Summary: Do you know it’s five times more expensive to find new customers than to retain the existing ones? Therefore, you should focus more on offering the best services to your existing customers to retain them for a longer period and ensure they don’t start buying products from your competitors. One of the best ways to keep the customer churn rate low is by measuring the Customer Lifetime Value (CLV). By doing so, you can acquire and retain highly valued customers and earn more revenues over time.

What is Customer Lifetime Value?

Customer lifetime value is a metric that determines the revenue a business can generate from a particular customer throughout the business relationship.

The longer a customer continues purchasing products or subscribing to your company’s services, the higher their lifetime value becomes.

The best part is that client service agents and support teams can influence this metric during the customer’s journey by offering suitable recommendations to help customers make better buying decisions and solve any challenges they face.

This metric will also help identify the customer segments who are most likely to subscribe to your services and purchase your products. This way, you can make decisions and brainstorm strategies for the target segment that is most valuable for your company.

Why is Customer Lifetime Value Critical for your business?

Read the following points on why getting a comprehensive picture of Customer Lifetime Value (CLV) is crucial for your business:

1. You can boost customer retention and loyalty.

Customer lifetime value allows you to determine alarming trends like a shrinking customer base. Then, you can brainstorm effective strategies to eliminate these trends and build a robust clientele.

For example, if your CLV score is very low, you can work around your customer support strategy and devise effective customer loyalty programs.

2. Increasing CLV can decrease customer acquisition costs.

A recent report by the European Business Review discloses that it’s five times more expensive to acquire new customers than to retain the existing ones.

Another study by Bain & Company shows that a 5% increase in customer retention rate can help companies increase their profit between 25% to 95%.

The reports mentioned indicate why it’s essential to identify and nurture the most valuable customers and build long-lasting relationships with them. As a result, you can increase your customer lifetime value, enhance profits, and bring down customer acquisition costs.

<<<Also Read: The Cyclonic Customer Buying Journey>>>

3. CLV is directly proportional to revenue over time.

Business revenue depends on the value a customer brings throughout the relationship. Therefore, the longer a customer’s lifecycle, the more income your business will earn.

CLV identifies customer segments that are most likely to purchase your products. This way, you can encourage these customers to make more purchases resulting in more cash flowing into your bank account.

A recent Hubspot research indicates that 55% of growing companies believe that investing in customer service programs is critical to their existence.

How to calculate customer lifetime value?

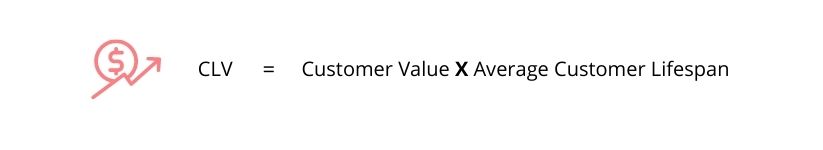

Use the following formula for calculating customer lifetime value (CLV):

Where,

Customer Lifetime Value models

There are two primary models for calculating customer lifetime value. Your outcome will significantly change based on the model you select. The first one extracts valuable insights from pre-existing data that helps study customer purchase behavior in the past. The second one allows determining how customer behavior will change in the future.

a. Historical Customer Lifetime Value

The historical model calculates lifetime value based on past customer purchase behavior without considering whether the customer will keep on purchasing products from the company or not.

This model determines the value of a customer based on their average order value and will prove beneficial for your business if a significant percentage of your customers purchase your business products continually over a sustained period.

However, this model has a substantial defect. For example, some of your active customers might stop interacting with your business after some time. On the other hand, inactive customers (who have stopped purchasing your products) might start interacting with your business after a brief pause. This way, your customer lifetime value (CLV) data can be skewed and will not help you make appropriate business decisions.

b. Predicting Customer Lifetime Value

The predictive CLV model predicts the future value of a customer using machine learning and regression analysis.

This way, you can determine:

- Which customers have the highest buying potential?

- Which products have the highest selling potential?

- Ways through which you can boost customer retention

Customer lifetime Value formulas

Remember that data helps you determine what products/services your customers are searching for, helping you brainstorm effective strategies better aligned with your business vision and mission.

Now let’s delve deep into the lifetime value calculation formulas that will allow you to analyze your business needs better and calculate customers’ buying potential.

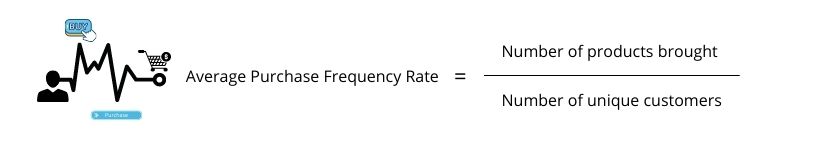

1. Average Purchase Frequency Rate

You can easily calculate this ratio by dividing the number of products purchased by unique customers over a particular period.

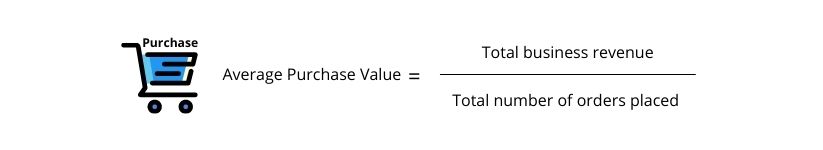

2. Average Purchase Value

This number can be easily calculated by dividing your business revenue by the total number of orders placed by customers over a particular period (mostly 1 year).

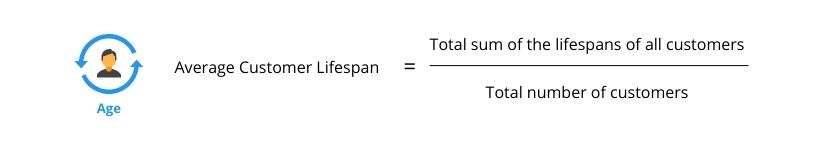

3. Average Customer Lifespan

Calculate this value by averaging the number of years a customer continues purchasing your business products.

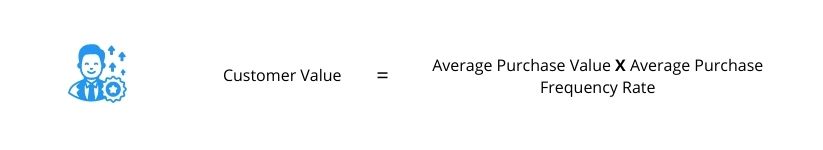

4. Customer Value

Start by calculating the average purchase value and the average purchase frequency rate. Then multiply both to calculate the customer value.

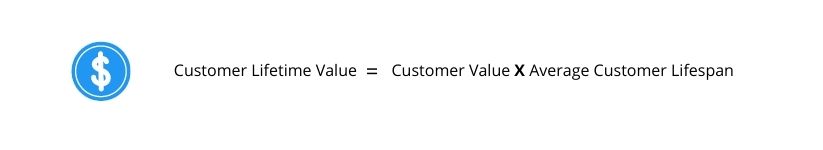

5. Customer Lifetime Value (CLV)

The lifetime value formula is pretty easy and straightforward to calculate. You need to multiply the customer value with average customer lifespan. Remember the following equation:

<<<Also Read: 5 Most Important Stages of a Customer Life Cycle>>>

Benefits of CLV

Here are the benefits of improving Customer Lifetime Value (CLV):

1. CLV will allow you to strike a balance between short-term and long-term marketing goals and help you make better financial returns on your investments.

2. CLV enables companies across industries to measure how marketing campaigns, activities, and other initiatives are helping achieve marketing goals.

3. CLV helps marketers judiciously use the marketing budget by spending more time acquiring customers with higher value.

4. CLV allows increasing lifetime value and building robust relationships by identifying the challenges of an existing customer.

5. CLV allows you to identify underutilized areas that help increase focused spending and create loyalty objectives.

How to boost Customer Lifetime Value

Below are some valuable strategies that will help you increase your customer lifetime value:

1. Increment the average order value

You can significantly boost your CLV by increasing the average order value.

For example, when a customer is on the checkout page, you can offer various complementary products. Amazon is the best example in this regard.

Suppose you are buying Harry Potter — The Philosopher’s Stone on Amazon. Then while you are on the checkout page, you can see a long list of related products. For example, many customers purchase the whole set of 7 Harry Potter books instead of buying only 1 because they get a massive discount on purchasing the entire collection.

Why this strategy works?

Considering that only a few people purchase the entire Harry Potter set. So, Amazon’s earning potential through this up-selling technique might appear insignificant. But even a tiny trickle of dollars over a sustained period turns into significant revenues and increases the total CLV.

2. Collect and analyze customer feedback

As discussed before, collecting and analyzing customer feedback allows you to determine:

- Whether your products are serving the purpose?

- Whether your customer service is up to the mark?

- Where do you stand against your competitors?

- How can you improve your products/services further?

- Gaps in your outreach programs to better connect with customers.

When you have data about the points mentioned above, you can calculate the lifetime value of a customer better and brainstorm effective strategies to acquire and retain new and existing clients, respectively.

Here are some ways of collecting customer feedback:

- Automated emails

- Focus groups

- Customized surveys

- Social media channels

- Face-to-face or online Interviews

Why this strategy works?

When you listen more to your customers, you understand their likes, dislikes, desires, and aspirations. Using this data, you can determine what products they are most likely to purchase, allowing you to devote time and resources to developing only such products. In addition, you can identify hidden loopholes in your product that would have otherwise gone unnoticed.

3. Build robust customer relationships

Forming long-lasting customer relationships is essential for your business to boost its CLV. If you offer the best product price and top-notch customer service, customers would like to interact more with your company and spread excellent word-of-mouth.

Moreover, social media has become a critical channel for building robust customer relationships. Sustained digital marketing efforts take time but eventually help identify new customers and retain the existing ones. Also, remember that customers today want to cultivate personal relationships instead of dull and dry business associations.

So, instead of only relying on posting product advertisements on social media channels, start replying to their comments. Request them to share their feedback with you. You can also send simple and small gifts that align with your target customers’ interests to show your gratitude.

Why this strategy works?

These are a few eye-opening facts that you should remember:

- You live in a cut-throat competitive environment where your customers won’t hesitate to buy products from your business rivals if you fail to provide the best customer service.

- The average annual churn rate for a SaaS company is between 32-50%.

- It’s five times more expensive to acquire new customers than to retain the existing ones.

So, ask yourself this question repeatedly: What is customer lifetime value? Because this way, you will realize that there isn’t any point in calculating CLV if your business fails to build a concrete customer relationship.

In short, forging smooth customer relationships is directly proportional to CLV. Therefore, the stronger your customer relationships are, the higher your CLV.

4. Simplify the process of creating customer relations.

A recent survey reveals that 88% of customers want a response to their email within an hour. However, the same survey also tells that 62% of companies failed to reply to an email from a customer at all.

Therefore, relying on automation response tools is the best way to increase the average number of customers you respond to over a particular period.

Customer Relationship Management (CRM) is the best example of automating a business’ customer outreach program.

For example, Sage CRM is one of the most effective CRM software. The following infographic will explain the benefits of implementing Sage CRM in your business.

Why this strategy works?

Today, building real-time customer connections dictate CLV. The better and earlier you respond to your customers, the higher the probability your customers will stick with you and refrain from associating with your competitors. While responding to your customers within one hour might not be possible right now, you can work towards decreasing customer response time.

This way, you can hold customers’ attention and encourage them to continue buying from you.

The below infographic explains how Sage CRM can help you build robust and long-lasting customer relationships.

5. Improve the product return experience

It might be the case that your customer is unhappy after purchasing a product or subscribing to a service. Therefore, you must have an appropriate channel for expediting product recall and providing refunds.

Why this strategy works?

There is a high probability that the customer will return to your website to give your product or service another try if you have a painless, smooth, and straightforward return process.

6. Create and share targeted marketing collateral

Succeeding in today’s cut-throat competitive world is impossible without investing substantial resources in developing high-quality marketing collateral, including ebooks, guidebooks, whitepapers, case studies, blogs, research papers, explainer videos, customer testimonials, podcasts, etc. Once you have an extensive repository of high-quality content, you should focus on sharing it across various social media platforms to increase your customer reach.

Why this strategy works?

Highly targeted marketing collateral enables companies to share critical information/data tailor-made for a specific target audience. This way, you can address their challenges, provide 360-degree information about your product or service, and build personal relationships. In addition, such sustained efforts allow a company to increase customer spending over a long period.

7. Simple and straightforward buying experience

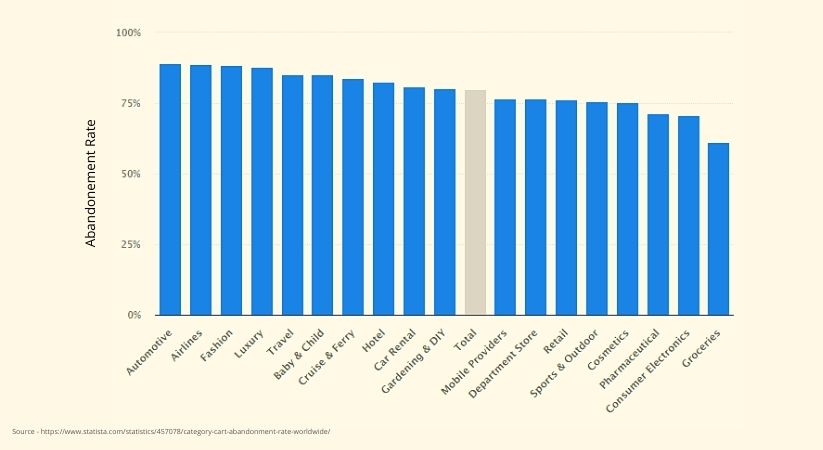

Businesses measure cart abandonment rates to identify how many customers add products to their cart but leave the website before making the final purchase.

The below infographic shows the cart abandonment rate per industry:

As you can see in the infographic above, the cart abandonment rate varies between 61-89%, meaning many customers don’t click on the final purchase button.

By providing a seamless and clutter-free purchase experience, you can encourage customers to pay for the products they have added to their buying cart.

Why this strategy works?

The fewer stages a buyer has to pass to reach the checkout page, the less likely they will abandon the cart. So ensure that the purchase experience is seamless, simple, and straightforward.

8. Identify and reward loyal customers

Remember that a loyal customer is one of your company’s most significant assets because they usually have the best CLV. So create hyper-relevant marketing collateral, up-selling & cross-selling opportunities, and give cash rewards to your most loyal customers to hold their interest.

Why this strategy works?

By giving top-tier benefits to your most valuable customers, you ensure that they will continue purchasing your products for a long time. In addition, you can also provide exclusive access to pre-released products & services and free expedited shipping services to hold on to your most valuable customers and significantly increase your customer lifetime value.

9. Manage unhappy customers

It’s critical to handle unhappy customers to increase your customer lifetime value. The following reasons explain why:

- You can reduce the customer churn rate by converting dissatisfied customers to loyal ones.

- You can resolve customer problems before they escalate out of proportion, resulting in the breakdown of the customer relationship.

- Not addressing or ignoring customer challenges can lead to irreparable reputation loss and spread bad word-of-mouth in the market.

Why this strategy works?

By managing unhappy customers, you can identify loopholes in your products and improve them. Also, you can encourage detractors to try your products/services again, contributing to your company’s revenues.

Few customer lifetime value mistakes

We have discussed the benefits of CLV and how it can benefit your business. But it isn’t a cure-all pill. If misused, CLV can waste a lot of time and money.

Following are a few CLV mistakes that you should avoid:

1. Choosing the wrong customer segment

Choosing the right target audience is at the center of CLV. You will lose significant time and money if you run behind customers who display the least interest in buying your products. But on the other hand, creating relevant customer segments requires cutting-edge research and mathematical precision, which may be a stumbling block for small and mid-sized companies that lack access to machine learning algorithms and AI.

2. Choosing a random number for your CLV

Small companies or start-ups lack concrete data regarding customer lifetime value. So they assume a random number. The problem with accepting random CLV is that it continually changes with:

- An increase/decrease in the number of customers.

- Launch of a new array of products in the market.

- New product prototypes.

Remember that you can estimate a better number if you have access to more data sources. So try to gather data from as many sources as possible.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.