Managing the financial segment of the business is a tedious task. A company maintains three types of financial reports or statements that brief the overall performance of your business. Out of the three income statement is a crucial financial information for any business. The other two types are balance sheet and cash flow statement. What is an income statement? In this blog, let us learn more about income statements and their importance for the company.

What is an Income Statement?

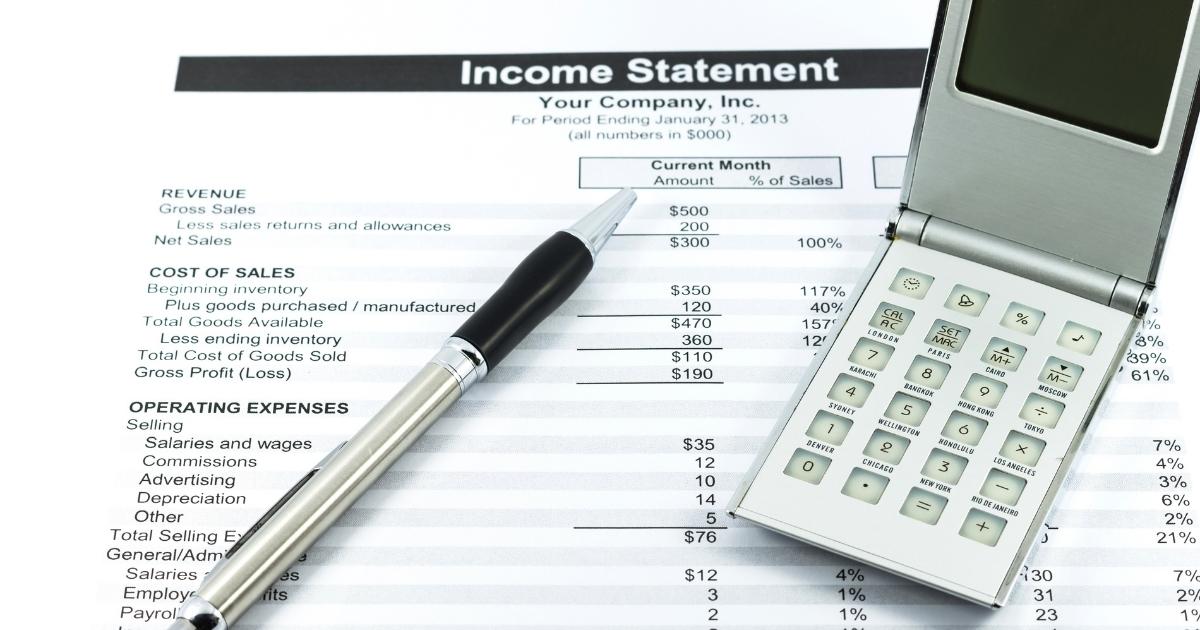

An income statement is one of the crucial pieces of financial information prepared by the company. This information is used for reporting the performance of the business in an accounting period. The major focus of the income statement is revenue, expenses, gains and losses reported by the business in a specific financial year.

Income statement is also known as a profit and loss statement or a statement of revenue and expense. If you want to gain valuable information about the company, check the income statement to peek into the efficiency of the company’s operations, underperforming sectors and compare its performance with its peers.

The Income statement will be very useful to investors, creditors and readers as it reveals if the company was profitable the previous year. The net profit of the company is calculated by subtracting the aggregate revenue from both operating and non-operating expenses.

The Income statement is regularly reviewed by investors, business owners and accountants to track if they are achieving their expected targets. Hence, the income statement is used to identify any shortcomings and change it to be on the right track to achieve business goals for the specific accounting period. Some of the other monickers linked to the income statement are listed below.

- Statement of earnings

- Profit and loss statement

- Statement of Income

- Revenue statement

- Statement of operations

Out of these, the financial experts prefer using profit and loss statement the most.

Also Read : Fixed Costs : What It Is and How It’s Used in Business

Importance of an Income Statement

An income statement is created monthly, quarterly or yearly by the company. This statement of comprehensive income helps the business owners to decide if they can generate revenue by increasing profits, lowering costs or both. The income statement also reveals if the company strategies are effective in a specific accounting period. Depending on the analysis of the income statement, the company can come up with an accurate solution to increase profits.

Some of the information provided by the income statements is enumerated below :

1. Frequent reports

Income statements can be generated on a monthly or quarterly basis. A regular review of this report can help the company to check if the expected revenue is achieved by the company. This helps the business to rectify the issue before it becomes risky and expensive. Most of the other financial statements can be generated only on an annual basis.

2. Aids better decision-making

Reviewing the income statement allows business owners to gain insight into the company’s present financial position. Business owners can make the right decisions for the business after analysing the figures of an income statement.

3. Tracks expenses

An income statement highlights the expenditure incurred in the company. It may be future expenses or any unexpected expenditure incurred by the company. Building rent, salaries and other overhead costs are some of the expenses a company incurs. As a small business experiences growth, it might encounter a surge in expenses. These costs could encompass hiring staff, procuring supplies, and marketing the enterprise.

4. Calculates profit or loss

It shows the investors and the business owners the current status of the company. Banks can also review the statements to comprehend and decide if the business is loan-worthy.

5. Crucial report for compliance

If you are operating your business in a specific country, then the company has to abide by all the tax regulations and business taxes of that particular place. In any place, paying business tax is mandatory. The necessary financial data to pay all the tax liabilities can be acquired from the income statement, the cash flow statement and the balance sheet.

Who uses an Income Statement?

An income statement is used by two major teams. They can be categorised into two types – internal users and external users. Company management and the board of directors come under internal users. They use the information presented in the income statement to review the business standing and make the right decisions to generate profit. They can be immediately responsive to any issue regarding the flow of cash.

Investors, creditors and competitors belong to the external users category. With the help of an income statement, investors can analyse whether it is wise to invest in the company. They check if the company is positioned to grow and if it can be more profitable in the future. Creditors refer to the income statement to ascertain if the company possesses adequate cash flow for loan repayment or to secure a new loan.

Competitors utilize these statements to glean insights into the performance metrics of a business and identify areas where the business might be allocating additional resources, such as in Research and Development expenditures.

What are the components of the Income Statements?

The income statement can exhibit slight discrepancies among different companies, as both expenses and revenue are contingent on the nature of their operations or business activities. Some of the major elements of the income are enumerated.

1. Revenue

Revenue is also known as sales revenue. It is referred to as the total amount of money a company earns by selling its products or services in a specific period. Here, the revenue comprises the profit made by conducting the core operations of the business.

Suppose a company is involved in the manufacturing of industrial machines, so the revenue would be the earnings acquired from selling those products. This will not include money earned from financial investments or cash earned by selling a building. All secondary earnings are documented somewhere else in the income statement.

2. Cost of Goods Sold

The cost of goods sold(for manufacturing companies) also known as the cost of sales(for retailers and wholesalers) comes under the direct costs. Cost of Goods Sold (COGS) represents the cumulative expenses directly tied to the sale of products, aimed at generating revenue. If the company is a service-based company, COGS is called ad cost of sales. Labour, parts, materials and allocation of other expenses(depreciation) would come in the direct tax.

3. Gross Profit

Gross profit is characterized as the difference between net sales and the total cost of goods sold in your business. Net sale refers to the revenue generated from the goods sold, whereas COGS represents the expenditure incurred in producing those goods.

4. Marketing, Advertising and Promotional expenses

Every business takes initiatives for marketing, advertising and promotional activities to sell its products or services. However, the expenses of all these initiatives are grouped together and considered as similar as all are related to selling.

5. General and Administrative expenses(G&A)

These expenses include the selling, general and administrative division. The expenses related to all these three sections are considered indirect costs. Some operational expenses such as travel expenses, salaries, rent and office expenses, insurance, and sometimes even depreciation and amortization are included in the indirect costs.

6. EBITIDA

Although not universally included in all income statements, EBITDA stands for Earnings before Interest, Tax, Depreciation, and Amortization. This figure is derived by subtracting SG&A expenses (excluding amortization and depreciation) from gross profit.

7. Depreciation and Amortization expense

The non-cash expenses such as depreciation and amortization. These expenses are created by accountants to spread out the cost of capital assets such as property, plant and equipment(PP&E).

8. Operating Income (or EBIT)

It is the money earned from the regular business operations. To put it differently, EBITDA represents the profit before factoring in any non-operating income, non-operating expenses, interest, or taxes deducted from revenues. EBIT, a widely used finance term, stands for Earnings Before Interest and Taxes.

9. Interest

Businesses commonly split out the interest expense and the interest income as a distinct line item in the income statement. This bridges the difference between EBIT and EBT and it is determined by the debt schedule.

10. Income tax expense

Income tax expense refers to charges applied on pre-tax income. Current taxes and future taxes are included in the total tax.

11. Net Income

The deduction of income taxes from pre-tax income is net income. Net income regarding the company’s earnings, gross profit means the total amount earned after the deduction of the costs of goods sold.

12. Operating Expenses

Operating Expenses are also known as Selling, General and Administrative expenses (SG&A). Operating expenses are the indirect costs associated with the business. Office supplies, rent and utilities, employee benefits etc.

Types of Income Statements

We have learned in detail about income statement and the components of income statements. It is a financial document used to analyse the profit or loss of the business. Single-step income statement and multi-step income statement are the two types of an income statement.

1. Single-step Income statement

This report is a basic financial document prepared to analyse the company’s profits. Single-step income statement can be calculated using the following formula.

Net Income = (Revenue + Gains) – (Expenses + Losses)

2. Multi-step income statement

Multi-step income statement uses a three-step process to calculate the net income. In addition, it segregates operational revenues and expenses from non-operational expenses.

Gross Profit = Net Sales – Cost of goods sold

Operating Income = Gross profit – Operating expenses

Net Income = Operating Income + Non-operating items

Conclusion

The important financial components such as an income statement, annual report, cash flow statement and balance sheet have the ability to reveal the company about its future growth trajectory. Investing in ERP software will help in the automation of all business processes, which will help in achieving accurate accounting results. Implement this advanced system to make the income statement process accurate, less complex and error-free.