In Sage X3, user can enter a tax manually for any Sales transactions. But automatically selection of taxes while creating Sales transactions on the basis of sales site and customer delivery location. on customer master and Sales transaction screens. Refer the below example for better understanding:

Automatic Selection of Taxes in Sage X3

The function is to automatic selection of taxes for intrastate and interstate, whenever sales order created from different sales site location to customer delivery location like within the state or out of the state.

Functional Path: Common data → BPs→ Customer → Ship-to customer.

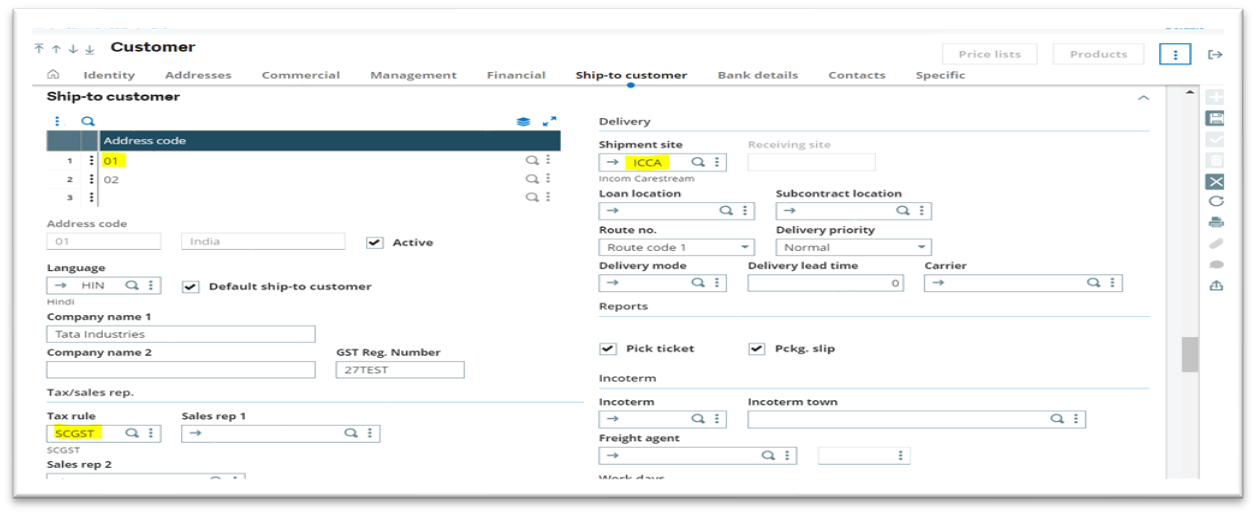

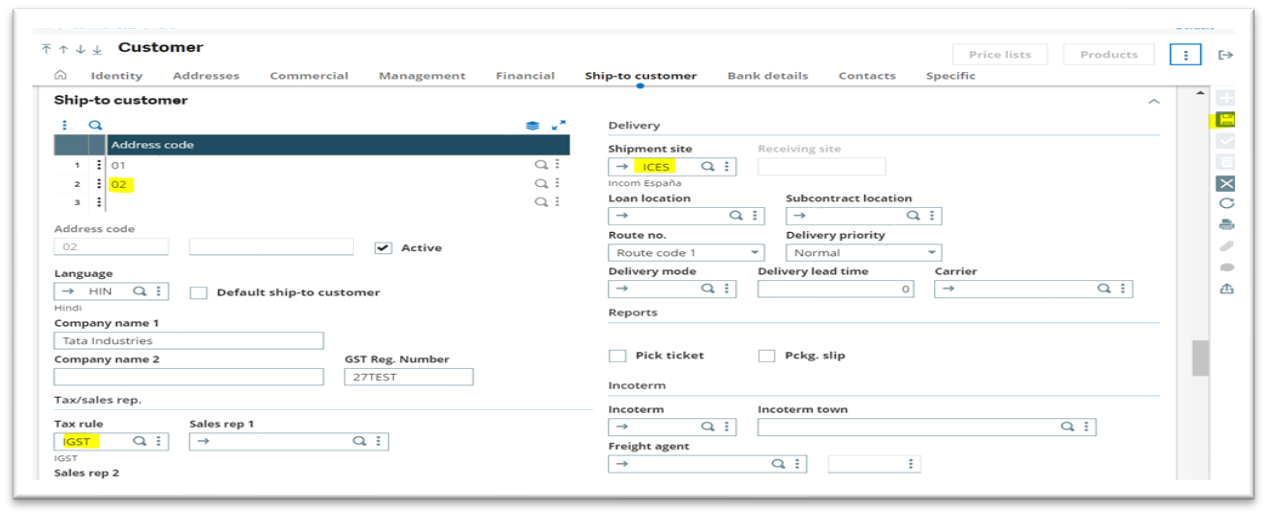

This functionality will work, when you configure the customer master by mapping address code with shipment site and tax rule in “Ship to Customer” tab.

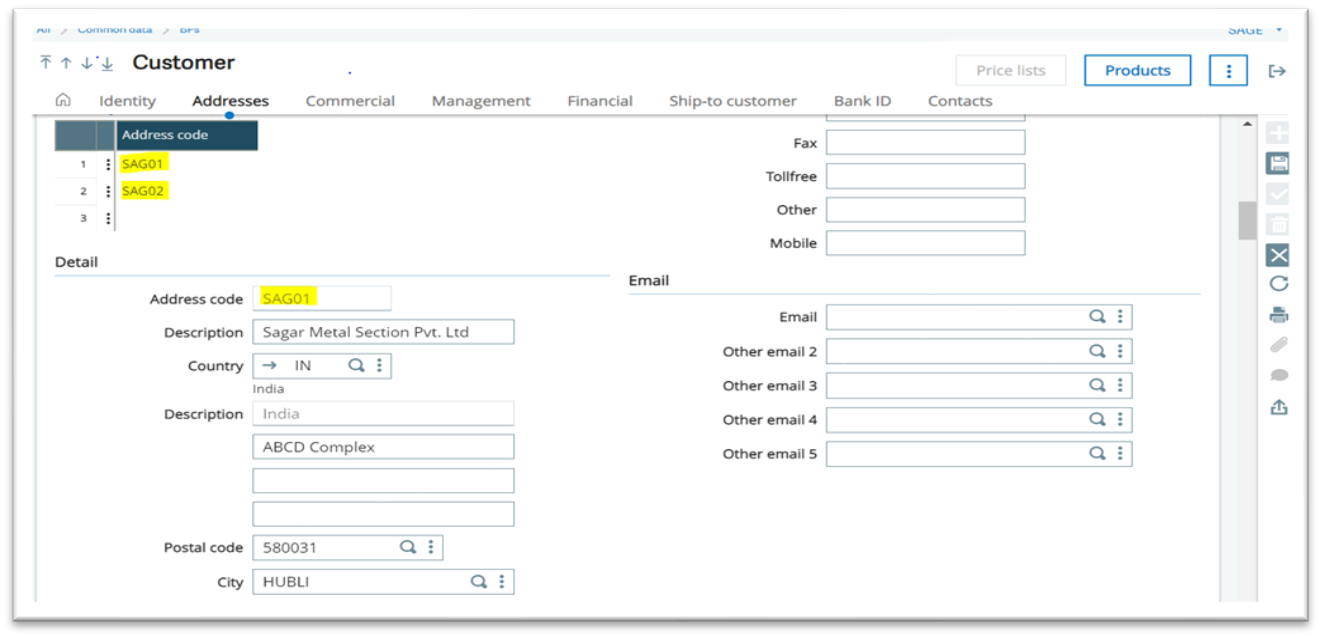

First, we need to create a customer master in common data module then in “Addresses” tab we need to add address code with different address location. Refer the below screenshot for better understanding:

After, go to “ship to customer” tab, select your address code which is created in “addresses” tab and select your shipment site from “delivery” sub tab, map the tax rule as SCGST for intrastate shipment, do the same procedure for second address code, first you select your second address code and select the other shipment site from “delivery” sub tab, map the tax rule as IGST for interstate shipment and save. Refer the below screenshot for better understanding:

1.

2.

Here we have completed the configuration of automatic selection of taxes, now you can you create Sales transactions with automatic section of taxes based on sales site and customer delivery location.

Hope this helps.