Today, a number of trade companies have been looking to digitise through automating daily processes with advanced tools like ERP software. The tools offer extensive traceability so that organisations can show optimum control of all business operations.

To bring a greater level of agility and transparency, the Ministry of Corporate Affairs (MCA) has made it necessary for all organisations to keep an audit trail for all their transactions from 1st April 2023.

The MCA has taken this step to gain better accountability and transparency in business functions. Maintaining an audit trail for all transactions will help companies, as well as stakeholders, detect loopholes in the company’s finance. This in turn would help the investigative teams and auditors to make accurate and compliant financial reporting. The audit trail here would not be just limited to financial transactions but also to administrative and operational tasks.

The main aim of MCA to mandate the need for an audit trail is to detect and avoid fraudulent transactions and manipulation in the books of accounts of the company to improve the level of transparency. Also, it aims to track all activities like deleting, cancelling, creating, editing, and updating in a specific event.

Also Read: 21 ERP Software Statistics You Need to Know

What is an Audit Trail ?

An audit trail is defined as a system which comprises a detailed record of all accounting, financial and project data which can be traced accurately.

In other terms, an audit trail is a sequential record offering proof of the documented history of a transaction which helps in tracking varied transactions and financial data at the fingertip. The system is used to track and verify a number of transactions like accounting and trades in brokerage accounts.

The audit trail is required to maintain at least 8 years from the financial year end for which it is obtained. This way, regulators can easily track each detail of a particular transaction and look for any inconsistencies if occurred.

The Working of Audit Trail

An audit trail has a full record of events that have occurred during the execution of the transaction. These events include all key details of a transaction to get reviewed in the future. The transactions can either be simple or can be complex.

In the case of a complex transaction, the audit trail can help you verify the source of funds. Then, the financial regulators can check these complex trails from the brokerage firms to identify and study suspicious activities.

What information should be included in an Audit Trail?

Apart from the other requisites, the rules mentioned by the MCA also mandate to contain crucial details of –

- Each transaction occurred within the company indicating the amount, date, and transaction nature.

- All authorised transactions and amendments made in accounts books.

- All rejected and approved transactions, and changes made in accounts books, comprising the names of the person who has rejected/approved the transactions.

- Each detail of restoration and backup activities with respect to the books of accounts.

- All-access details to the books of accounts of the company like the time and date of access and who has accessed them.

Required Features of Audit Trail in the Accounting Software

- Timestamps should be essentially involved in the accounting program

- All transactional changes should be tracked by the feature

- The audit log should be maintained till the validity of accounting records

- The audit train should maintain a precise track of every single operation of the software on the date-by-date concept

- The software should be able to record user information

- The tool should be able to detect the difference between an audit log and a technical log

- Every change in the transaction should be indicated in the audit log like changes made right from the establishment of the transaction to its edition or deletion

Key Benefits of Audit Trail

Let’s take a glance at the incredible benefits of an audit trail –

- Identify process breakdown

- Early and quick detection of inconsistencies

- Check for internal process fraud

- A structured method to keep records along with explaining the details of every event and history of a ledger entry and transaction

- Detect vulnerable data breaches

- Needed for the best accounting strategies to stay compliant with numerous statutory as well as regulatory provisions

Also Read: Top 3 Benefits of Implementing Sage ERP for SaaS Businesses

SAGE X3 Audit Trail Feature

Audit functionality in Sage X3 provides the in-detailed trail\log of the transactions which are created, modified, and deleted. This functionality is applied to the tables of the transactions on which users are desired to enable the audit log.

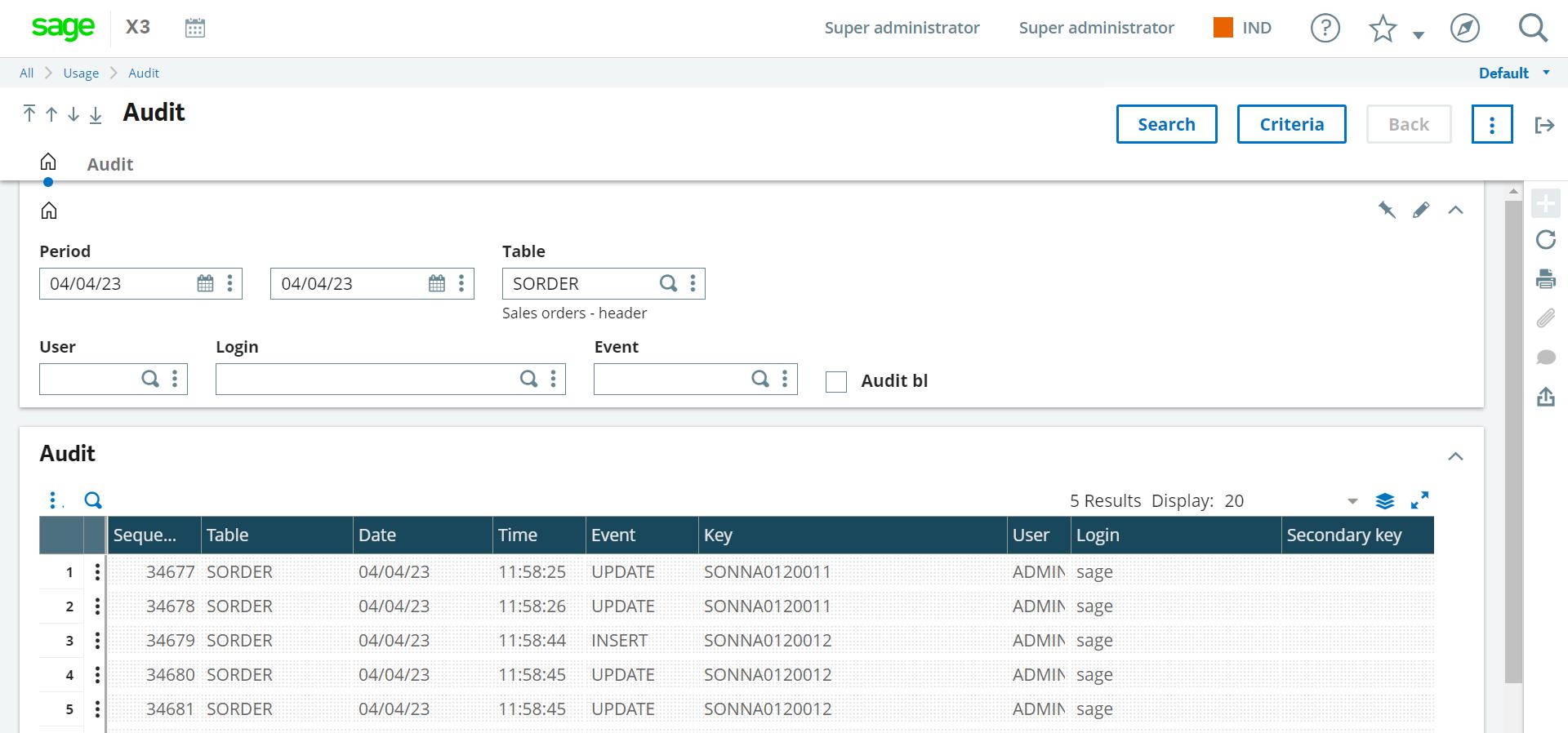

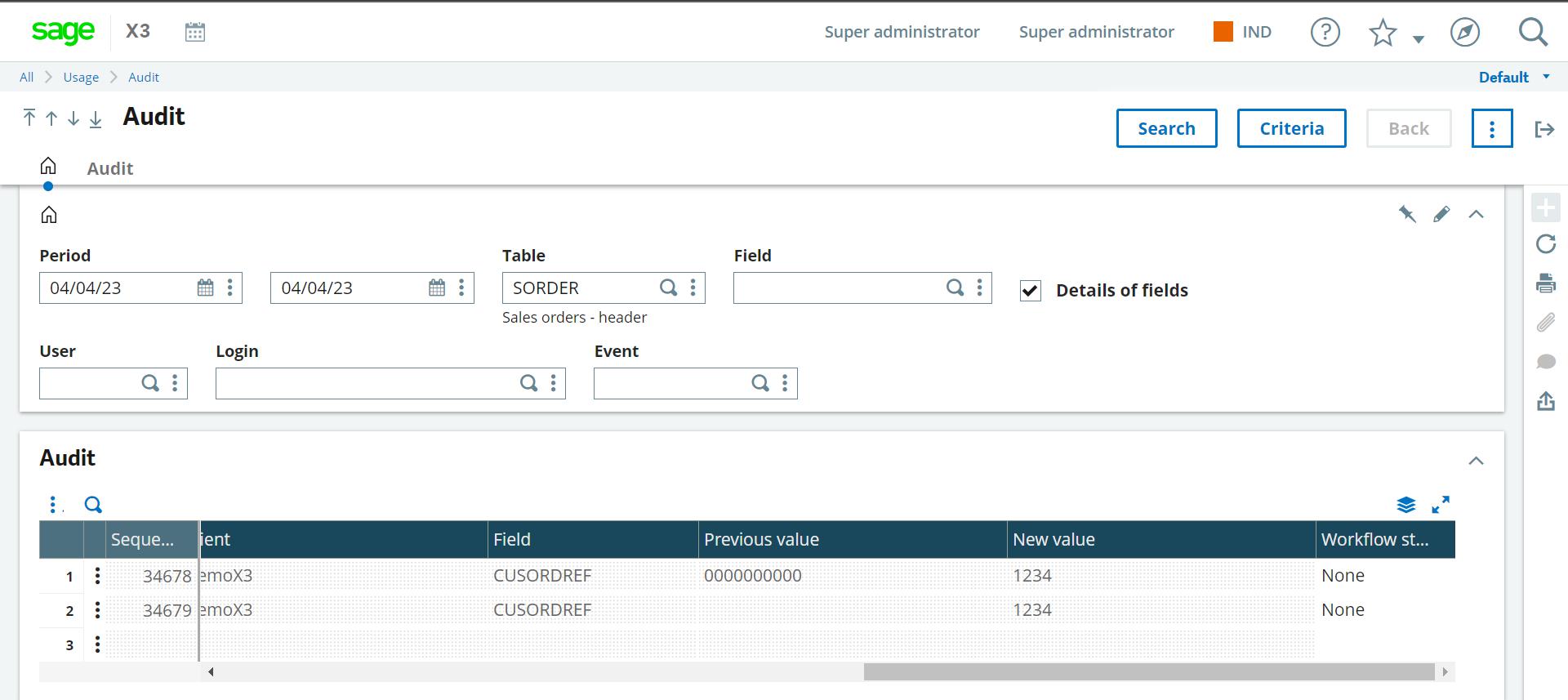

The audit log can be viewed in two ways in the Sage X3, in the basic screen(tables) and in the advanced screen (Fields).

Procedure to enable Audit log:

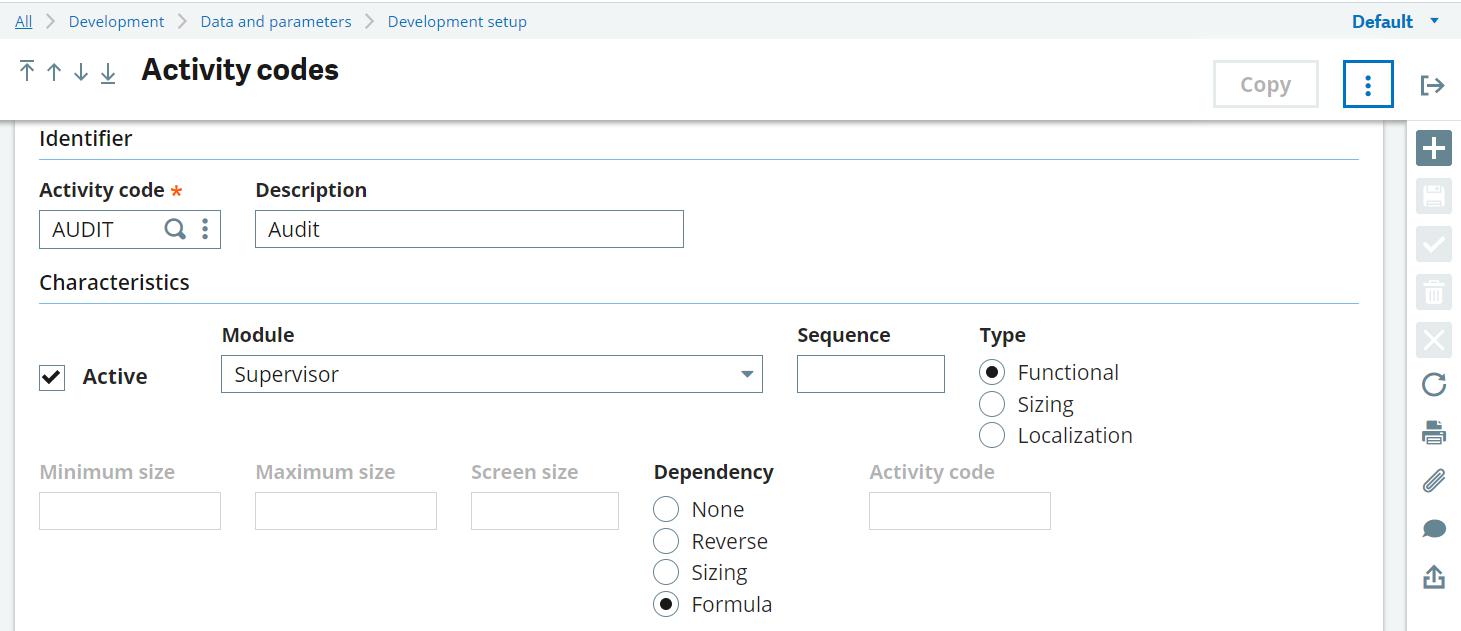

1) Verify the activity code “AUDIT” is active by navigating to the path: Development→ Data and Parameters→ Development setup→ Activity Codes.

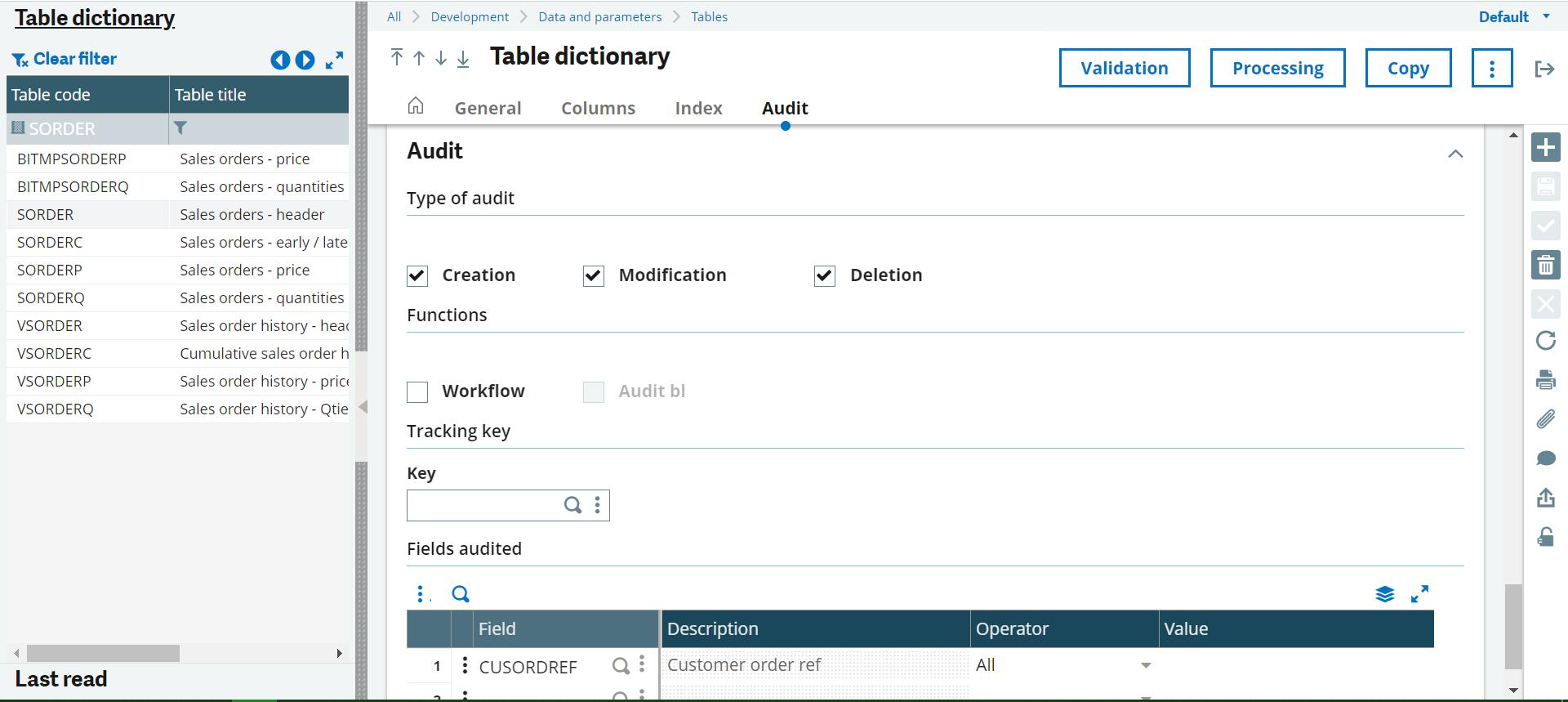

Once the table is selected in the Audit tab, we can enable the type of audit which suggests the operation on which the user wants to apply the audit log.

Creation: – whenever a new record is added newly into the table from the system, the log will be generated.

Modification: – whenever an existing record is modified into the table from the system, the log will be generated.

Deletion: – whenever an existing record is deleted into the table from the system, the log will be generated.

3) In the Fields audited section, the user can add the specific fields on which the log needs to be enabled. (Only those fields will have logs which are added in this section)

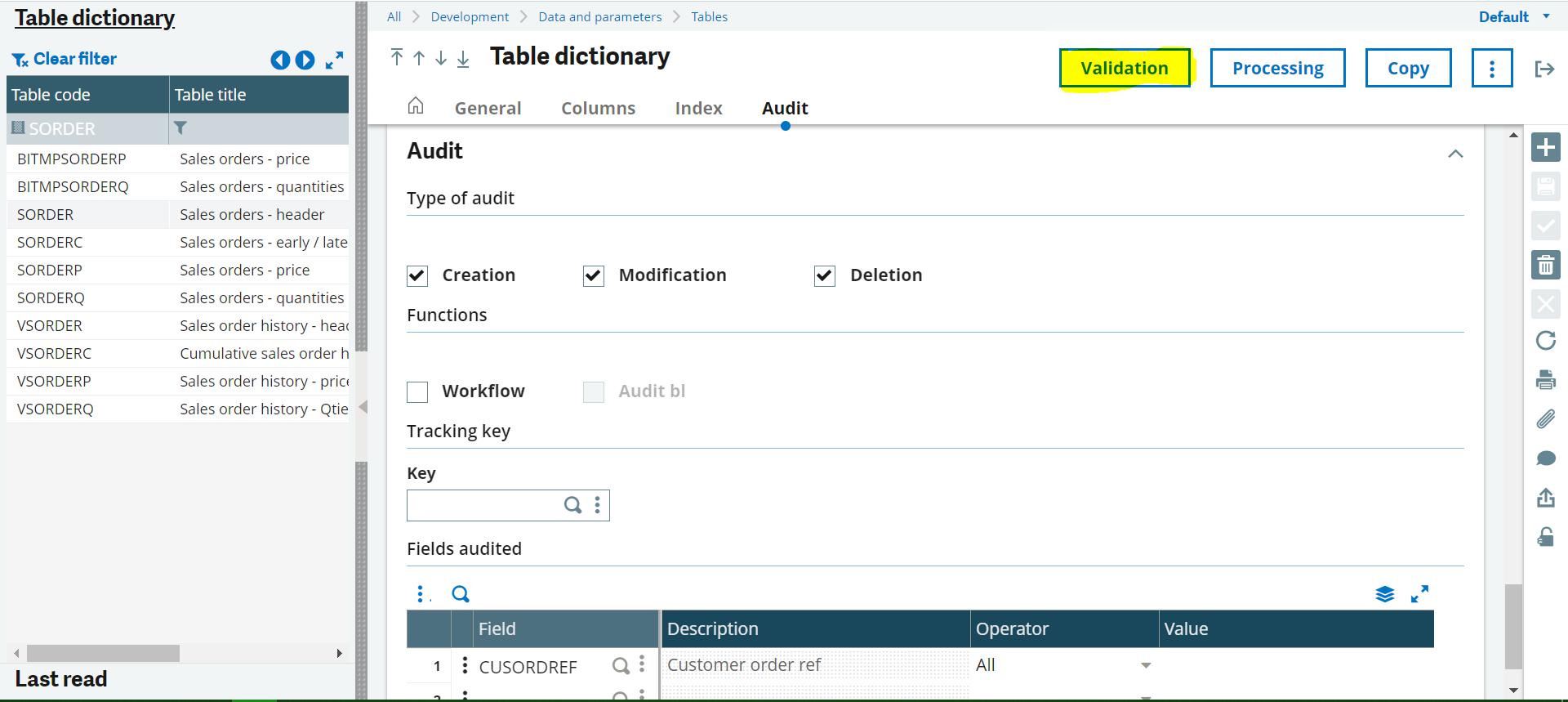

4) Save the configuration and validate the table by clicking on the Validation button as highlighted below screenshot

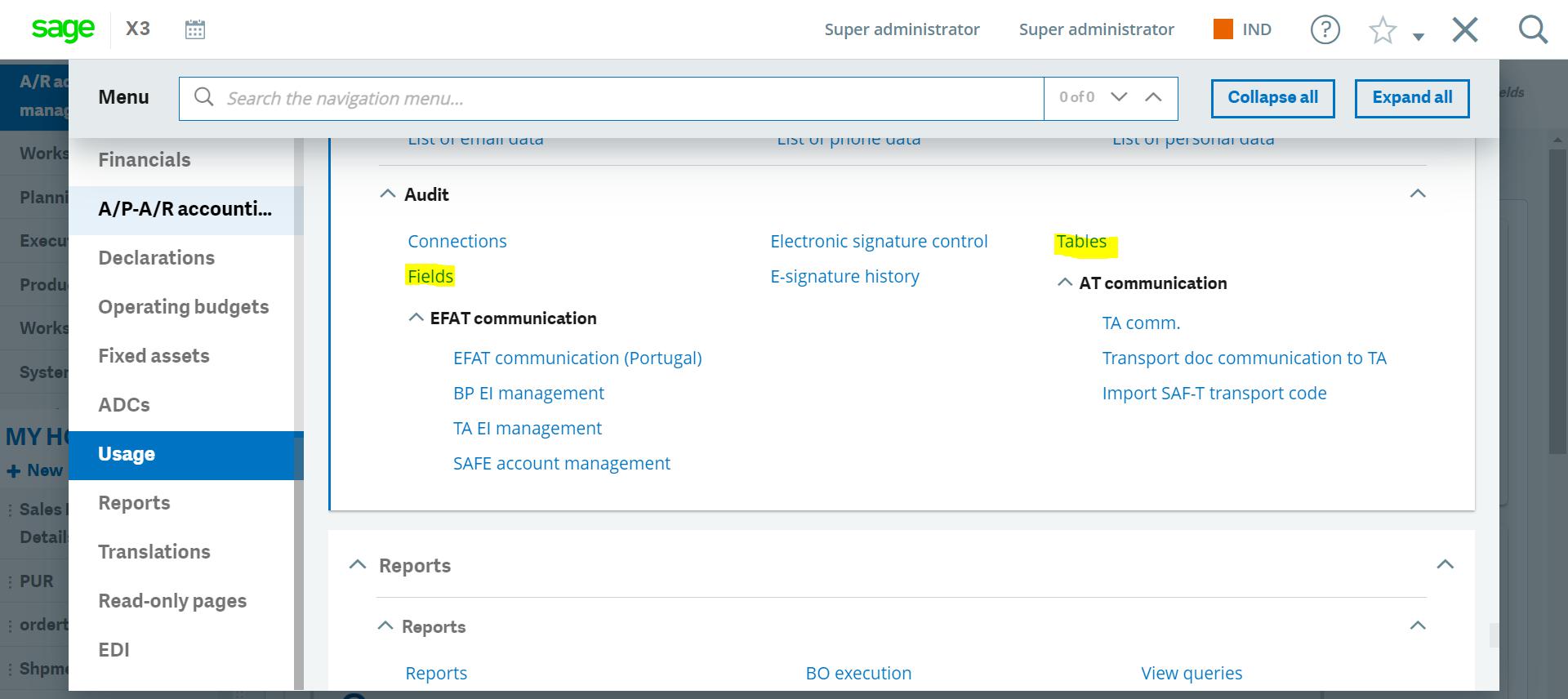

5) Now audit recording for the table is activated, to view the audit log there are 2 screens as highlighted below screenshot:

6) Tables: – This screen provides the basic information of the audit log such as which user and on which date the record is created, modified, or deleted.

7) Fields: – This screen provides in-detailed information on the audit log such as which user has modified which field and what were the previous value and the new value on that field.

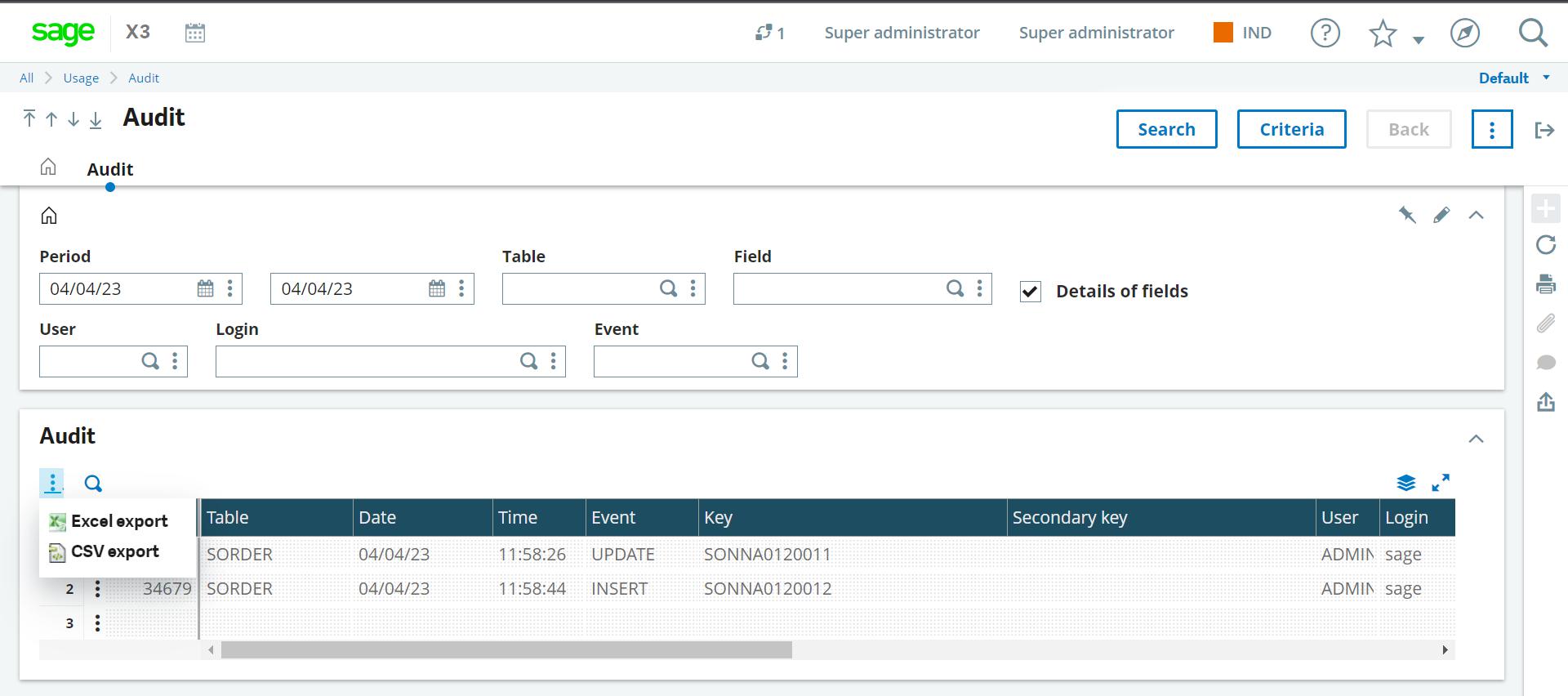

8) User can extract the above data in excel as shown below image:

By following the above process user can successfully apply the audit log into the system for the desired transactions.

Wrapping Up

Sage X3 Audit trail is the most important feature that helps you keep a track of every single activity that can occur during the transaction. So, get Sage X3 for your large-scale business and leverage its audit trail feature for more advanced and precise financial operations of your company.