Overview

As we know taxation system is used by many countries. These taxes can be on the state or the central level. Some of the noted taxes that need to comply are TDS, VAT, Excise, Service Tax, etc. Various taxes are imposed on individuals and businesses that need to be complied with, mandatorily.

When we are talking about so many taxes and regulations to follow, there is also a requirement for software that can take care of all of these efficiently and seamlessly, saving the administration team a lot of time.

Using the Sage 300cloud Add-on module you can apply TDS on the purchase of goods that are developed to do just the same. You can generate a statutory report from our systems such as Form 16A, deduction, and remittance report.

TDS Configuration in Sage300

To deduct TDS on purchase of goods under section 194Q you need to follow below steps.

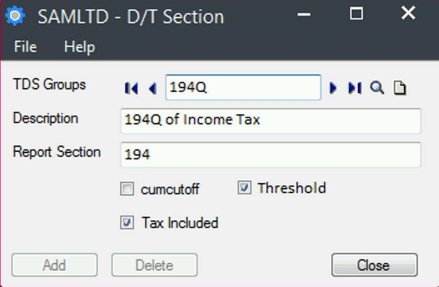

- For creating new section go to Tax Deducted at Source 🡪 D/T setup 🡪 TDS Section

- Define section with threshold option for selection. User must select threshold option for TDS 194Q setup

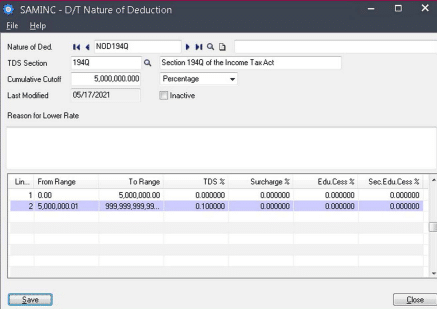

- Next step is to create Nature of Deduction (NOD) & define TDS rate. You can create NOD from Tax Deducted at Source 🡪 D/T setup 🡪 Nature of Deduction screen.

- We will define a new NOD code eg:- NOD194Q which will have 0.1% as TDS rate and cumulative cut-off value of INR 50,00,000

- Make sure that TDS section selected in NOD is 194Q and TDS% is defined at 0.1

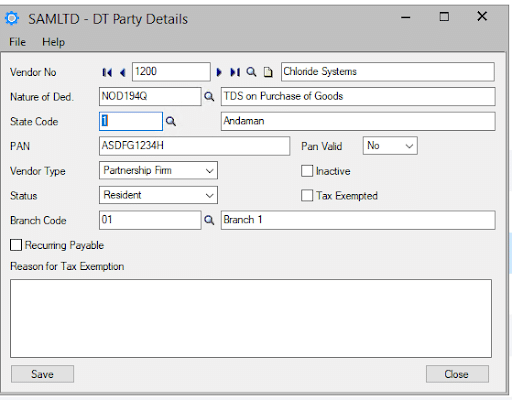

- Now assign NOD created NOD194Q to vendor in party details by navigating to Tax Deducted at Source 🡪 D/T setup 🡪 Party Details

By assigning NOD for section 194Q, the system will pick up this NOD by default while creating transactions against the vendor.

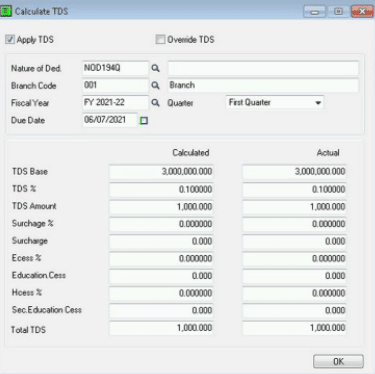

TDS Deduction on transactions at 0.1%

As per the new section 194Q, the TDS will be deducted on different amount unlike the default cumulative functionality which deducts TDS on Total amount.

Let’s check with example:

Threshold cut-off: 50, 000, 00

- Use will enter an Invoice value of 30 Lakh

TDS Effect: No TDS will be deducted

- User will again enter an invoice value of 30 lakh for the same vendor

- Programmatically the system will check for the threshold flag and for total sum of invoice based on vendor code, Nod code and financial year.

TDS Effect: TDS 0.1% of deducted will be on 10 Lakh

i.e.: 0.1% of 10 lakhs = INR 1000 TDS value

Note:-

- The accounting of TDS deduction will be entirely based on Vendor & NOD code & fiscal year combination.

- Same functionality will be applicable on AP Credit Note & Debit Note, AP Prepayment, and AP Miscellaneous. Payment.

- To print this report Go to Tax Deducted at Source 🡪 D/T transaction report–>Deduction and remittance

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.