Sage X3 Cost Functionality

In an ERP or accounting system everyday transactions like Procure to Pay and Order to Cash play very important role and needs to be configured according to the requirements of the business.

Apart from the above transactions, Additional Cost functionality is needed to load additional cost like Freight, Custom duty etc. charges on the inventory.

Additional cost is booked on the basis of whether you need the stock valuation on the inventory or you don’t need it to be loaded on the inventory.

We need to configure invoicing elements on the basis of whether we need stock valuation or not and in purchase invoice types we need to make an invoice type of Additional cost invoice type.

If we decide to keep stock valuation as yes, then the system will generate a stock valuation entry for loading the cost.

Secondly if we decide to keep it as no, then it will not generate a stock valuation entry.

Configuring invoicing elements is a key functionality in Sage X3, because it will decide on what different ways additional cost will impacts the system.

In Sage X3, we use Invoicing elements to book additional cost against Purchase Receipt.

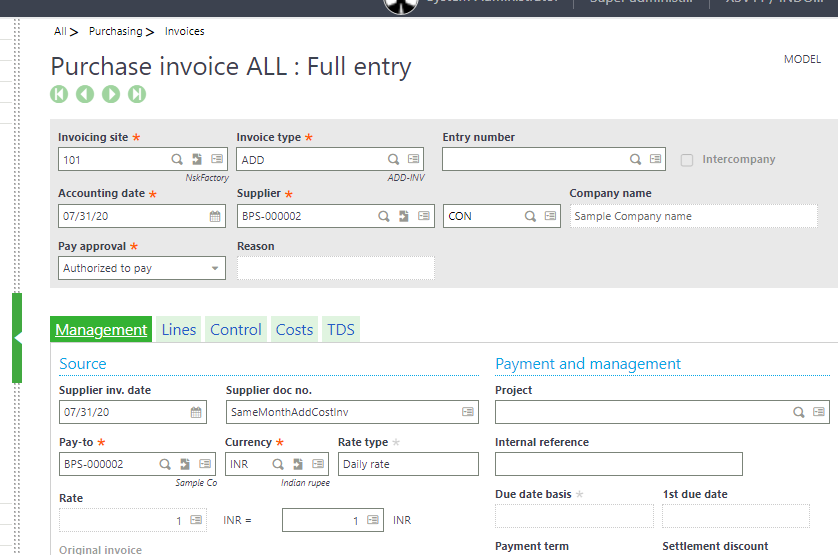

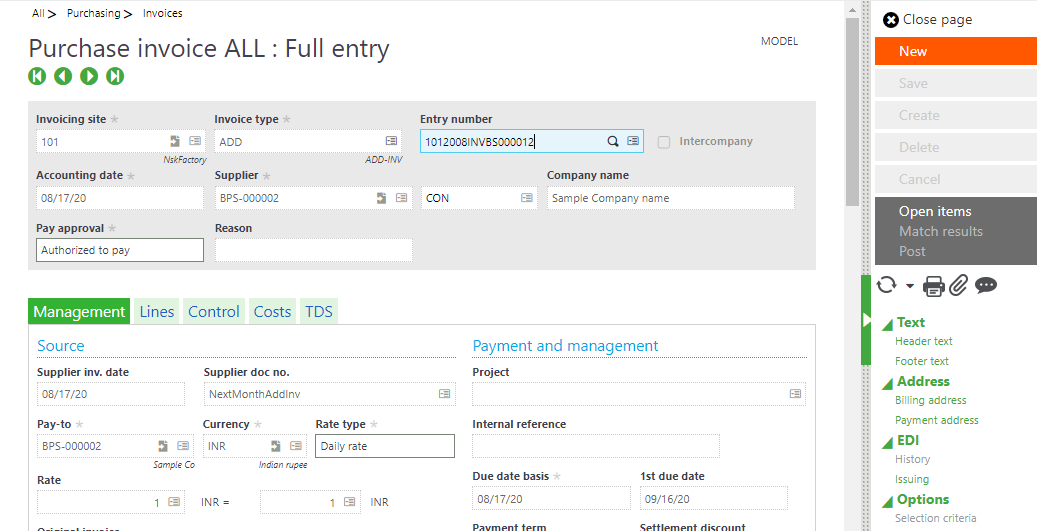

Now, suppose you have booked a purchase receipt for which you want to book an additional cost invoice, you will go to Purchasing -> Invoices -> Invoices – Click on new and select an Invoice type as ADD (Additional cost Invoice)

Challenges businesses face while booking additional cost invoice

In the case of stock valuation kept as no there will be no issue in this scenario, secondly if we need the case in which cost to be loaded on the inventory – this happens in 2 scenarios in the system we will understand this in detail.

- We will book an additional cost in same month as of date of the purchase receipt without closing the fiscal period of that particular month.

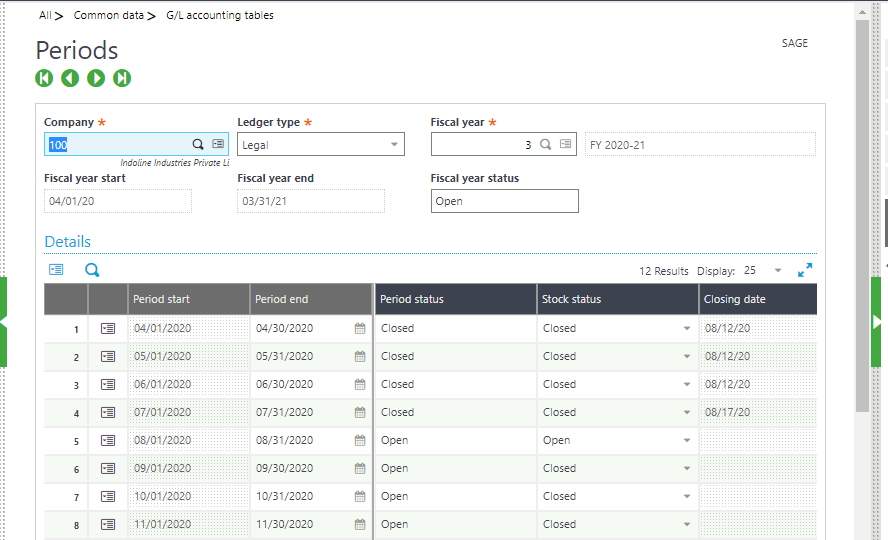

- We will book an additional cost in another month as of date of the purchase receipt and also close the that fiscal period of that particular month before booking additional cost invoice.

We will book a purchase order and purchase receipt first, run accounting interface for Stock Valuation Entry to get generated for stock and then proceed with the above 2 scenarios.

1. Booking Additional Invoice in the same month as of the date of Purchase Receipt

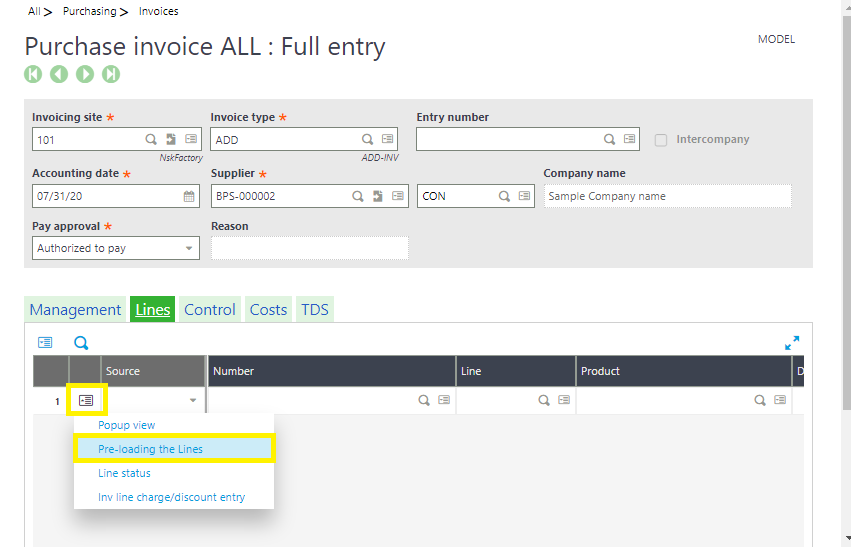

In Additional cost invoice instead of selecting receipt from the sidebar we have to go to lines and click on the action button and select pre-loading the lines as shown below.

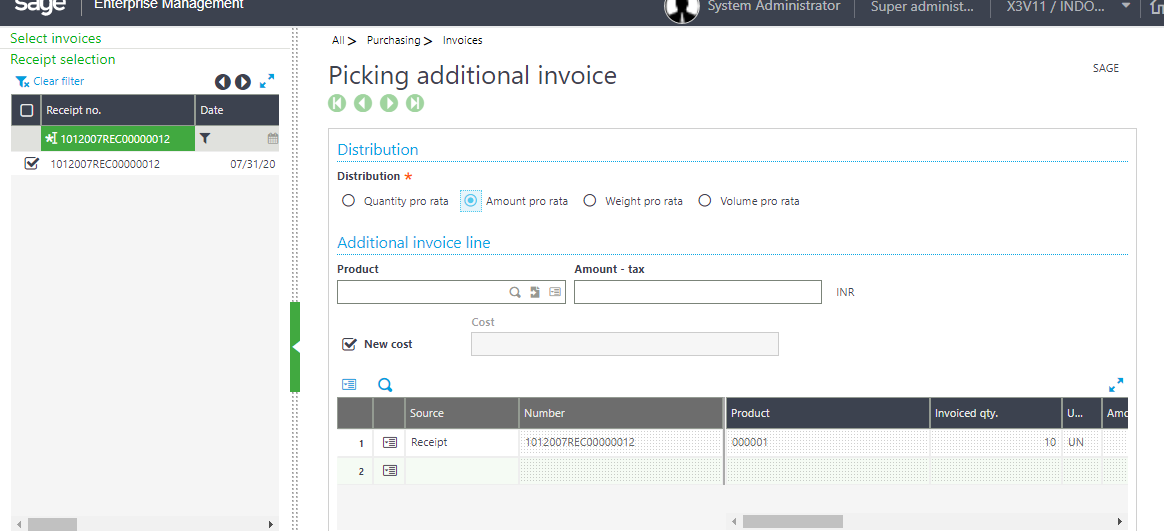

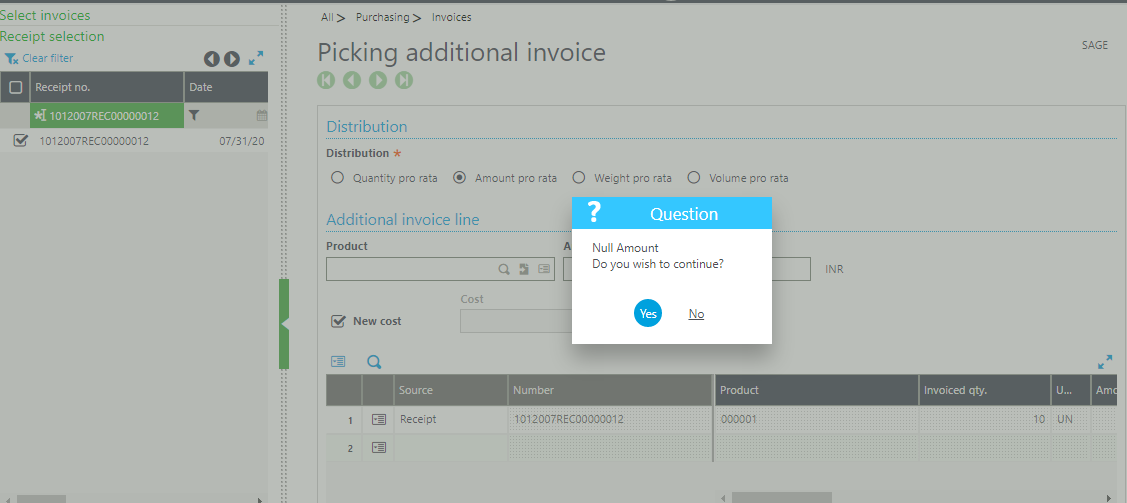

After that a screen will open from that Select receipt from the side bar and click on Ok and press yes for a pop up that asks Null amount do you wish to continue.

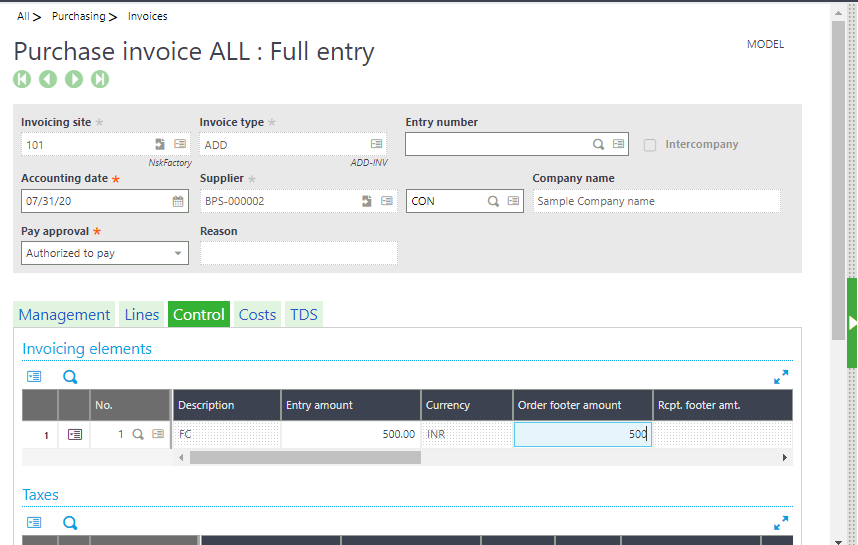

After clicking Ok navigate to control tab and enter the invoicing element for which you need to load Additional cost and enter Entry amount and Order Footer amount.

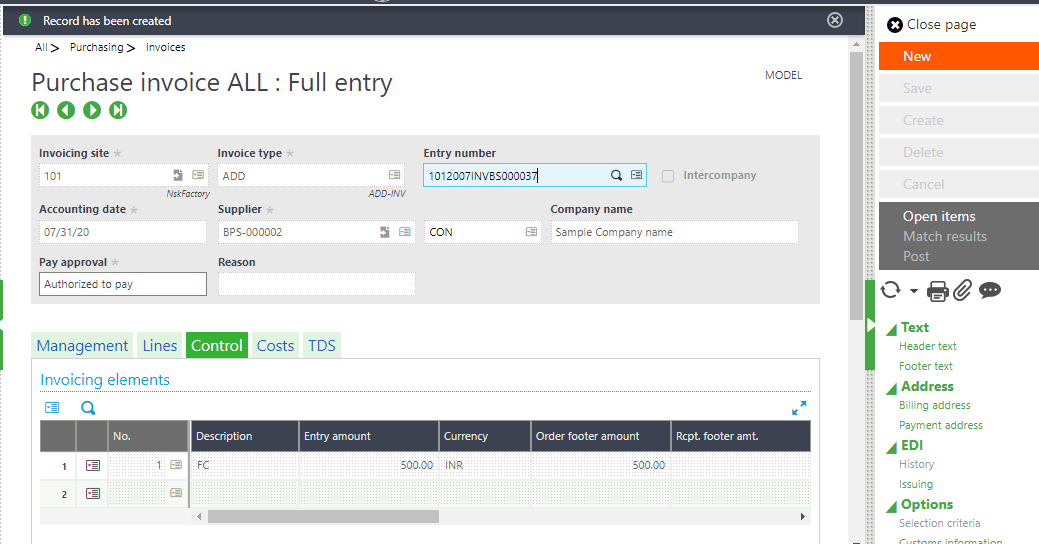

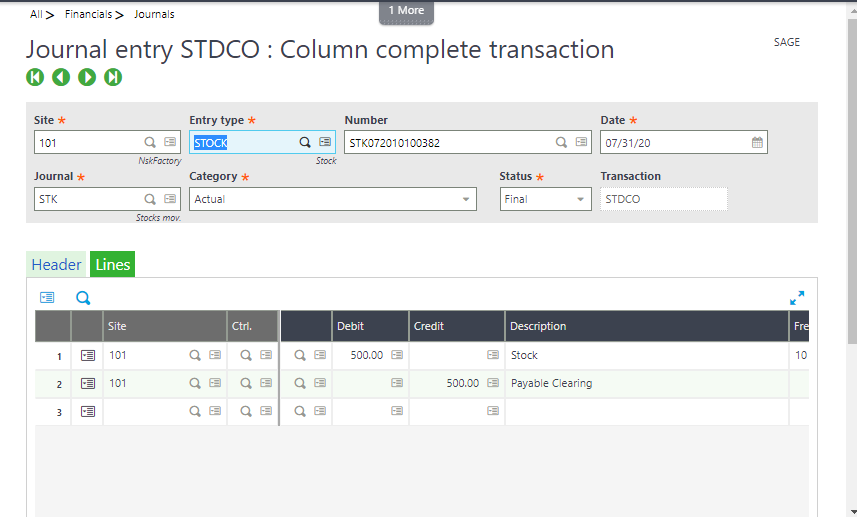

Create and post the entry and Run accounting interface from stock so that STK entry will be created for the Additional cost invoice.

Stock impact would be same as that of the Purchase Receipt.

| Account | Debit | Credit |

| Stock | 500 | |

| Payable clearing | 500 |

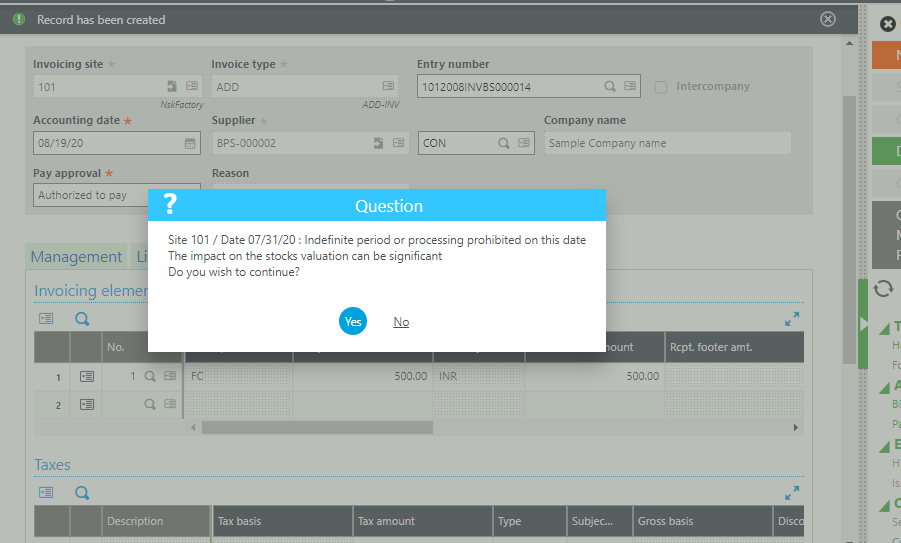

2. Now suppose a user by mistakenly closes the period in which receipt is booked and then do additional cost entry in the next month then Adjusted purchase order/Invoice will be impacted instead of stock (Inventory account) because stock period is closed.

In the following scenario impact would be as below.

| Account | Debit | Credit |

| Adjusted purchase order/invoice | 500 | |

| Payable Clearing | 500 |

In this above scenarios we can conclude that if you need to book additional cost invoice of a particular receipt you need to make sure that at least stock period of that particular date on which receipt has been created is open to avoid the impact going in Adjusted purchase order/invoice.

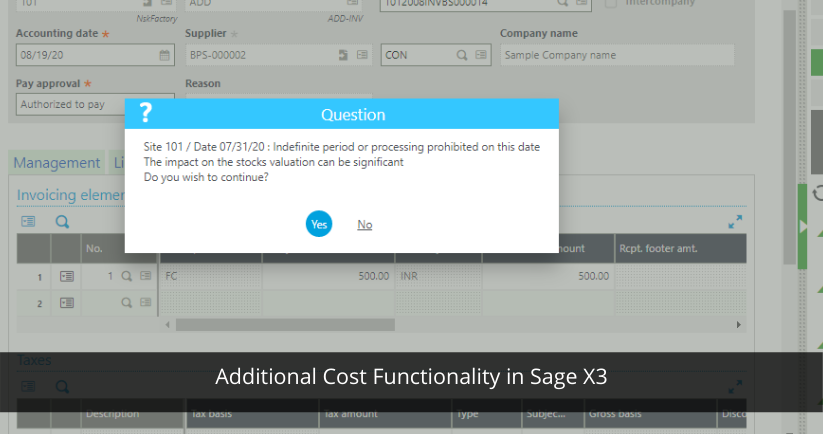

If the stock period is closed system will give you following message stock impacts would be insignificant do you wish to continue if you are okay with impact going in Adjusted purchase order/variance click on yes, if not click on no and open the stock period and then post the following entry.

For more details on Sage X3 features and functionalities for business growth, visit our website or write to us at sales@sagesoftware.co.in. You can also check out industry-specific ERP and CRM solutions here.