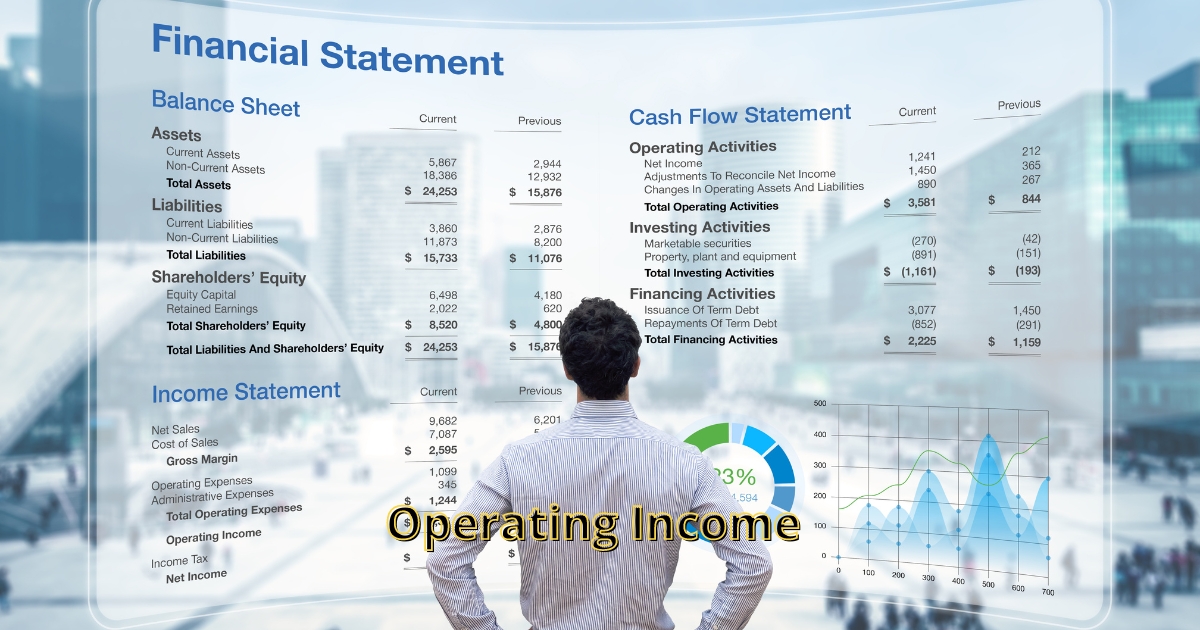

Operating Income can be located in the income statement listed as the business’ mainstream revenue. It is the value that calculates the profit left after subtracting operating expenses and the cost of goods sold.

In this blog, let us learn more about operating income and its importance –

Operating Income Meaning

What is operating income? Operating income is another term for operating profit. Operating Income is the profit that is left after deducting the operating expenses and cost of goods sold from the total gross income. The direct expenses include raw materials and labour costs linked to the product or service of the business. Indirect expenses include indirect costs incurred during the production process such as salaries of administrative staff, office rents, sales commissions and marketing expenses.

One of the most common methods to value a company is by adopting the financial ratio method. It has the ability to cover costs and generate profit. If your business is generating more operating income, then it means that the business is earning more, simultaneously controlling expenses, production costs, and overheads.

In simple terms, operating income is a measurement which determines a company’s profit after deducting all the expenses of business operations. Further, there are two types of expenses – the cost of goods sold(COGS) and operating expenses. The cost of goods sold involves the expenses directly related to the manufacturing of a product. It includes labour, raw materials, and overhead allocated to items sold. Whereas, administrative and general expenses prior to taxes and income expenses come under operating expenses.

Significance of Operating Income

A company’s operating income is a vital metric to measure as it reveals the company’s ability to generate profits from its operational activities. This data can be used by the business owner to measure the operational success of your business. Plus, this data will be very helpful to improve the operational capabilities of your business.

Investors and stakeholders find this data to be very useful as they are investing money in your business. You will have to show them the operating income and other accounting reports to inspect the efficiency and profitability of the business. These financial reports reveal the health of your business.

Also Read : What is Income Statement ? – Definition, Importance and Examples

Operating Income Formula and Calculation

You can calculate operating income in three ways – top-down approach, bottom-up approach and one leverage cost accounting classifications.

Operating Income Formula: Top-Down Approach

Operating Income= GP − OE− D − A

where, GP=Gross profit, OE=Operating expenses, D=Depreciation, A=Amortization

When you subtract the cost of the goods sold from the net revenue you will earn net income which is the gross profit. Operating expenses exclude allocated costs, hence, depreciation and amortization should also be subtracted.

Operating Income Formula: Bottom-Up Approach

If you have net income, you can easily calculate the operating income. Net income is calculated by deducting a few items from operating income. Later, you can just add them back to arrive at operating income:

Operating Income = NI + IE + TE

Where, NI=Net income, IE=Interest expense, TE=Tax expense

In this equation, it is essential to have a fully computed income statement since net income represents the final and lowest element in the financial statements. In this scenario, the company might already be disclosing operating income near the conclusion of the report.

Operating Income Formula: Cost Accounting Approach

In the financial accounting of the company, direct and indirect costs are not widely used. However, for internal use, a company will classify these expenses. In that case, the company can find operating expenses by deducting all these expenses from the net revenue(taxes and interests are not classified either):

Operating Income = NR − DC − IC

where: NR=Net revenue, DC=Direct costs, IC=Indirect costs

Here, the net revenue is used if there are any product returns or other deductions to make the gross revenue.

What is included in Operating Income?

→Gross Income

Gross income is the total revenue your business generates from sales, without deducting taxes and other business expenses. Gross income has to be measured properly as the value is used as a starting point to calculate operating expenses and taxes.

Given is the formula to calculate gross income:

Gross Income = Gross Revenue – Cost of Goods Sold (COGS)

Gross revenue is the earnings you get from sales activities before any deductions are made. Cost of goods sold(COGS) is the total cost incurred in reading the product for the market sale. Raw materials, labour costs, packaging materials, shipping charges overhead costs, etc. come under COGS.

Example of Operating Income

ABC Company’s operational income for the fiscal year amounted to 5 million rupees. This figure reflects the revenue generated from core business activities, such as sales and services, minus the associated operating expenses like production costs and overhead. Essentially, operational income provides insight into the profitability of the company’s day-to-day operations before factoring in interest and taxes. In this case, the 5 million rupees signify the earnings derived specifically from the company’s operational endeavours, offering a key indicator of its financial health and efficiency in generating profits from its core business functions.

Who Deals with Operating Income?

In a business, accountants deal with tracking and reporting operating income. This information is reported on the financial statements such as the income statement and the statement of operations. The statement of operations also gives an overview of the cost of goods sold (COGS), sales numbers, and operating expenses.

In mergers and acquisitions, investment bankers and finance professionals leverage operating income when comparing company analysis and while considering investment options. Because operating profit doesn’t account for taxes, analysts can use it to compare companies in places with different tax rules, like states or countries.

The finance team of the business will also use the operating income to review spending and budgeting. This profitability measuring method is the best to analyse the revenue of the company when compared to sales. The finance team can use this information to analyse how well the company is managing its operational expenses.

Also Read : What is Operating Profit Margin?

Operating Income vs. Net Income

If you want to measure your company’s profitability, then operating income and net income are important. Operating Income is the profit you attain after subtracting the cost of goods sold and operating expenses from net sales revenue. All revenues and expenses are taken into account by net income. It encompasses non-operational earnings from investments and asset sales, alongside non-operational expenses like taxes, interest, and one-time charges. Net income, often referred to as “the bottom line,” holds significance as the concluding entry on a company’s income statement.

Is it possible for a Company to have High Operational Income but Lose Money?

If a company has good operating income, it indicates that the company has very good profitability. However, the company must spend money on interest and taxes. It may be due to one-time charges or poor financial decisions made by the company. In addition, the increased interest rate scenario also affects the outstanding debts. On the other hand, a company might generate substantial interest income, a component that wouldn’t be reflected in the operating income.

What is Non-Operating Income?

Non-operating income is the complete opposite of operating income. Non-operating income is the expense derived from activities which are part of a business’s core operations. Non-operating income includes expenses such as dividend income, interest, gains or losses from investments. Plus, expenses incurred in foreign exchange and asset-write downs are also included in non-operating income.

Using Accounting Software for Operating Income

To avoid the risk of manually calculating operating income, you can automate the process with accounting software for accurate results. Further, your business can also leverage the benefits of implementing ERP software. This advanced system is multi-functional and provides efficiency in conducting business operations.

ERP can manage the entire sales of the business from the beginning to the end. In addition, it can automatically receive and record online payments, easily generate and send invoices, track bills and purchases, automate tax calculations, and many other functions. All these functions are performed in a single platform. Implement this sole solution for your business for productivity and growth.

Conclusion

Finally, we know why companies are more interested in measuring the operating income than the net income. Operating income measures the expenses that are directly related to the company (operational expenses). Operating income can be measured in multiple ways. It is found at the bottom of a business’s income statement. Operational income is the leftover money to pay for financial costs such as interest or taxes after deducting operating expenses.