR 40,000 to its workforce.

Salary is a part of the nominal account as is considered an expense to the business. And cash is part of a real account.

Based on the golden rules of accounting (for nominal and real accounts):

- Credit what goes out

- Debit all losses and expenses

| Account | Cr | Dr |

| Cash A/c | 40,000 | |

| Salary A/c | 40,000 |

⇒ The foundation of the modern accounting system stands on these three golden rules of accounting. It helps companies across industries standardize financial transactions, enabling government authorities, financial institutions, and tax authorities to get a 360-degree view of the business’s financial situation.

Always remember these guidelines while applying these golden rules of accounting :

- Identify the types of accounts in the transaction.

- Monitor whether transactions in the account increase or decrease the account value.

The three golden rules of accounting will always keep your accounts updated.

Frequently Asked Questions –

1. What are the Golden Rules of Accounting?

The three Golden Rules of Accounting are-

1. Debit the Receiver, Credit the Giver

2. Debit what comes in, Credit what goes out

3. Credit all profits and incomes, Debit all expenses and losses.

2. What are the 3 types of accounts?

The three types of accounts are-

1. Personal Account

2. Real Account

3. Nominal Account

3. How to apply the golden rules of accounting?

The Golden Rules of Accounting are essential for accurate double-entry bookkeeping. They ensure transactions are recorded systematically based on account types:

- Personal Account: Debit the receiver, Credit the giver.

- Real Account: Debit what comes in, Credit what goes out.

- Nominal Account: Debit expenses/losses, Credit incomes/gains.

4. Why are the golden rules important?

The golden rules of accounting are your go-to for recording financial transactions right in the double-entry system. They keep your books clear, balanced, and reliable, making financial decisions and compliance a breeze.

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.