Withholding Tax Rates

Withholding tax is also called as “Retention Tax”. When purchasing goods or services from a vendor, you may need to withhold some of the amount in the transaction, and then remit the withheld amount on behalf of the vendor.

Some business challenges faced by most of the companies are in general with the withholding taxes. Due to poor invoicing procedure, complication arises when a business integrates with multiple purchase orders on a single invoice or where a transaction includes multiple lines that fall into different payment categories. Without proper data, a withholding agent may be unable to impose accurate withholding and is often left with no choice but to subject the entire payment to the highest rate applicable among the payment on the invoice. Because withholding rates can vary wildly between payments types, this can result in over withholding.

In the newer version of Sage 300cloud ERP i.e. v2020, we are pleased to announce that we have a new feature called ‘Withholding taxes’. Which carry out the withholding tax process in quick and effective way and help the users to in just few clicks This allows us retain a certain amount of tax which has to be paid to the government directly.

To setup withholding taxes,

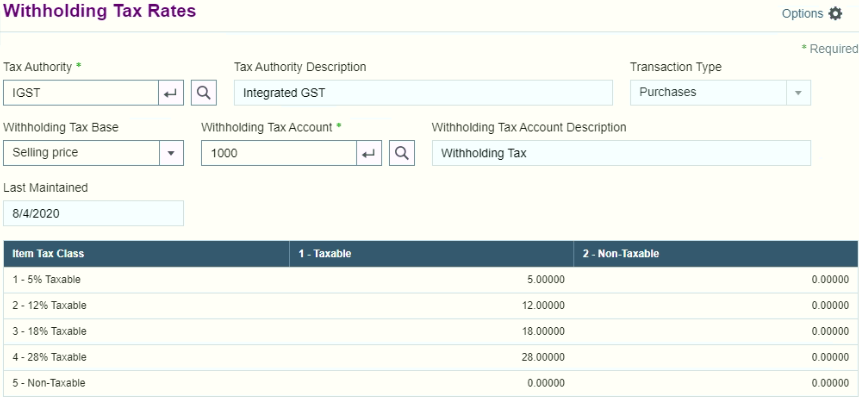

Navigate to Common Services > Tax Services > Withholding Tax Rates

In Sage 300cloud ERP, let us see how a withholding tax rates is charged. The screen allows the user to define rates that needs to be withheld for purchases. This is available for every tax authority and rate-wise that has been defined in the tax services which will makes easier to understand its applicability and simplify the concept of withholding tax.

Please refer the below image for Withholding Tax Rates

To setup, please follow below steps

- Tax Authority: Select tax authority code that requires you to withhold amount to be send.

- Transaction Type: This field’s displays default value of Purchases as withhold taxes are only applicable at the time of purchase.

- Withholding Tax Base: Select at which amount, withholding tax is applicable i.e. on selling price or Tax amount.

- Withholding Tax Account: Select the withholding tax account that specify the general ledger account to which you post tax amounts that you have held for the tax authority.

- Detail line Item Tax Classes: Select a tax rate that has to be withheld for each combination of item tax class and vendor tax class.

Kindly note that you can edit or modify tax rates if they change.

This feature of Sage 300cloud ERP help to define multiple arrays to create withholding tax rates and also it reduces the time and stress of users.

Now let us walk through the implication of Withholding Taxes in transactions and its accounting entries

Scenario 1: Payment against an Invoice

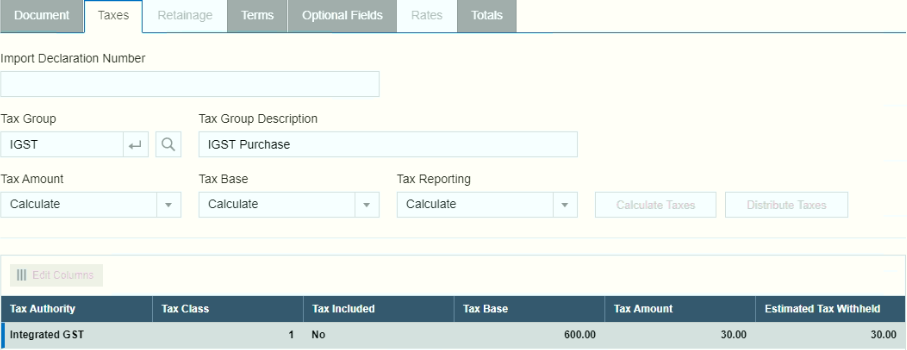

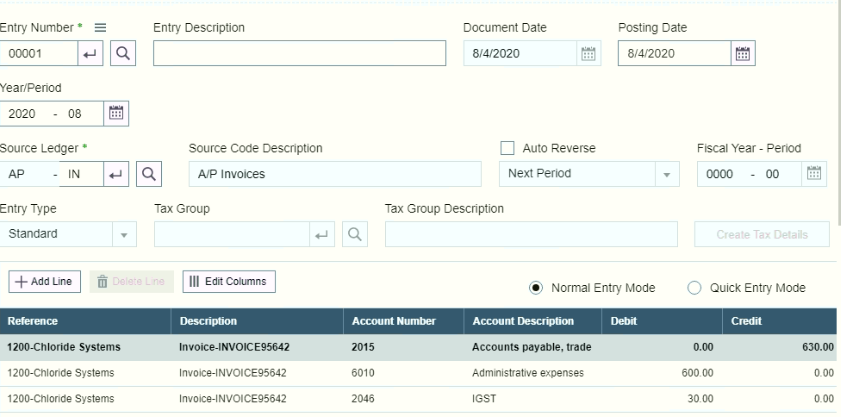

AP Invoice Entry

To book the invoice received from the vendor,

Navigate to

Accounts Payable > A/P Transactions > Invoice Batch List > Invoice Entry

The new rates will be applicable to an invoice entry once you define the withholding tax rates. You can check the taxes in the ‘Taxes’ tab where it displays the actual Tax Amount along with the Estimated Tax withheld.

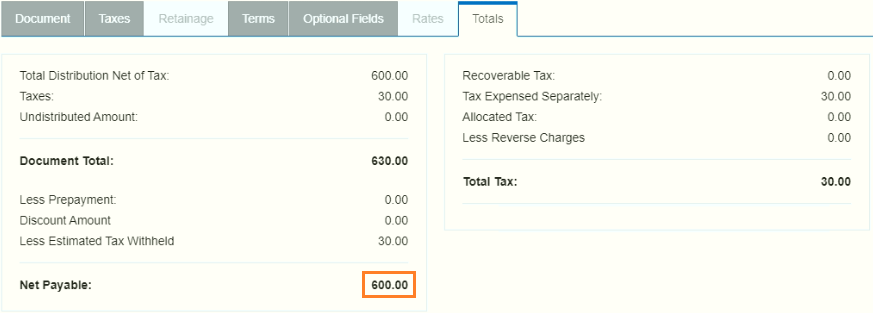

Click the ‘Totals’ button to see the document summary information. The net payable will be amount after deducting the withheld taxes.

Accounting Impact for AP Invoice

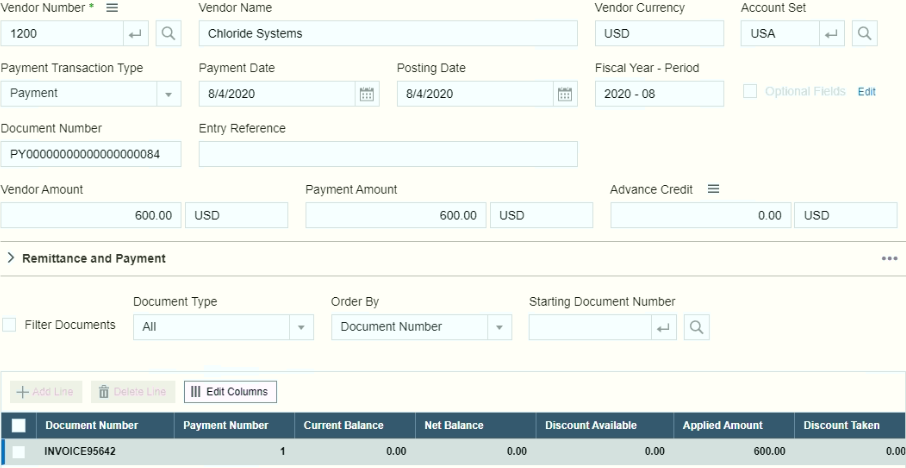

AP Payment Entry

Navigate to

Accounts Payable > A/P Transactions > Payment batch list/Payment Entry > Payment

While passing payment transaction for the invoice, it displays the payment of outstanding balance by automatically deducting the withheld amount.

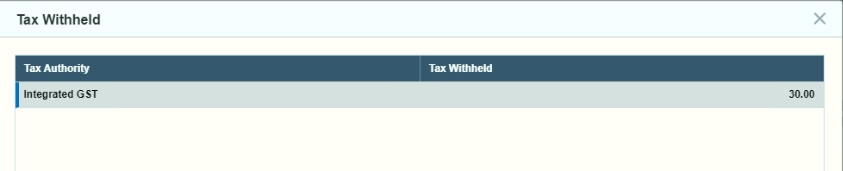

Click on ‘Tax Withheld’ button to view the tax withheld against the invoice.

Refer below screen

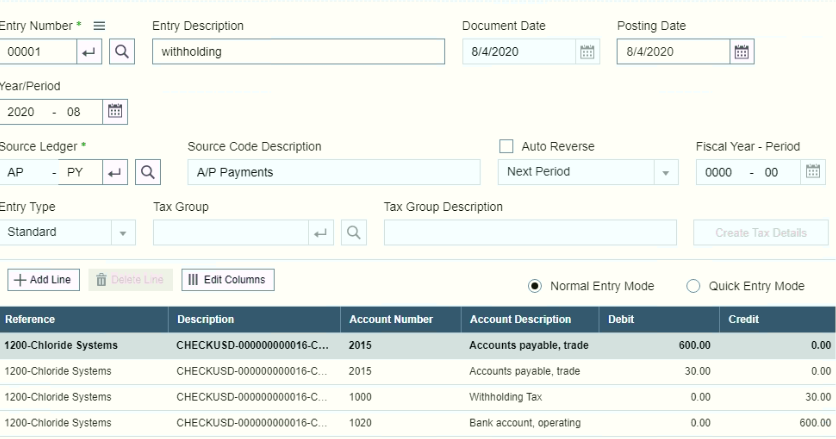

Accounting Impact for AP Payment

Scenario 2: Applying Advance Payment against an Invoice

AP Prepayment Entry

Prepayments are not automatically applied to invoices that use withholding taxes. To apply a prepayment to an invoice that uses withholding taxes, you must pass an ‘Apply Document’ transaction.

Navigate to

Accounts Payable > A/P Transactions > Payment batch list/Payment Entry > Prepayment

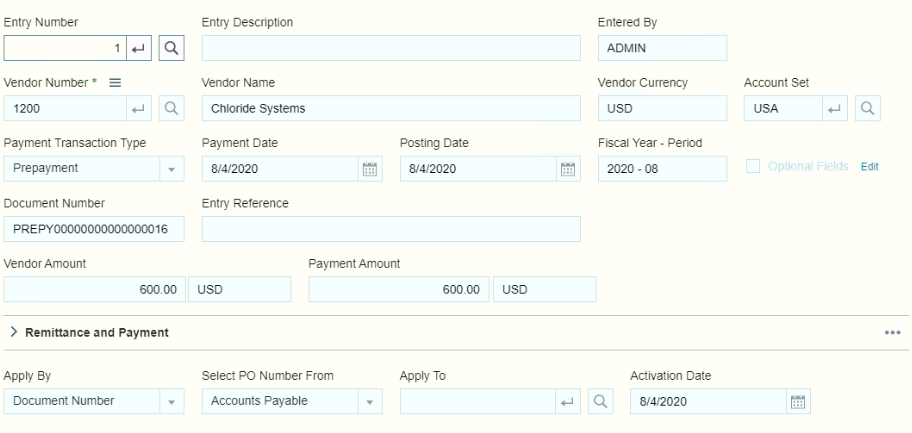

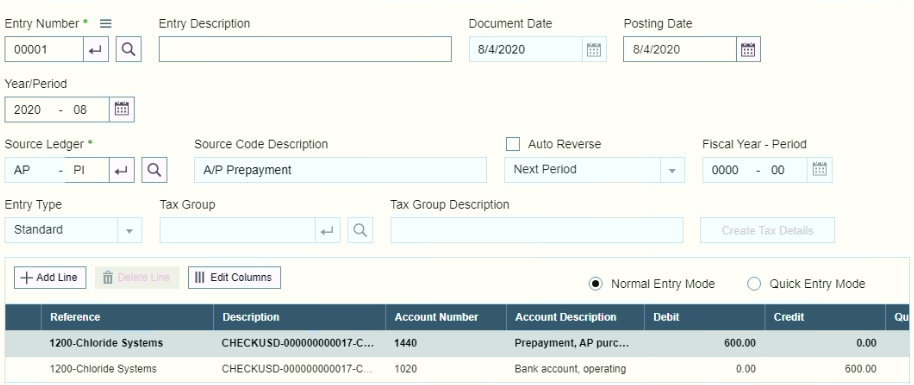

Accounting Impact for Prepayment

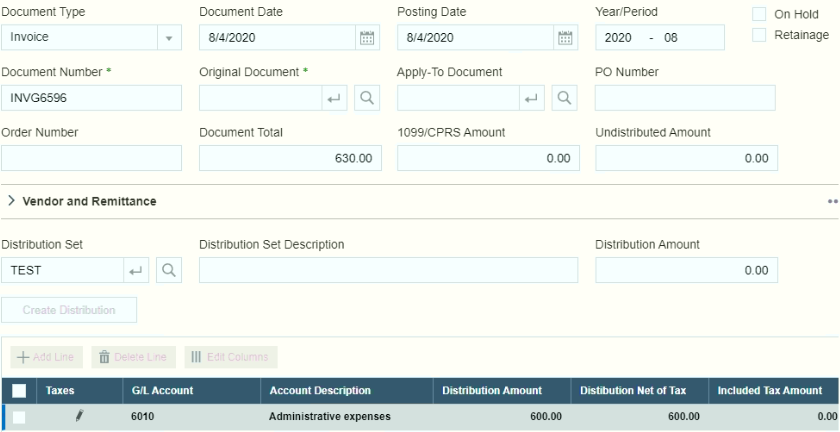

When we receive the invoice from vendor, book an invoice which would later be applied to the Prepayment made.

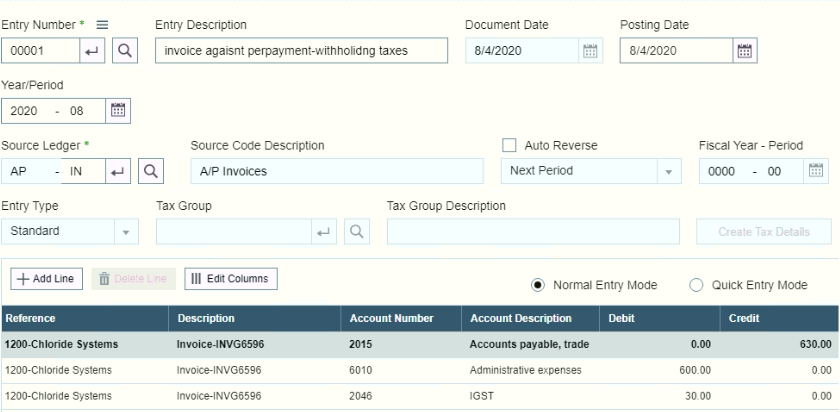

Accounting Impact for Invoice against prepayment

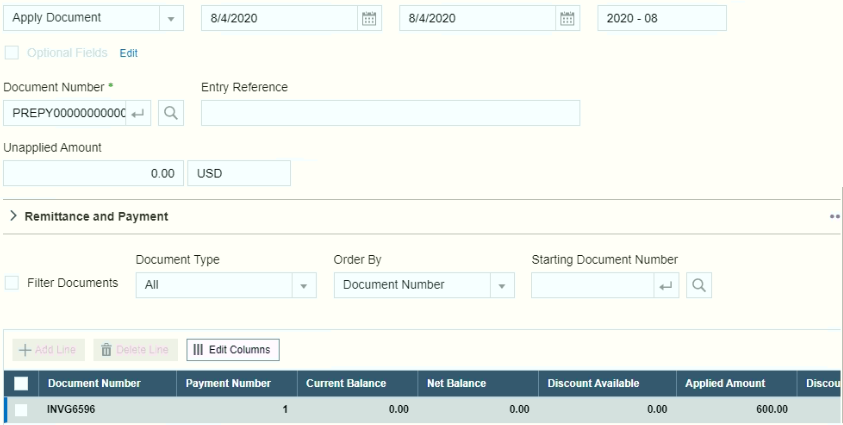

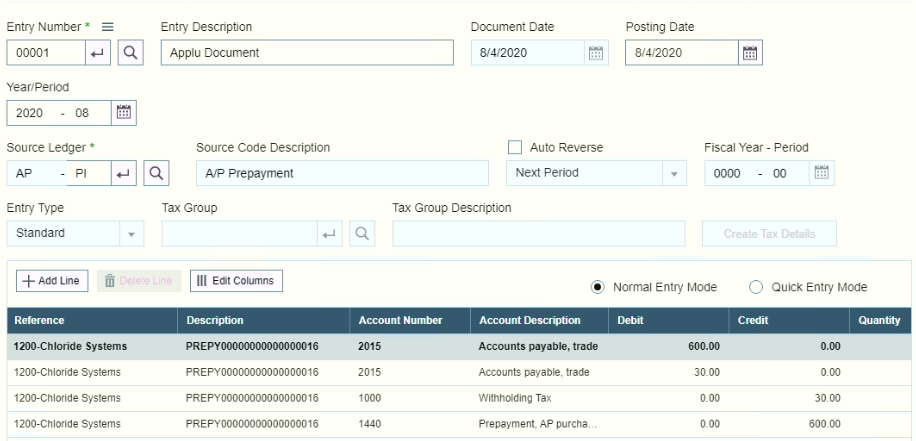

Apply Document Entry

We apply the pending prepayment against the vendor invoice received.

Navigate to

Accounts Payable > A/P Transactions > Payment batch list/Payment Entry > Apply Document

Here we can set the ‘Withholding Tax’ in the taxes tab.

Refer below screen shot

Accounting Impact for Apply Document

By using Sage 300cloud ERP withholding taxes feature, we can

- Specify withholding tax rates for each set of purchases tax classes

- Provides comprehensive invoicing

- Manage accurate data flow from Invoicing to Payment

- Allow to maintain real-time withholding tax verification

- Reduce taxation errors

Sage Software Solutions (P) Ltd. has been designing and implementing ERP systems for over three decades to businesses across India. You can drop a mail at sales@sagesoftware.co.in for a free demo and consultation.