Business owners have to face challenges when operating a business. The biggest hurdle is to get paid on time. This can be achieved by having an efficient invoice management system in place. It helps in tracking and reviewing the finances. In addition, numbering and differentiating invoices are also crucial and must be a part of this system.

To differentiate sales and purchase orders, businesses assign unique invoice numbers to each invoice they issue. All these codes are generated from a numbering system. What is an invoice number and how can it be generated? Get answers to these questions from this blog.

»What is an Invoice Number?

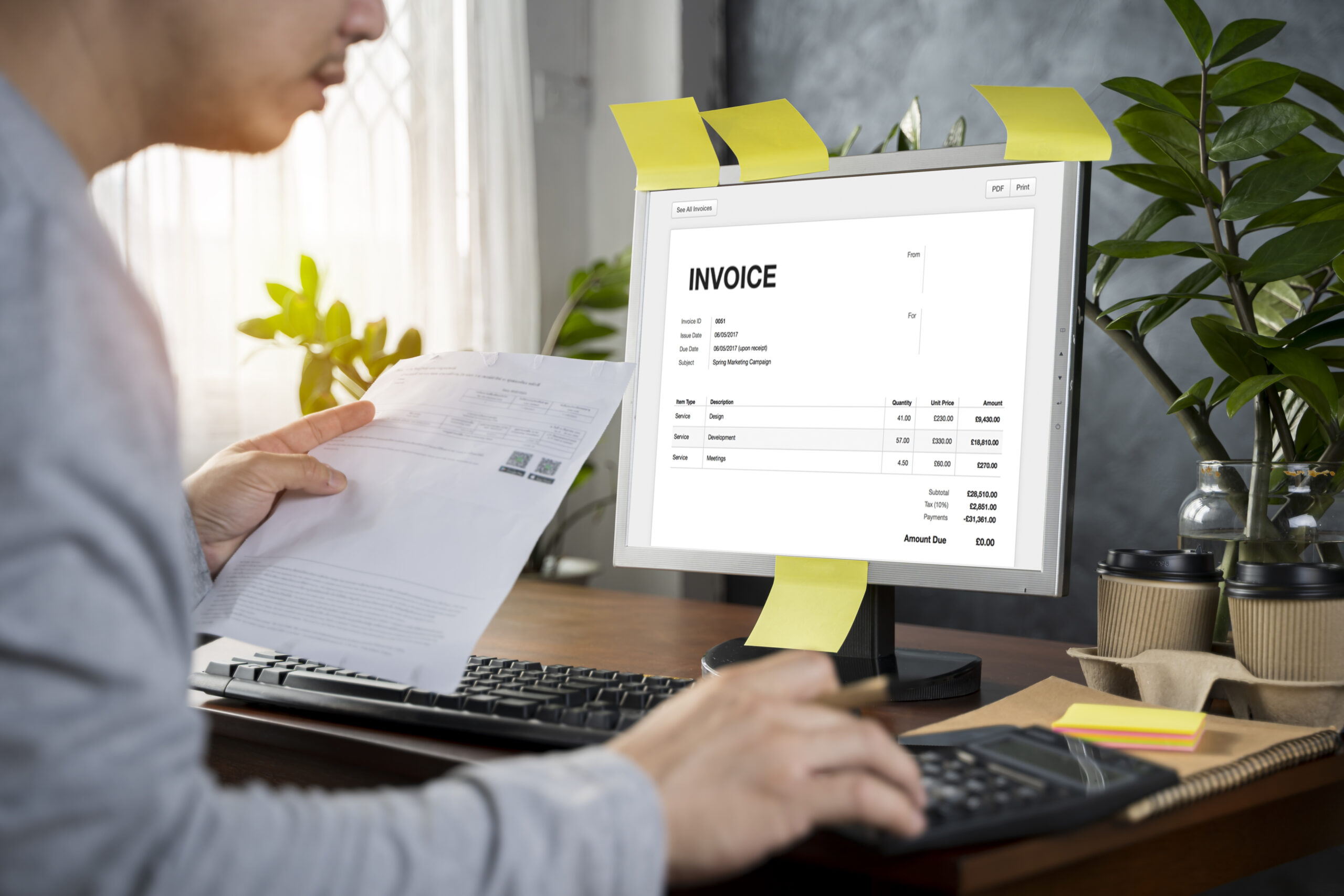

Business owners know the value of invoice numbers. What is an invoice number? The meaning of invoice number is very simple, it is a unique number assigned to the invoices that are issued. This number can be created in two ways – one by using an invoicing software and the other by manually creating it. The invoice number remains as a record or reference for the vendor and buyer. If there are questions or doubts regarding a purchase, this document can be referred.

Further, Invoice numbers can be used for billing questions, income tracking and taxes. The invoice number must include the following elements :

- Invoice ID or invoice number

- Contact information of the client

- Contact information of the business

- Product/service description

- Delivery date of product/service

- Due date for the payment

- Unit price of the product/service

- Total amount

- Other payment terms

Basics of an Invoice

Invoice number is a unique identification number used for internal and external reference for your business. In general, your business requires an effective invoice numbering system to identify the right invoices for the assigned purpose. Invoice numbers comprise mainly the contact information of the seller or service provider if there are any problems or errors.

⇒Terms

The terms of the payment have to be clearly outlined in an invoice. Information regarding discounts, early payment details, or finance charges for late payments are specified vividly in an invoice. Additionally, the unit cost of an item, total units purchased, freight charges, handling, shipping and associated tax charges are also included. Overall, it gives detailed information on the payment to be made.

⇒Timing and printing

Optionally, companies send a month-end statement as an invoice for every outstanding transaction. If a business sends this kind of document, it states that no further document will be sent. In earlier times, multiple invoice copies were generated, both for the buyer and the seller. This will be recorded by both the seller and the buyer.

Now due to vast automation, the invoices are computer-generated. Invoice numbers are printed on demand or it just can be sent via email. Sending your invoice numbers electronically is efficient as it will be easier to keep track of the transaction. The transaction can be searched and sorted by number, dates, goods or client.

Also Read : What is Invoice Management System – Definition, Importance and Types

Why is Invoice Number Important?

Businesses require the invoice number for the following purposes:

→Track payments

If there is an issue with an invoice which is months old, the logical numbering system can be referred to track this invoice. If there is no invoice number, then tracking it can become tedious and time-consuming.

→Eliminate Duplication of payments

Your business can incur huge losses if the billing is incorrect or duplicated. This will impact the reputation, time and money.

→Grants professional and legitimate service

Invoice serves as a professional document. If any regions do not support the requirement for an invoice, the customer will still demand the reference number of the invoice as it is a professional and transparent document.

→Records income for taxes

Utilizing invoice IDs enables the tax office to conveniently cross-reference invoices with the sales and expense records of your business during their review process.

How to Assign Invoice Numbers?

There are many invoice numbering methods, it is entirely up to the business to follow whatever is working for them. Invoice numbering is divided into four categories:

⇒Sequential Invoice Numbering

In this invoice number method, in a sequence, the number moves up numerically with every new invoice. It can begin as 1,2,3 and so on or 0001, 0002, 0003. However, the commonly used approach is a ten-digit number beginning with 0000000001.

If the numbering is done manually, the customer name and the owed amount should be written on a separate sheet. If any error occurs, it has to be mentioned clearly for future reference. An accounting software can be used to automatically assign invoice numbers to the invoices. Hence, Duplication can be eliminated.

⇒Chronological invoice numbering

The chronological method involves incorporating the creation date of the invoice to generate lengthier, more comprehensive invoice numbers. For, example, the invoice dated 5 October 2023 can be typed as 20231005-001. It is written in this format: YYMMDD-001.

Other alternate formats are 05102023-001 (DDMMYYYY), 10052023-001 (MMDDYYYY) etc. If you want to personalise the invoice number with the customer number, it would look like YYYYMMDD-CCC-001. Here, CCC refers to the customer number. For example, you can mention your client’s previous sale(20231005-303-001).

⇒Customer Invoice Numbering

In this invoice number format, adding a date is optional. The customer ID is mandatory and it ends with the sequential number. In all of your invoice numbers, the sequence number should come at the end. For example, 4356-20231005-001 or 4356-001.

⇒Alphanumeric invoice numbers

An invoice number of this type includes numbers, letters and special characters such as slashes or dashes. In an invoice number, if special characters and letters are added, it will be easier for your business to track your invoices. For example, your invoice number can be B0002.

⇒Project-based Invoice Numbers

The project number serves as the final option for invoice referencing. This approach is particularly beneficial for businesses heavily involved in numerous projects, especially those where the project number holds paramount importance, such as in the case of construction companies.

The two formats of this method are given below :

- project number + customer number + sequence number or,

- customer number + project number + sequence number.

For example, the invoice number can be formatted as LGHI302-1126-01 or 1126-LGHI302-01.

Also Read : Bills vs Invoice – What is the difference ?

How to Correct Invoice Number Errors?

An invoice number is assigned to each invoice to track and identify the relevant invoices. The invoice number is essential for eliminating errors and to avoid duplication. However, do you know that sometimes your invoices can be incorrect which will cost a lot for the company? Duplication can be a typo error, spelling mistake or human counting error. Rectifying these errors can be tedious.

It is an accounting rule that no invoice must be deleted. To fix this issue, it is better to create a new invoice can be created with the right data. Another method to fix the error issue is by automating the invoice numbering process with accounting software.

Key Takeaways

An invoice number is a unique identification number used to track the invoice at ease. Invoice numbers are beneficial for businesses to track payments and accounting purposes. The invoice number should contain all the relevant information such as contact details, date and time, customer number, client details etc. For more efficiency in the invoice numbering system, leverage the benefits of ERP software to avoid errors.