Enterprise Resource planning also known as ERP software integrates and runs critical aspects of a business such as accounting. Further, with the help of customization, ERP system can address various challenges and concerns by integrating various critical modules/functions such as sales/purchase, accounting, inventory control, ledger, accounts receivable automation, etc.

Now when it comes to purchase order (PO) report, we require tax bifurcations of detail level items where the new GST Structure is applied per the respective slabs.

As we know that the entire tax structure has been reformed with the introduction of GST and this goes for businesses operating in all industries.

GST (Goods & Services Tax), which is a single tax structure is aimed to unify the country’s intricate tax system. It is in fact, one of the biggest tax reforms for the country post-independence.

As the tax structure changes, the entire Purchase Department’s calculation changes as per the new tax slabs and rules along with tax deductions for each and every product.

With GST in action, we now have different tax slabs for different types of goods. For e.g. a particular item such as Rusk comes under the 5% tax slab. Similarly, there are different types of slabs such as 8%, 12% and 28%.

GST is a dual tax system, wherein both the state as well as central governments administer, collect and share the taxes.

Read also: 4 Reasons your Business needs an ERP System to be GST Ready

Components in GST: There are three different components in GST i.e.

- CGST, which stands for Central GST, is applicable on supplies within the state and tax collected will be shared to the central government.

- SGST is State GST and is applicable on supplies within the State and the tax collected goes to state government.

- IGST stands for Integrated GST and is applicable on interstate and import transactions, whereas the tax collected will be shared by both central and state governments.

GST plays important role on Purchase Transaction of a company, which includes Purchase Orders, Receipts & Invoice taxes. To tackle this change, Sage 300 has introduced a GST Module, wherein we can automatically create GST Taxes & configure the same with Vendor/Customer & Items of Sales & Purchase Transactions.

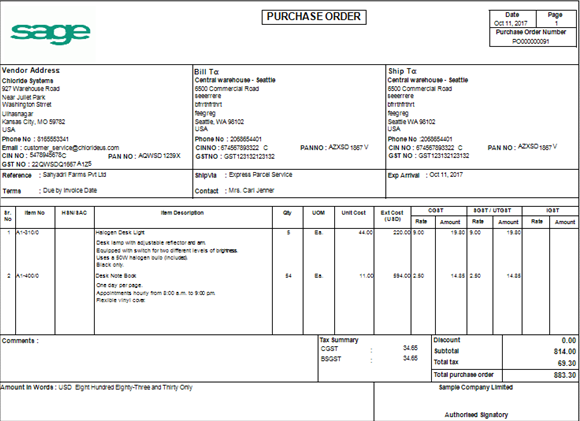

The new GST Format of Purchase Order Report in Sage 300 displays all the taxes calculated. Below is a screenshot for the same:

As per the above screenshot, you can see that the taxes are calculated on each and every item of the purchase order. All the taxes applicable on the above purchase transactions are handled by our new GST format of Purchase Order Report.

Also, we have included some important fields in the report such as HSN Code, CIN, PAN, Vendor GSTIN Number and Company’s GST Number, which are mandatory, and need to be registered and included in every transaction.

The main purpose of this module is to provide our users with proper distribution of detailed level of taxes as per the GST Tax Structure and to display important data of Vendor and Company.

To know more about how Sage 300cloud can help your business stay GST compliant, contact us here. You can also write to us at sales@sagesoftware.co.in or SMS SAGE to 56767 for free demo and consultation.