EWay Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in.

When an eway bill is generated, a unique Eway Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

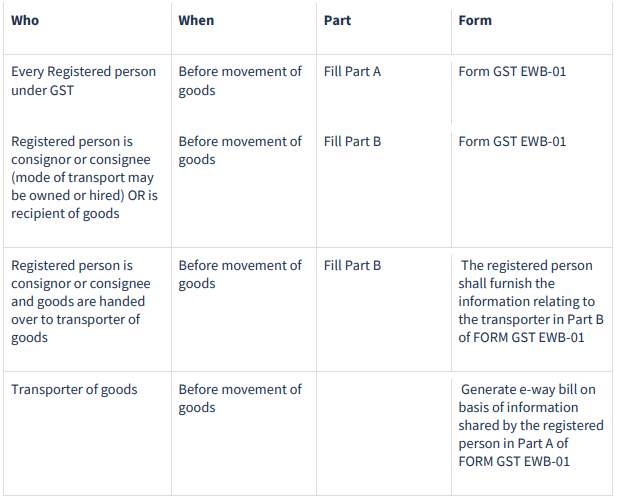

Who should Generate an eWay Bill?

- Registered Person – Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered A Registered person or the transporter may choose to generate and carry eway bill even if the value of goods is less than Rs 50,000.

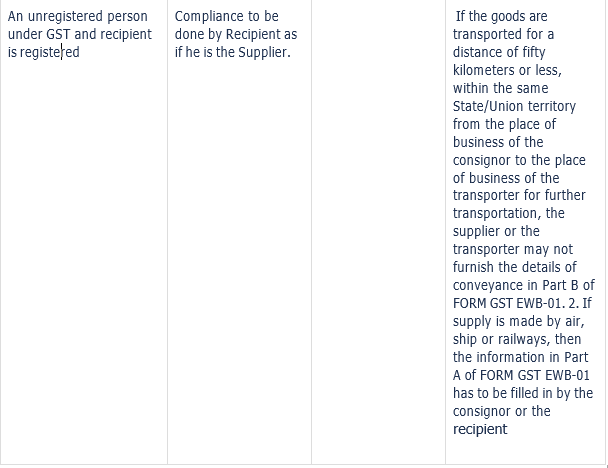

- Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the

- Transporter – Transporters carrying goods by road, air, rail, also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

Cases when eWay bill is Not Required

In the following cases it is not necessary to generate e-Way Bill:

1. The mode of transport is non-motor vehicle

2. Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

3. Goods transported under Customs supervision or under customs seal

4. Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

5. Transit cargo transported to or from Nepal or Bhutan

6. Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

7. Empty Cargo containers are being transported

8. Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

9. Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

10. Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

11. Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications.

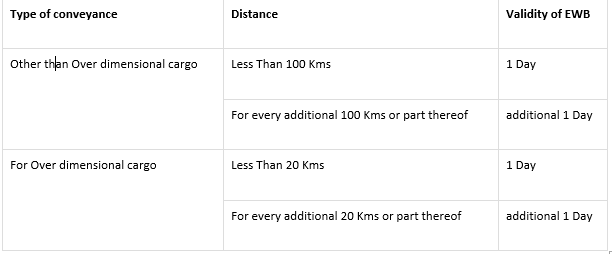

Validity of eWay Bill

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the goods. Validity is calculated from the date and time of generation of e-way bill-

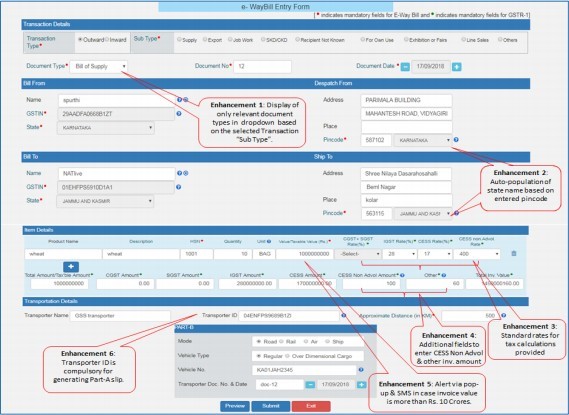

E-Way bill generation

Documents or Details required to generate eWay Bill

1. Invoice/ Bill of Supply/ Challan related to the consignment of goods

2. Transport by road – Transporter ID or Vehicle number

3. Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document

E-way bill Number management for inter-site goods transfer in Sage X3

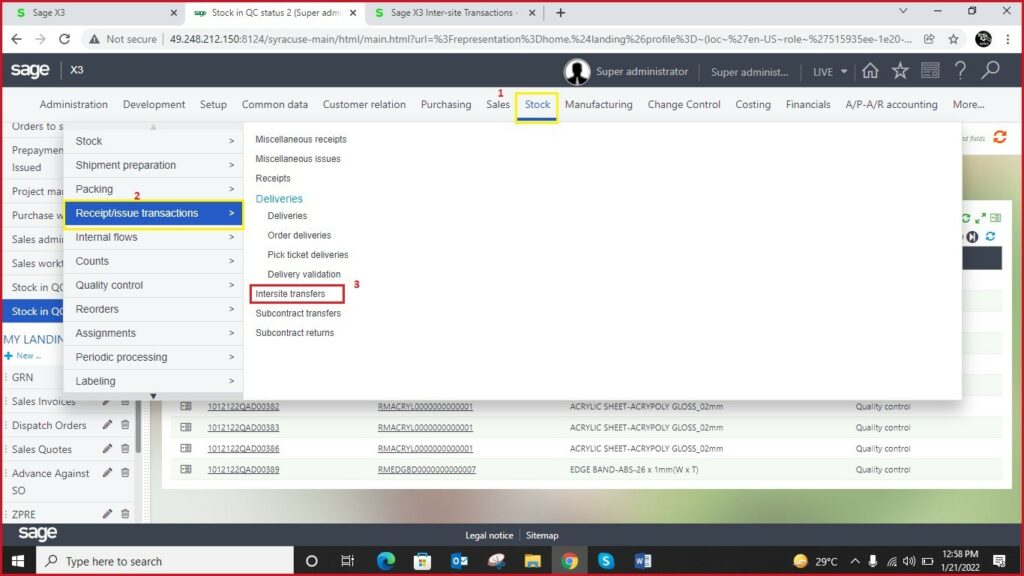

Navigating to Inter-site Goods transfer screen in Sage X3

Stock >> Receipt/Issue transaction >> Inter-site transfers

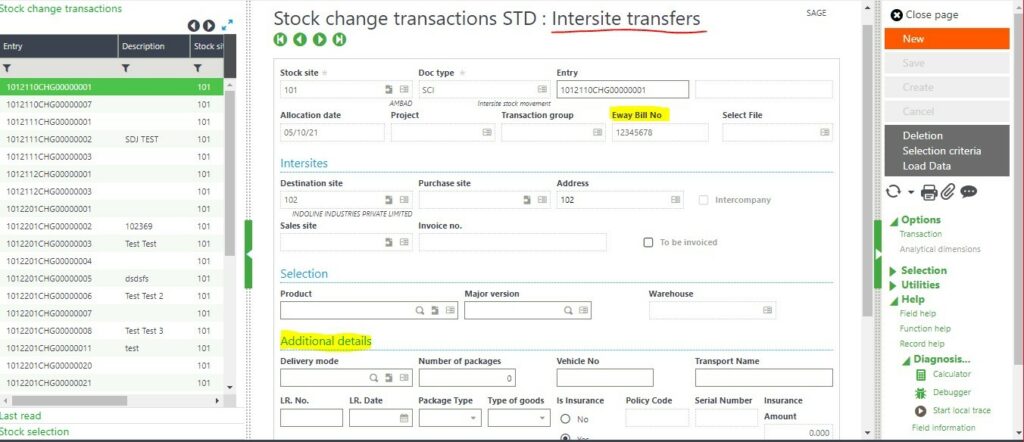

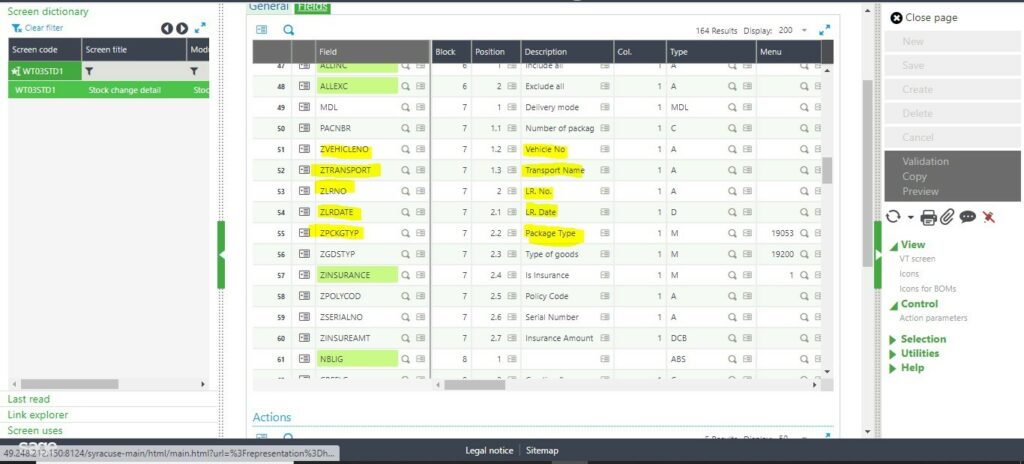

Inter- Site Stock transfer screen will have the following highlighted fields

Fields in Inter-site transfer screen

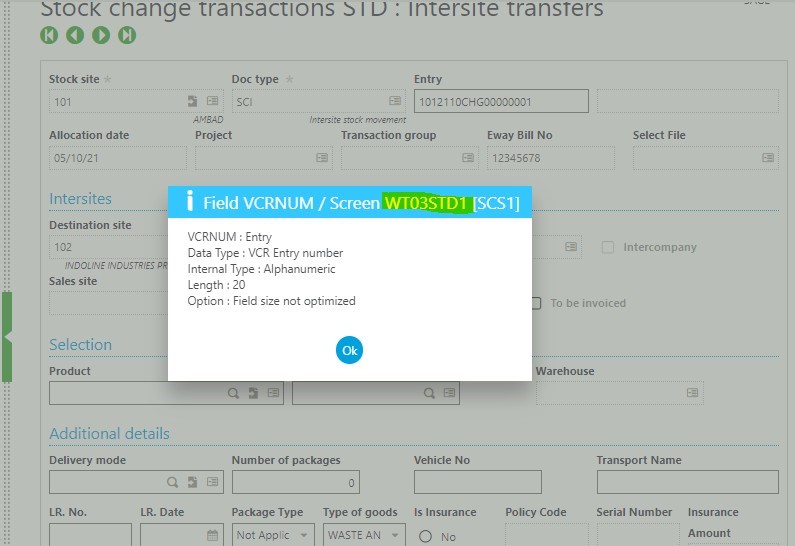

Click on the standard field and Press Esc+F6 to get the screen details

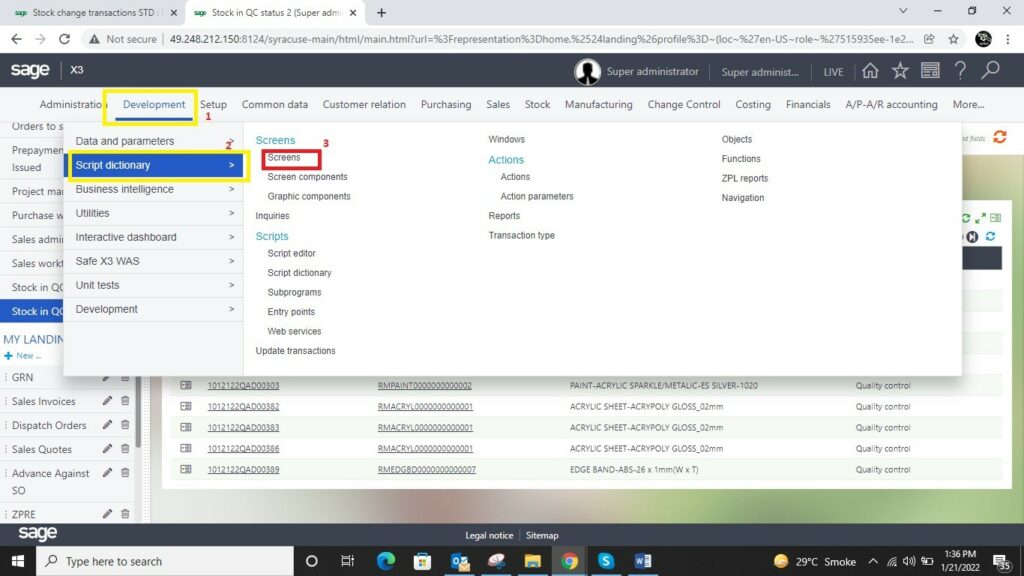

Once you find the screen name, you can go to Development module and search the screen name as per the below image shown.

Development >> Script Dictionary >> Screens

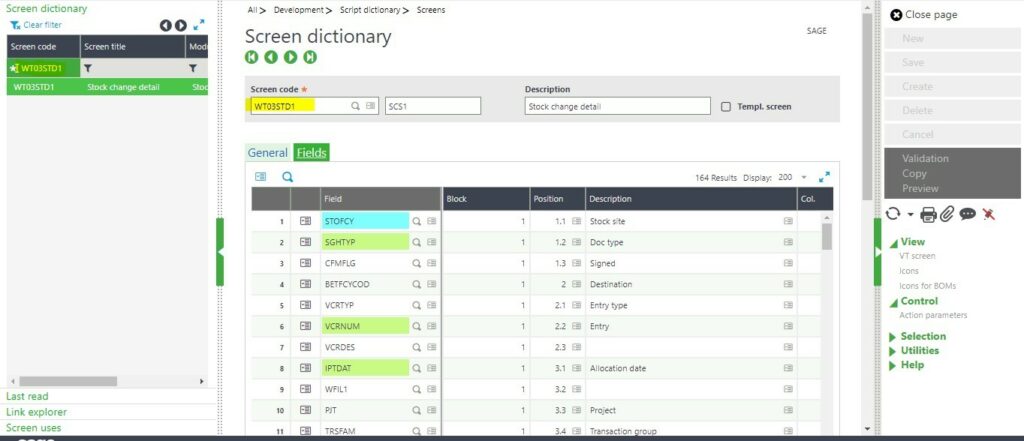

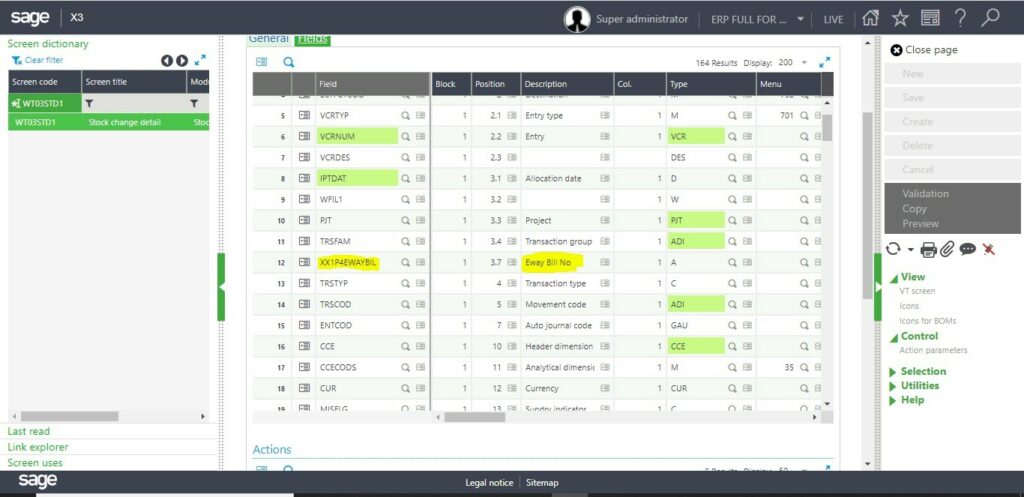

Open the Screen and input the screen code in the left pane Screen code WT03STD1

In the field Tab add the field for E-way Bill details to be flow and captured.

After creating this Save and Validate the same.

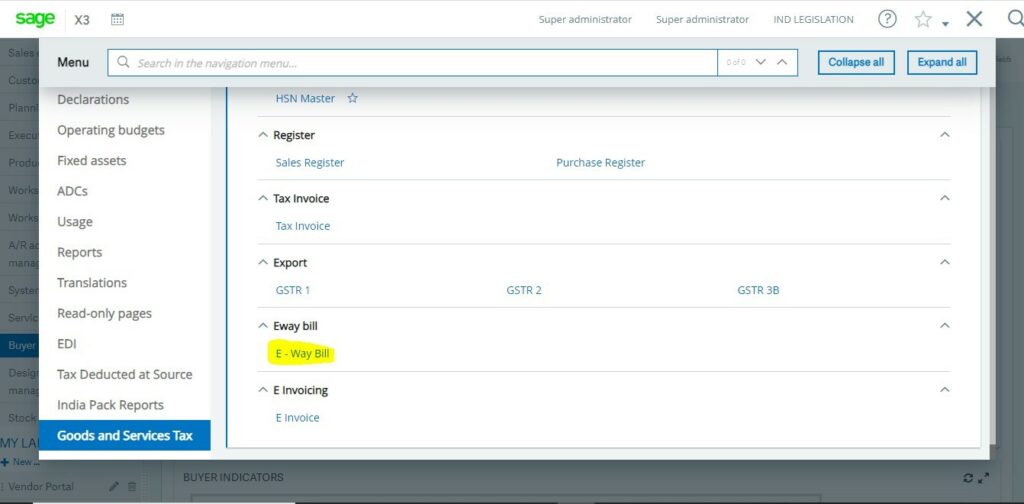

E-Way Bill Module in SageX3 path

Navigation >> Goods and services Tax >> E-way Bill

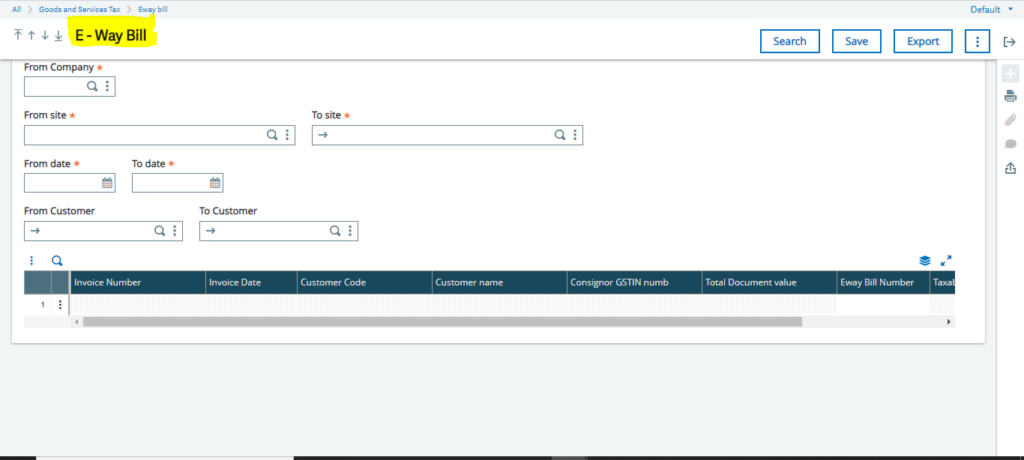

EWay Bill Module Screen to generate the E-way Bill. Input the required details and process.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.