What is Variable Cost?

Variable Cost is an expenditure that changes in direct proportion to the volume of goods and services produced and influences the key product pricing and policy decisions, and availability of the products and services in the market.

When the volume of production goes up, the variable cost is expected to increase. Similarly, it is expected to reduce when the production volume goes down. The Variable Cost is also known as the Direct Cost incurred throughout the production activity.

What are the Different Example for Variable Cost?

Now that we’ve discussed what is Variable Cost, let us discuss its examples. Variable costs may vary depending on the nature and scale of a business. Here are the most commonly incurred variable expenses:

1. Raw Materials

Raw materials are unprocessed or minimally processed substances. During the production activity, they are transformed into finished goods — for example, wood, crude oil, coal, and rubber. Raw materials can be both natural and artificial (manmade). Expenses incurred on raw materials are included in the variable costs.

2. Part-time Labor Cost

The labor cost of part-time workers is another example for variable cost. It includes costs specific to the laborers engaged in the production activity. For example, part-time labor wages, benefits, and taxes paid to the Government. Sometimes, the part-time labor cost may increase due to economic circumstances and higher demand for production.

3. Sales Commissions

Most companies pay their partners a specific percentage of sales as a commission. The exact percentage may vary depending on the nature of the product, competition, and the company’s financial position. Besides, partners who regularly achieve their sales target may receive a higher commission than others.

4. Utility Bill Payments

For a business to conduct its regular activities, it requires a continuous supply of electricity and water. In addition to the electricity and water bills, it also incurs regular bill payments such as telephone & Internet expenditures, insurance bill payments, and so on. These bills are either charged at the start or end of the month or year, depending on the payment mode selected.

5. Packaging Expenditure

Another example for variable cost includes packaging expenses. Businesses have to produce goods and package them in attractive packaging boxes, bags, or plastic wrappers. The Packaging expenditure is another type of variable cost that can increase with the volume of production, and vice versa. Moreover, the quality of the packaging materials influences the overall cost.

What is the Variable Cost Formula?

For manufacturing companies, accurate calculation of variable costs is important to closely monitor changes in production costs. Here are three different formulas you can use to calculate variable costs.

- Variable Costs = Total Costs – Fixed Costs

This formula is used when you know your total costs, and fixed costs such as property tax, employee salaries and annual maintenance contracts. Variable costs are calculated by subtracting fixed costs from total costs.

- Variable Costs = Total Cost of Materials + Total Cost of Labour

Variable costs can also be defined as the sum of raw materials and daily labour wages, which typically change with production volume.

- Variable Costs = Total number of units produced x Average Variable Cost per unit

This equation shows a direct relationship between the average variable cost per unit and production volume. So, manufacturing more units will increase variable costs, while manufacturing less will decrease them.

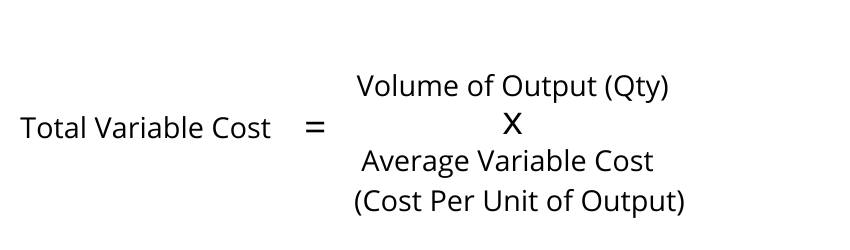

The formula for calculating the Total Variable Cost is straightforward. To calculate it, you will need the number of units produced (total quantity of output) and average variable cost (i.e. cost per unit of output).

You can derive the Total Variable Cost for a specific duration by multiplying the average variable cost by the volume of output (measured in quantity).

Here’s the Variable Cost Formula:

Sample Example

Now, let us take an example for variable cost of a small-sized company that produces computer hard disks. The average variable cost (per-unit cost) of each hard disk is $80. The company produces a total of 2,000 quantities. Thus, the Total Variable Cost is $160,000 (2000*80).

The Variable Cost will go down to $80,000 (1,000*80) if the company produces only 1,000 quantities. Similarly, if the company increases the production to 3,000 quantities, the Total Variable Cost will be $240,000.

Variable Cost vs. Average Variable Cost

Though closely related, variable costs and average variable costs are different. Average variable costs represent variable costs for all units produced over some time, which gives an average of the variable costs. They are calculated by dividing total variable costs by total output.

- Average Variable Costs (AVC) = Total Variable Costs / Total Output

For example, for a ready-to-eat food manufacturer, if the price of edible oil was low at the beginning of the year, and later the price increased, the average variable costs remain low. Because the calculation averages the low and high prices of the raw material.

Use variable cost when you want to have a real-time view of the costs of producing each additional item. Average variable cost, in contrast, is used for evaluating overall production efficiency and viability over a specific period.

What are the Benefits of Variable Cost Analysis?

As we’ve discussed the Variable Cost meaning, examples, and formula, let us discuss how the Variable Cost Analysis helps businesses in various ways from reducing Variable Expenses and making data-driven decisions to fine-tuning their pricing strategies.

1. Reduce Production Costs

The cost of production consists of both fixed and variable costs. While the fixed cost remains the same, the variable cost increases with the volume of production. Analyzing the Variable Cost can help the company find ways to reduce it. Reduction in the Variable Cost translates into lower variable expenses and production costs.

2. Avoid Under-pricing

When the actual product price is much below the face value of the product, it is said to be underpriced. A product can be underpriced due to various reasons such as market competition, increased material cost, or it may be an intentional decision. Analyzing Variable Costs allows the company to deal with such situations effectively.

3. Identify Break-even Point

The Break-even Point is the state during the manufacturing process at which both the production cost and revenues become equal. In other words, the company covers the entire cost of production. Understanding the Break-even Point enables the business to forecast future profitability, set revenue targets, and make informed decisions to fulfill them.

4. Track Progress

Variable Cost Analysis is an effective way of comparing the company’s targeted production costs with the actual costs to ascertain the effectiveness of the business strategies. Such a comparison can help identify any discrepancies in meeting the desired targets and take timely actions to prevent future occurrences.

5. Fine-tune Pricing Strategies

Variable cost analysis provides a deeper understanding of the company’s cost structure. The decision-makers can accordingly fine-tune the pricing strategies and adopt the best pricing model such as value-based pricing, competitive pricing, dynamic pricing, etc. A thoroughly planned and well-structured pricing strategy contributes to the overall financial health of the organization.

Difference Between Fixed Cost & Variable Cost

Here’s the tabular difference between Fixed Cost and Variable Cost:

| Fixed Cost | Variable Cost | |

| Meaning | Fixed Costs are the costs that do not change irrespective of the changes in the output. | Variable Costs are the costs that change in proportion to the changes in the output. |

| Nature | The fixed cost remains the same over a while, even if the production activity is stopped. | The variable cost changes with the changes in output |

| Examples | – Salary (other than salaries for part-time workers) – Depreciation on fixed assets – Property taxes |

– Wages for part-time workers – Sales commission to partners – Credit card fees |

| Alternate Meanings | It is also known by other names such as Overhead Costs, and Period Costs. | It is also known by other names such as Prime Costs and Direct Costs. |

Tips for Reducing Variable Cost

Businesses can implement a series of measures to reduce the Variable Cost and gain cost efficiency. Here are some tips & tricks:

1. Automate Tasks

The easiest way to reduce the Variable Cost is to adopt automation. Modern businesses leverage robotics and technology to speed up the manufacturing process, minimize human errors, and lower their Variable Cost.

2. Technological Adoption

Businesses can bring down Variable Costs by bringing a transformative approach to their manufacturing process. They can adopt new technologies & innovations such as automation, Cloud ERP, and the Internet of Things (IoT) devices.

3. Reduce Procurement Costs

Another way to reduce the Variable Cost is to negotiate with your vendors and ask for a fair price, or look for cheaper substitutes. Reducing your procurement cost will ultimately bring down the cost of production and increase profit margins.

4. Better Inventory Control

Businesses can implement an inventory management system to lower their inventory costs. Strict inventory control helps free up their capital from being tied up, minimizes inventory waste, and reduces the amount of stock-outs and overstocking.

5. Employee Training

Conducting regular employee training sessions is essential to improve employee productivity and reduce human errors. Training empowers employees with the necessary knowledge and skills, which reduces the monetary and time costs.

Final Words

Determining the Variable Cost enables businesses to compare actual manufacturing costs against the pre-planned budgeted costs, and effectively strike a balance between their marketing strategies and profits. An ERP software enables manufacturers to perform cost analysis, reduce excessive spending, and adopt lean manufacturing principles in their business.

Sage X3 is a next-generation ERP that provides vital tools to understand the company’s financial performance and make informed decisions to make substantial savings and minimize discrepancies. It provides a unified platform of information management that helps make the right pricing strategies, reduce variable expenses, and adopt cost-saving measures to achieve their pre-planned objectives.

FAQs

1. What is the Variable Cost Definition?

Variable cost meaning is the direct cost incurred during the production activity that fluctuates with the proportion of goods or services produced. Every business engaged in producing goods or services analyzes the variable cost while planning their production activity.

2. Can Variable Cost Impact the Business Profitability?

Yes, the Variable Cost can impact the business’s profitability. A higher variable cost can increase the cost of production and reduce the profit margin. In contrast, a business that manages to keep the variable cost under control while retaining product quality will be in a better position to expand its market share.

3. Is Variable Cost the Same as Marginal Cost?

Variable Cost and Marginal Cost are different, yet interlinked concepts. Variable Cost definition is the sum of all marginal costs incurred by the business during the production activity. It is a part of the Total Cost Structure. In contrast, a Marginal Cost refers to the cost incurred for producing an additional product unit. It is obtained by dividing the change in production costs by the changes in the production volume (defined in quantities).

4. What is the Difference Between Variable Cost & Average Variable Cost?

Variable Cost is the total direct cost incurred in proportion to the volume of production. In contrast, average variable cost refers to the per unit cost incurred during the production activity. Average Variable Cost is also known as the Average Cost for one unit of the product. Unlike Variable Cost, the Average Variable Cost is directly linked to the production activity and determines the cost per unit of production.

5. What is the Correlation Between Breakeven Point & Variable Cost?

The Breakeven Point and Variable Cost are both interlinked. Breakeven Point is the point at which the total revenue equals total costs incurred, resulting in a no profit- no loss situation. When the Variable Cost increases, so does the Break-even Point. Similarly, when the Variable Cost remains constant, the Breakeven Point decreases further.