THIS DOCUMENTS REFER’S THE CONFIGURATION OF INVOICING ELEMENTS (FREIGHT CHARGES, TCS) IN THE SALES PROCESS WITH THE PRODUCT TAX LEVEL.

- BP TAX RULE

- TAX LEVEL

- TAX DETERMINATION

- TAX RATES

- INVOICING ELEMENTS

- AUTOMATIC JOURNALS

- ACCOUNTING CODES

- IMPACTS

Configuration of Invoicing Elements for Sales in Sage X3

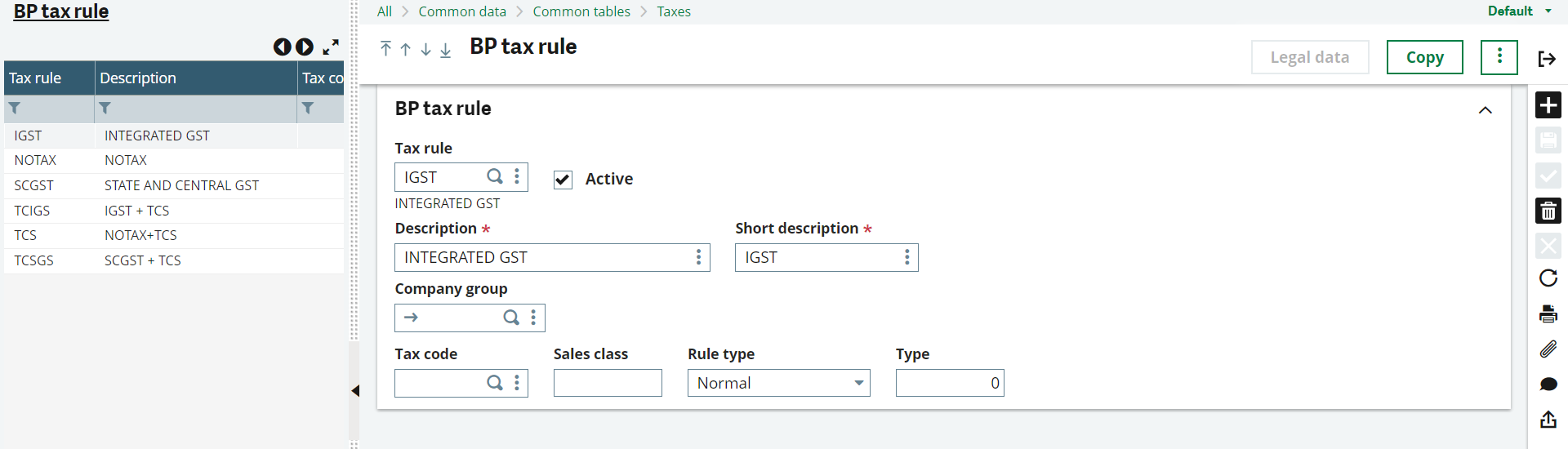

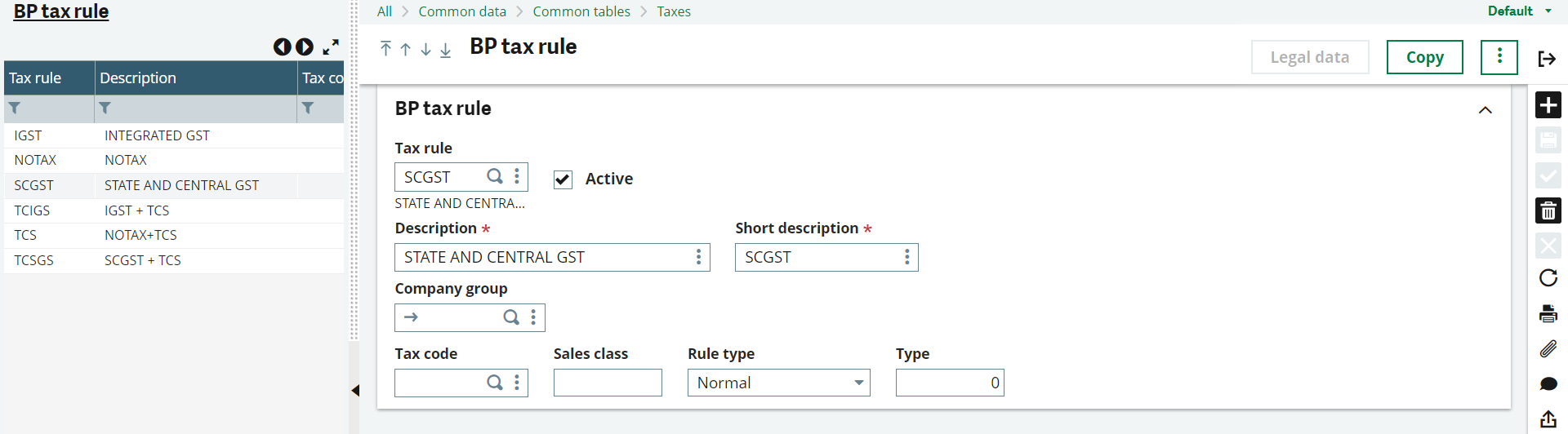

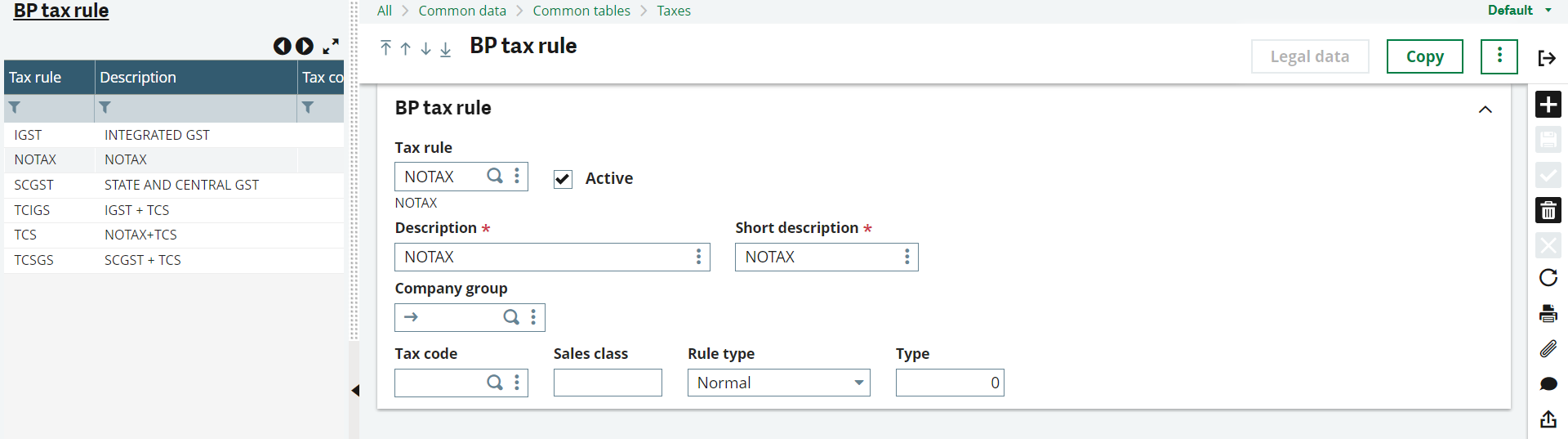

⇒ BP TAX RULE

PATH: COMMON DATA → TAXES → BP TAX RULE

CREATE THE TAX RULE’S AS MENTIONED IN THE BELOW IMAGE (For Example: IGST, SCGST & NOTAX)

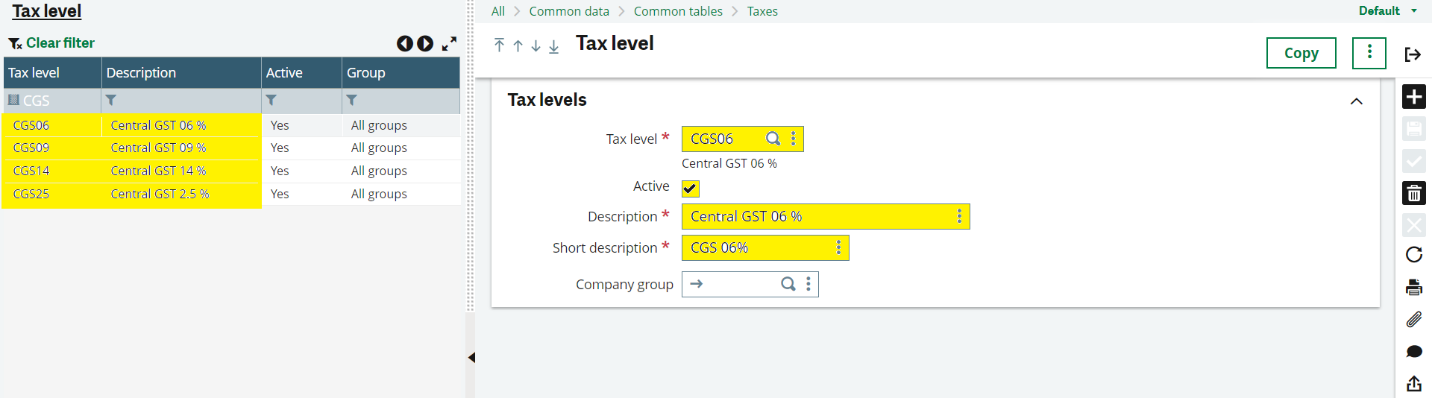

⇒ TAX LEVEL:

PATH: COMMON DATA à TAXES à TAX LEVEL

CREATE THE “CGST” TAX LEVEL’S AS PER THE REQUIREMENT (For Example: CGS2.5%, CGS6%, CGS9%, CGS14%)

Refer the Below Image:

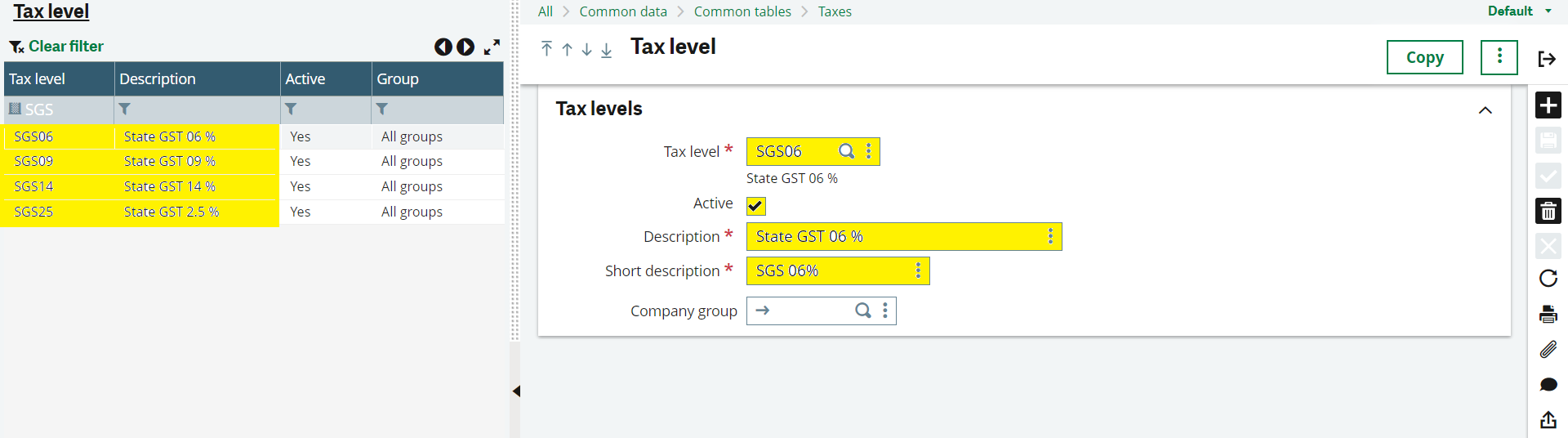

CREATE THE “SGST” TAX LEVEL’S AS PER THE REQUIREMENT (For Example: SGS2.5%, SGS6%, SGS9%, SGS14%)

Refer the Below Image:

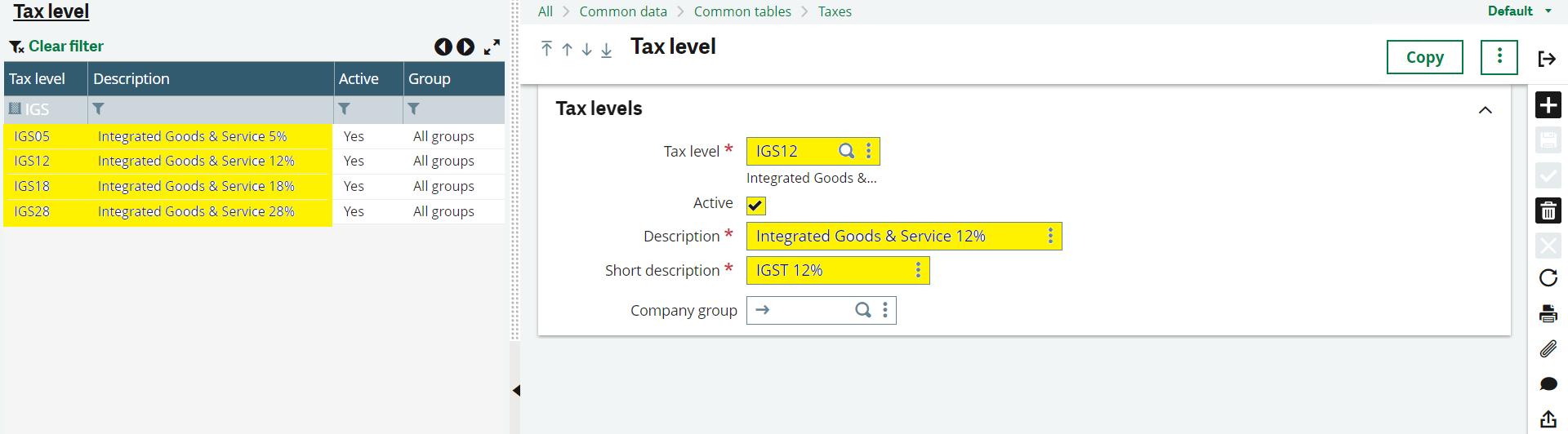

CREATE THE “IGST” TAX LEVEL’S AS PER THE REQUIREMENT (For Example: IGS5%, IGS12%, IGS18%, IGS28%)

Refer the Below Image:

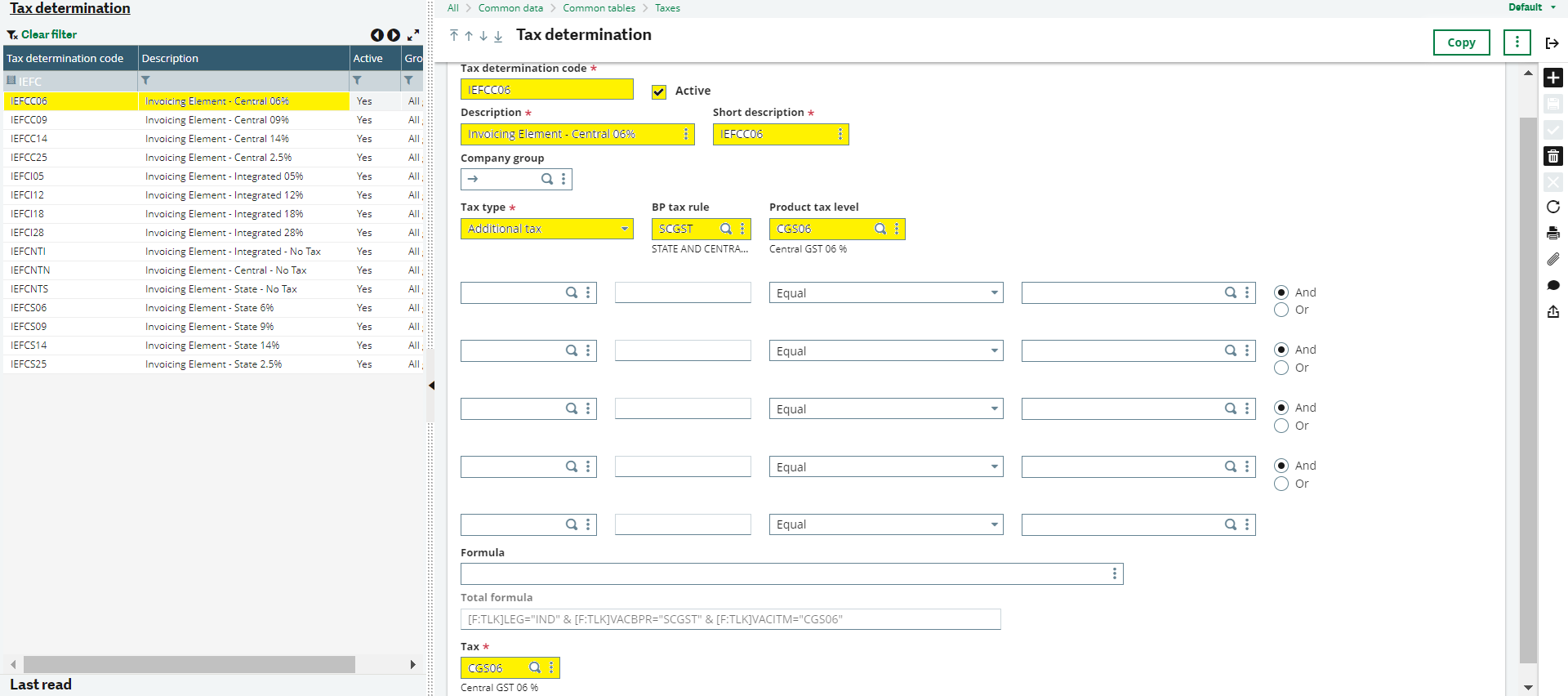

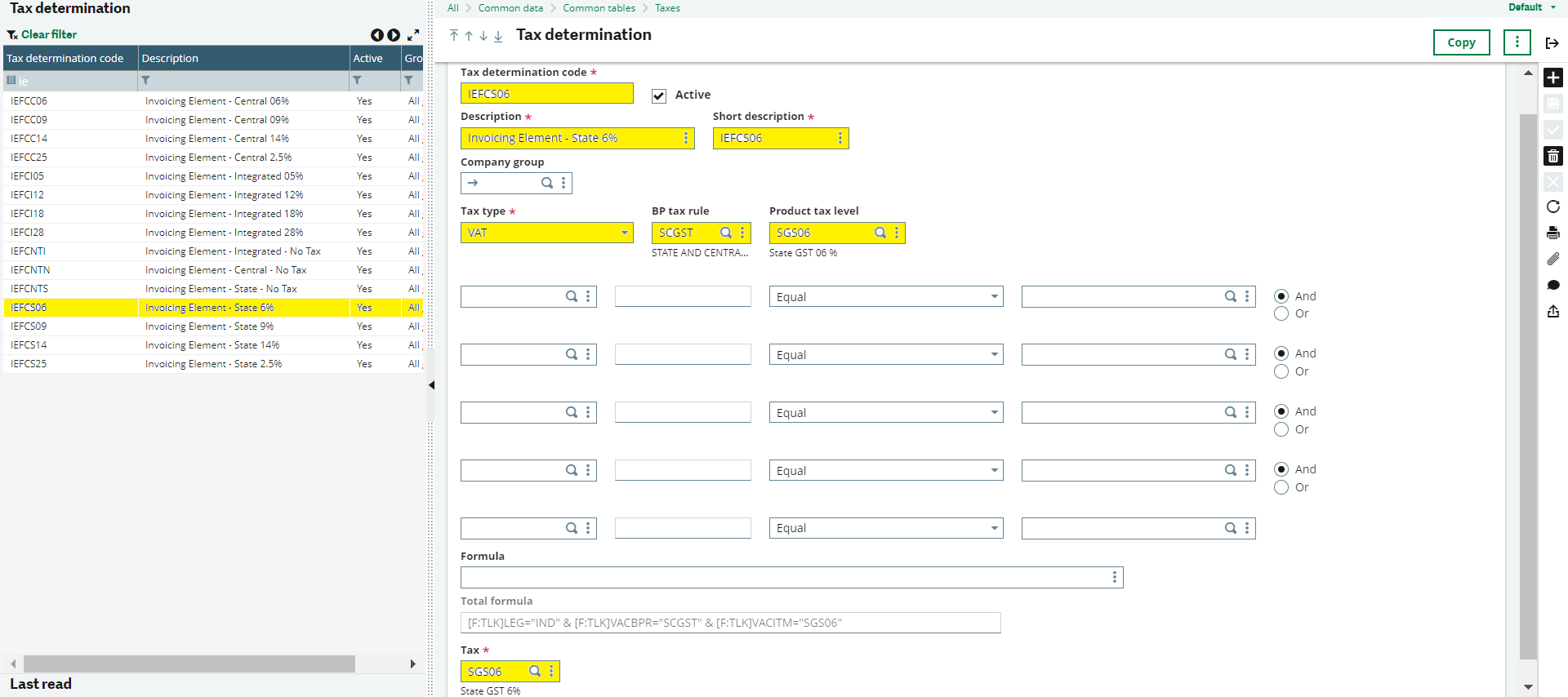

⇒ TAX DETERMINATION:

PATH: COMMON DATA → TAXES → TAX DETERMINATION

CREATE THE SEPARATE TAX DETERMINATION’S FOR THE INVOICING ELEMENTS (FOR ALL CGST LEVELS)

Refer the Below Image:

CREATE THE SEPARATE TAX DETERMINATION’S FOR THE INVOICING ELEMENTS (FOR ALL SGST LEVELS)

Refer the Below Image:

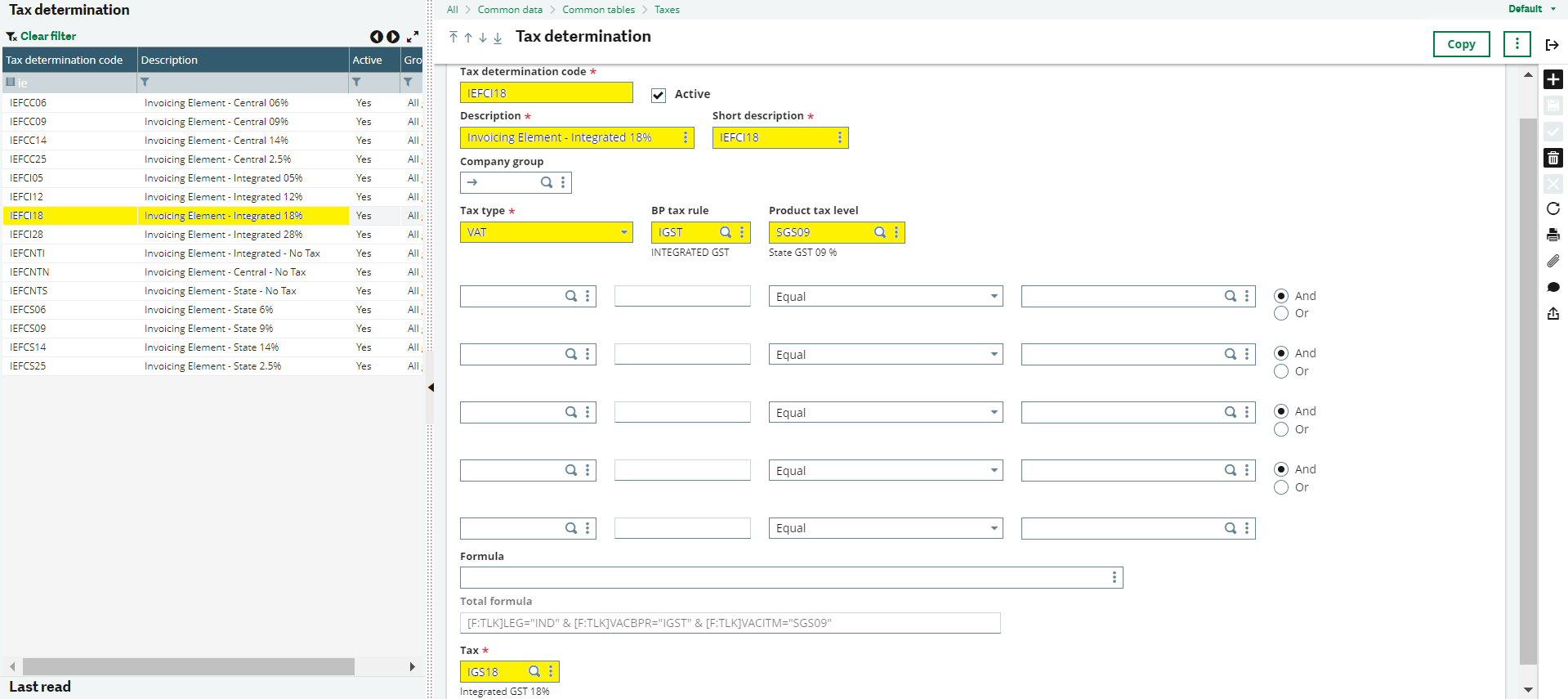

CREATE THE SEPARATE TAX DETERMINATION’S FOR THE INVOICING ELEMENTS (FOR ALL IGST LEVELS)

Refer the Below Image:

Also Read : Automatic Selection of Taxes based on Sales Site and Customer Delivery Location in Sage X3

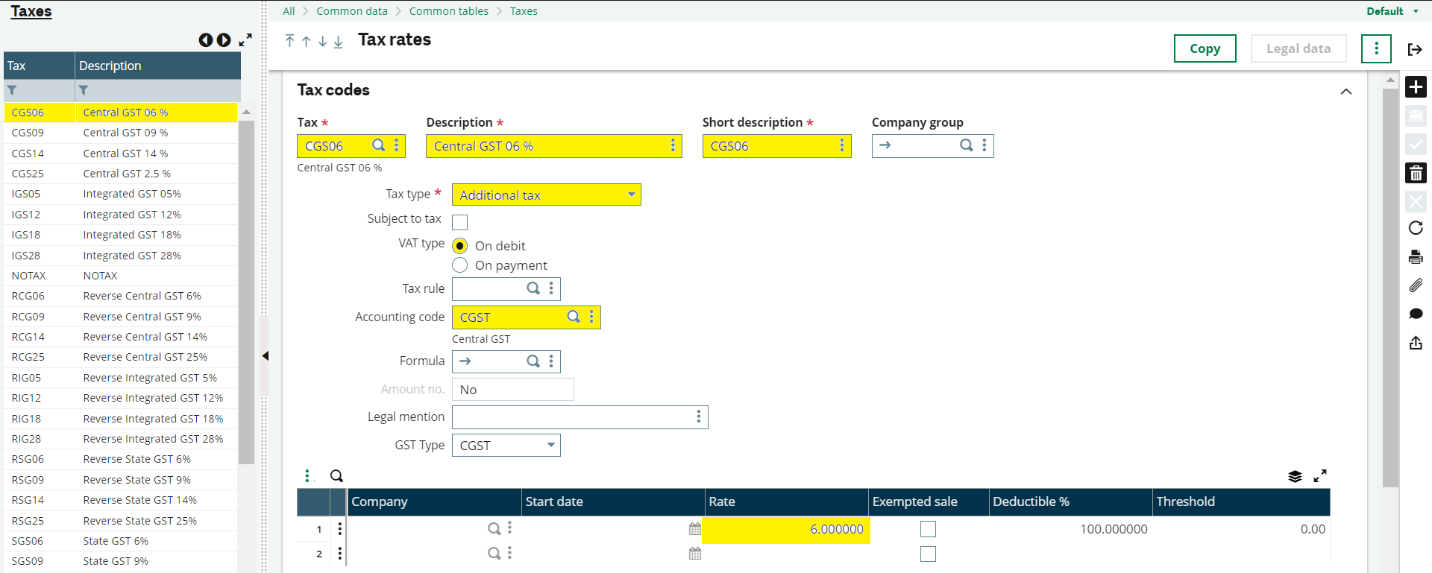

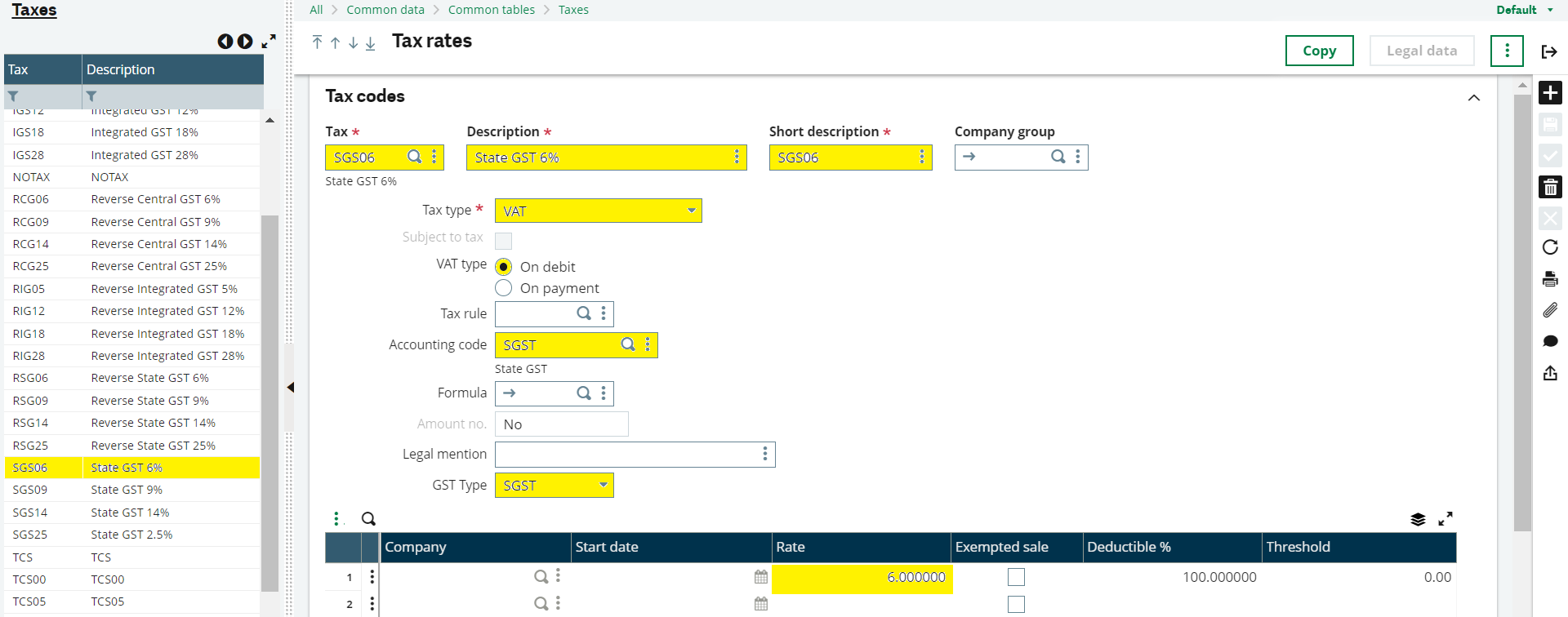

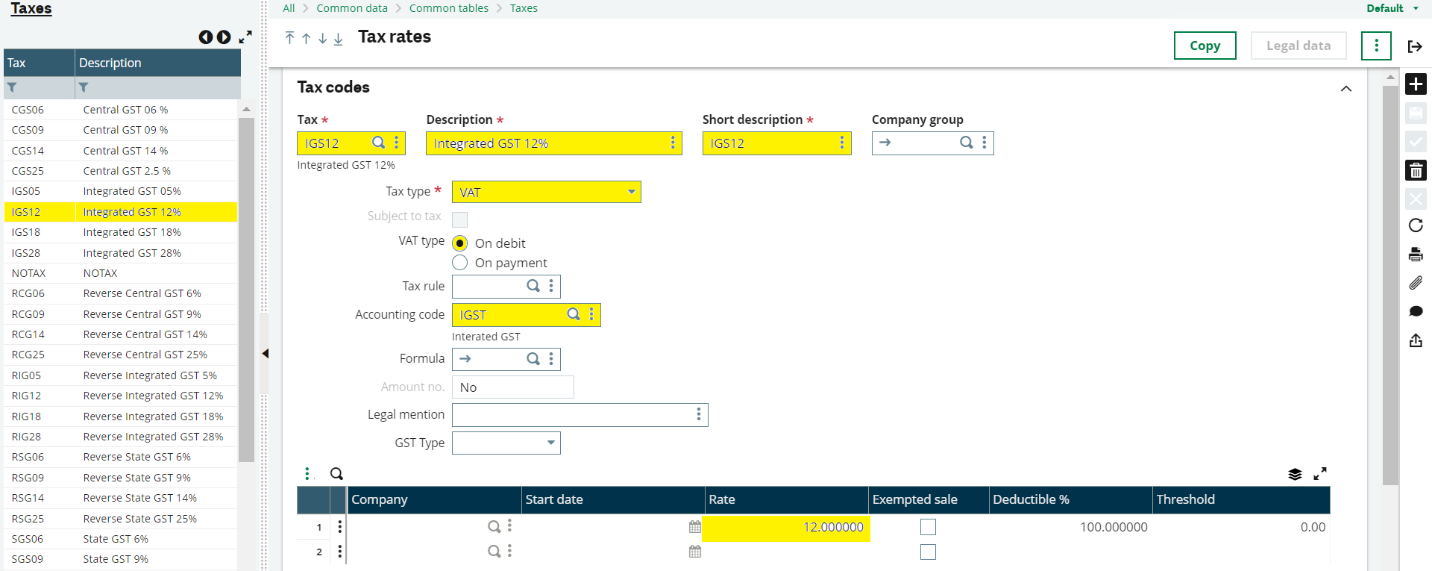

⇒ TAX RATES:

PATH: COMMON DATA → TAXES → TAX RATES

CREATE THE TAX RATE’S AS PER THE REQUIREMENT (For Example: CGS2.5%, CGS6%, CGS9%, CGS14%, SGS2.5%, SGS6%, SGS9%, SGS14%, IGS5%, IGS12%, IGS18%)

Refer the Below Image:

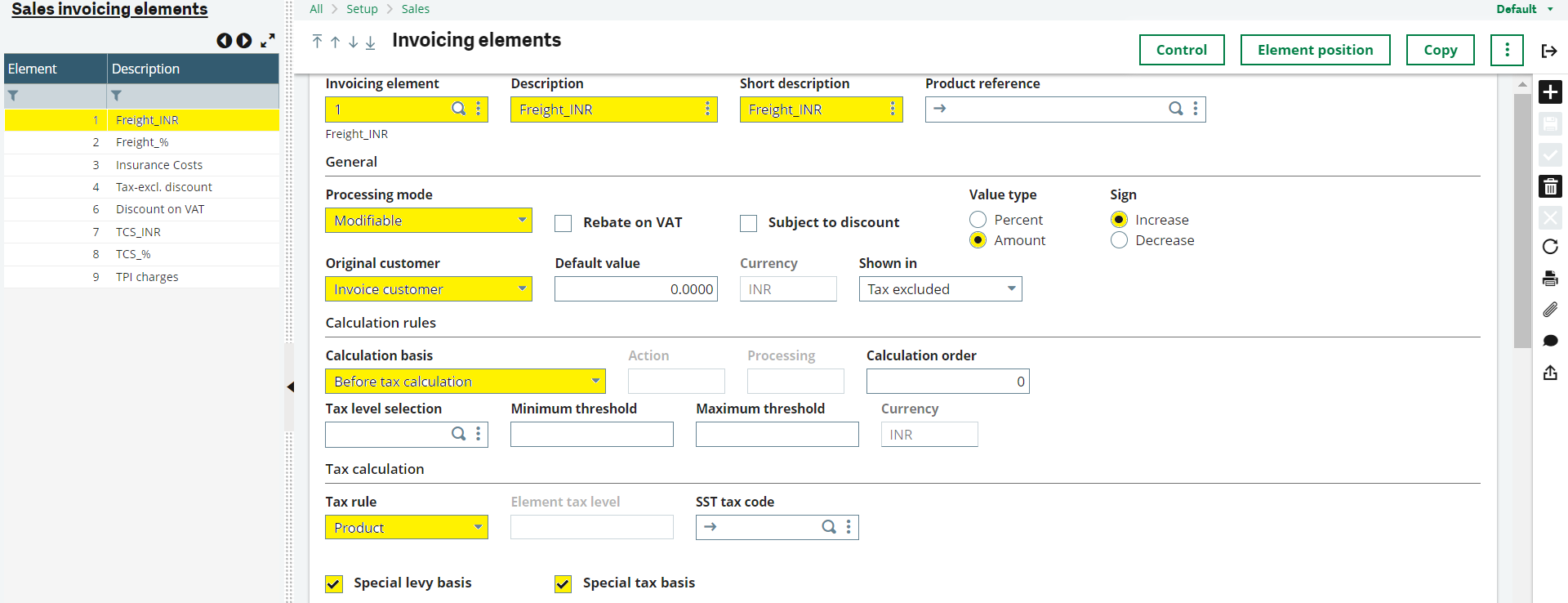

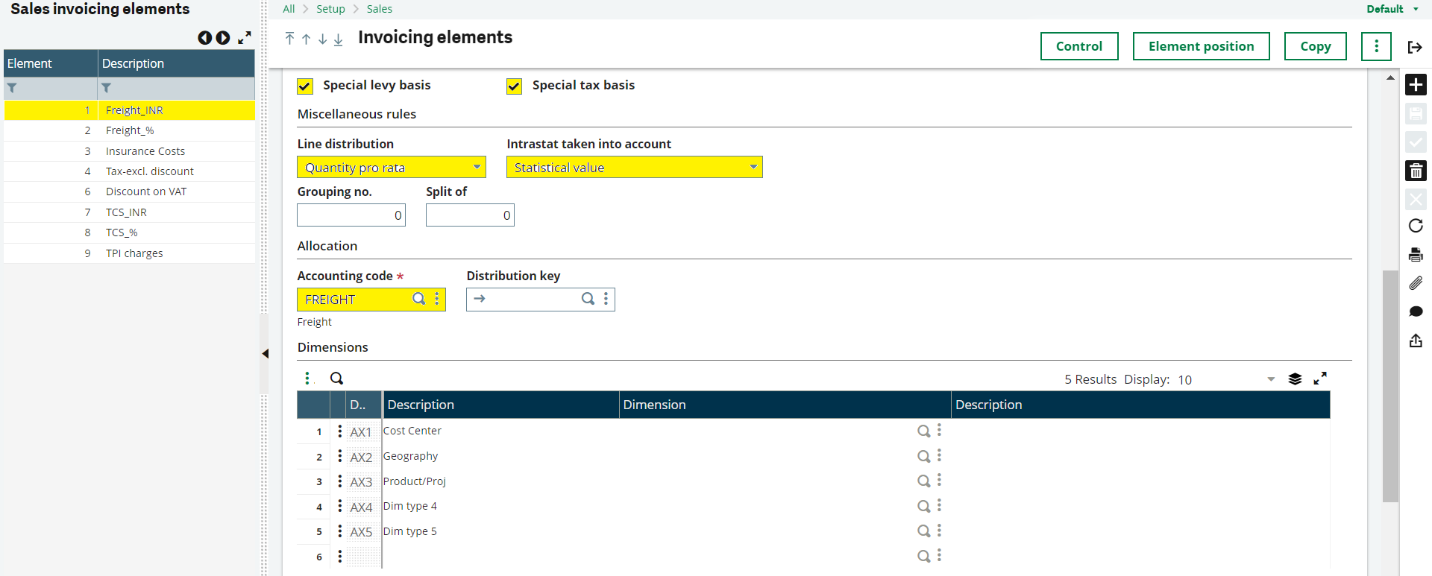

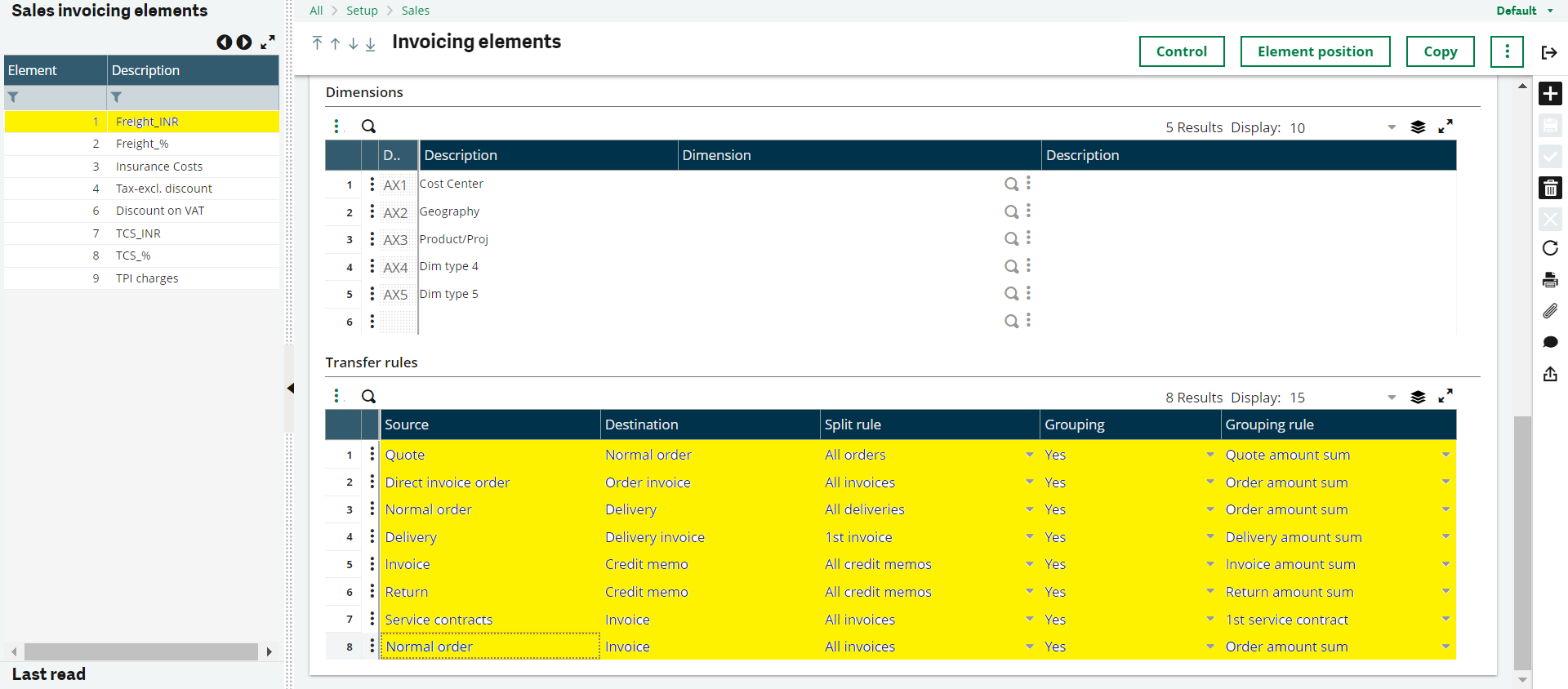

⇒ INVOICING ELEMENTS:

PATH: SETUP → SALES → INVOICING ELEMENTS

CREATE THE INVOICING ELEMENTS AS PER THE REQUIREMENT FREIGHT, TCS, INSURANCE (AMOUNT OR PERCENTAGE)

Refer the Below Image:

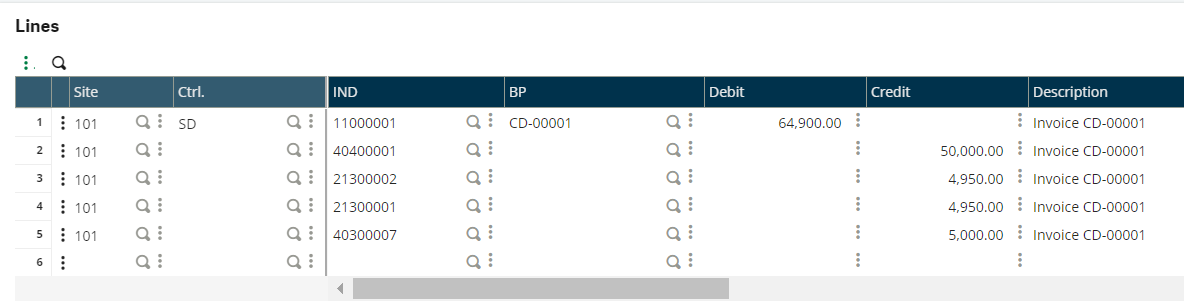

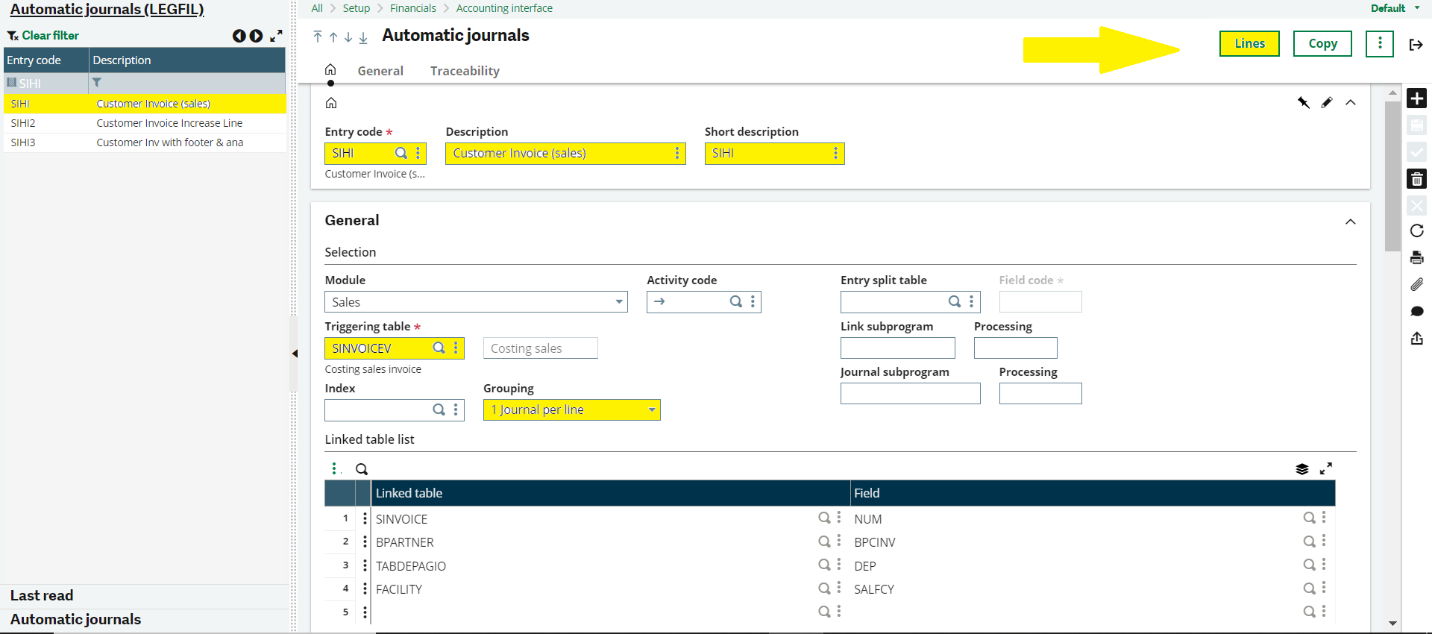

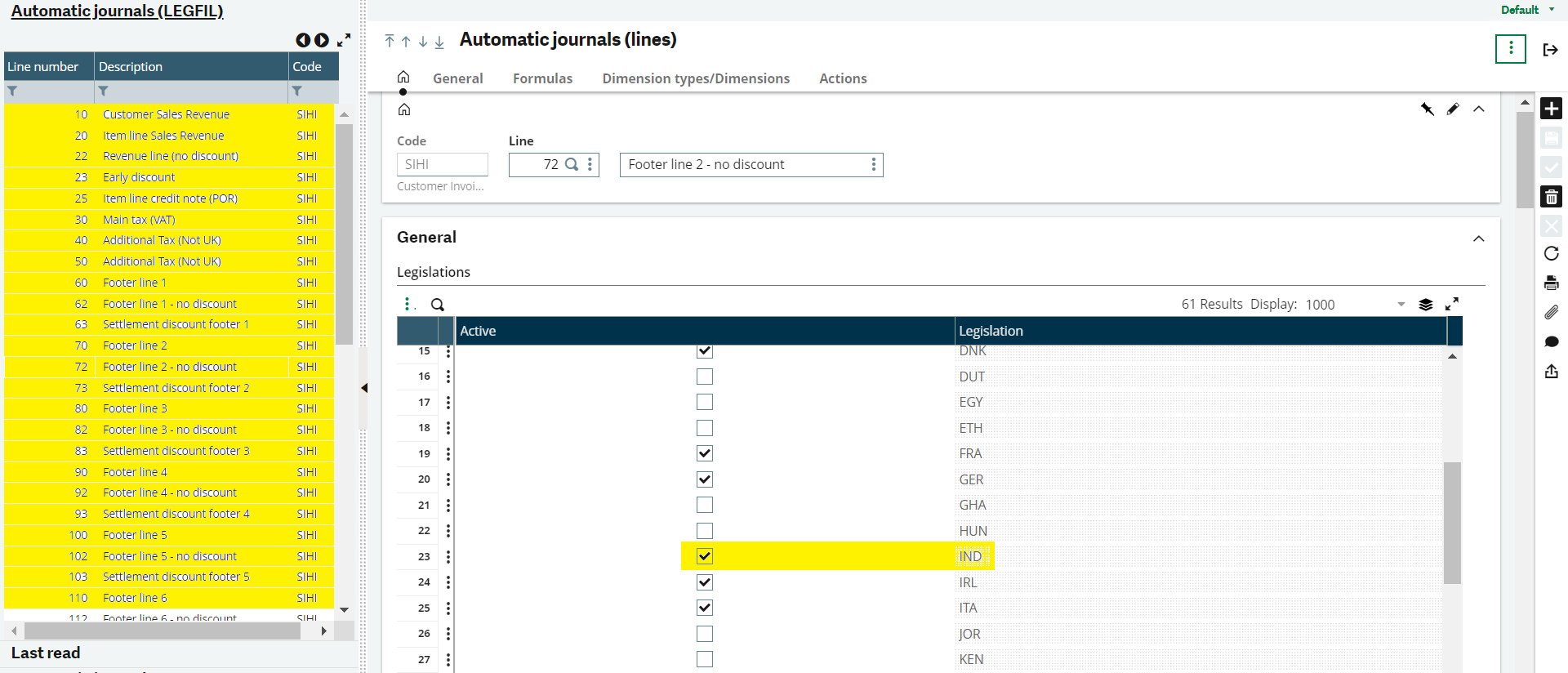

⇒ AUTOMATIC JOURNALS:

PATH: SETUP → AUTOMATIC JOURNALS → SIHI

SELECT LINES → MAKE SURE ALL THE IND SHOULD BE TICKED IN THE FOOTER LINE.

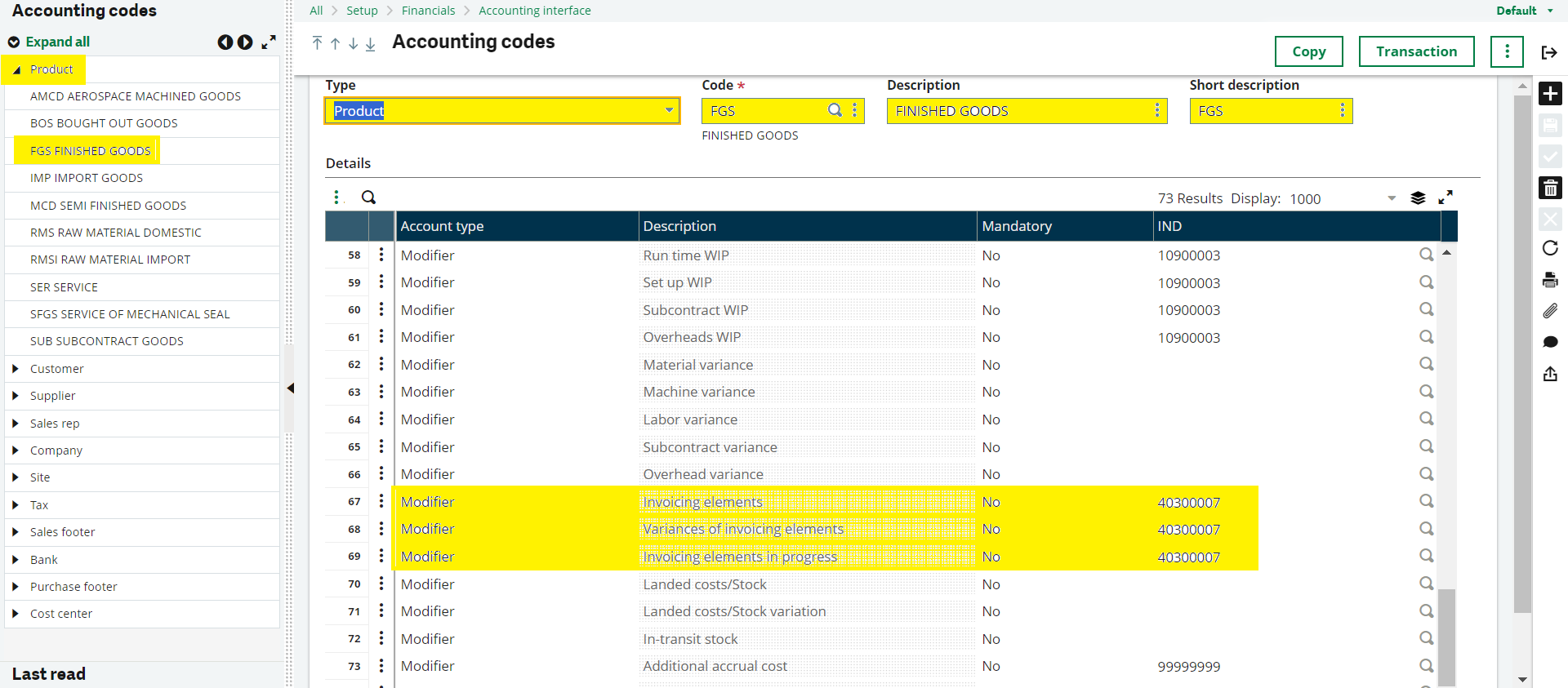

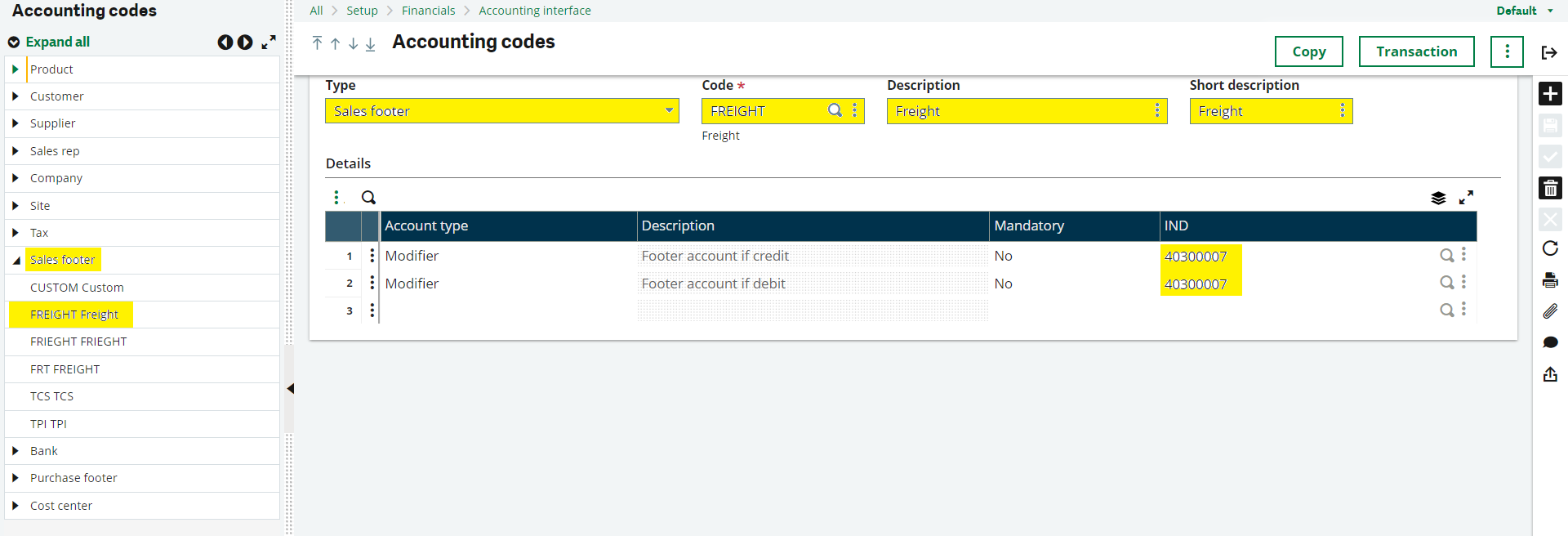

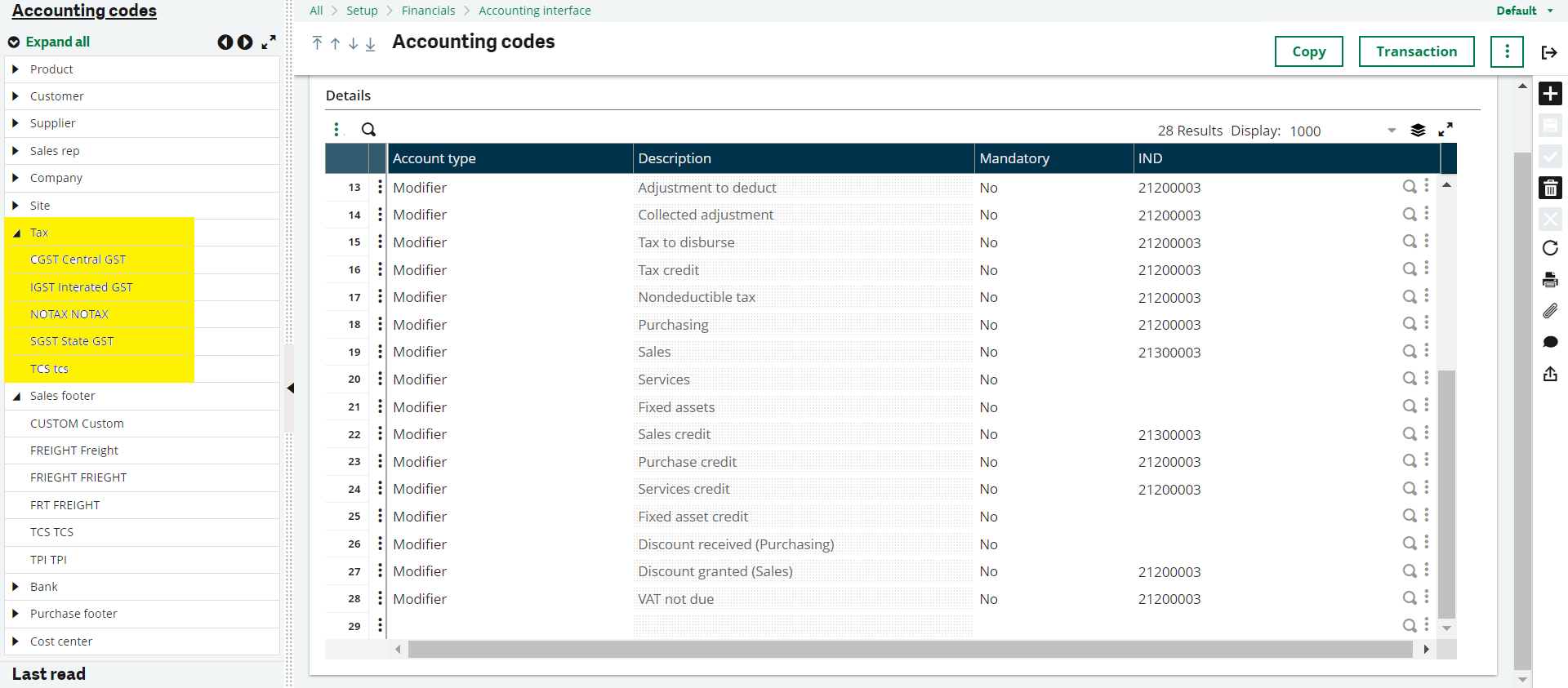

⇒ ACCOUNTING CODES:

PATH: SETUP → ACCOUNTING CODES

CHECK THE ACCOUNTING CODES FOR THE PRODUCTS, TAX, SALES FOOTER

⇒ SALES FOOTER:

⇒ TAX:

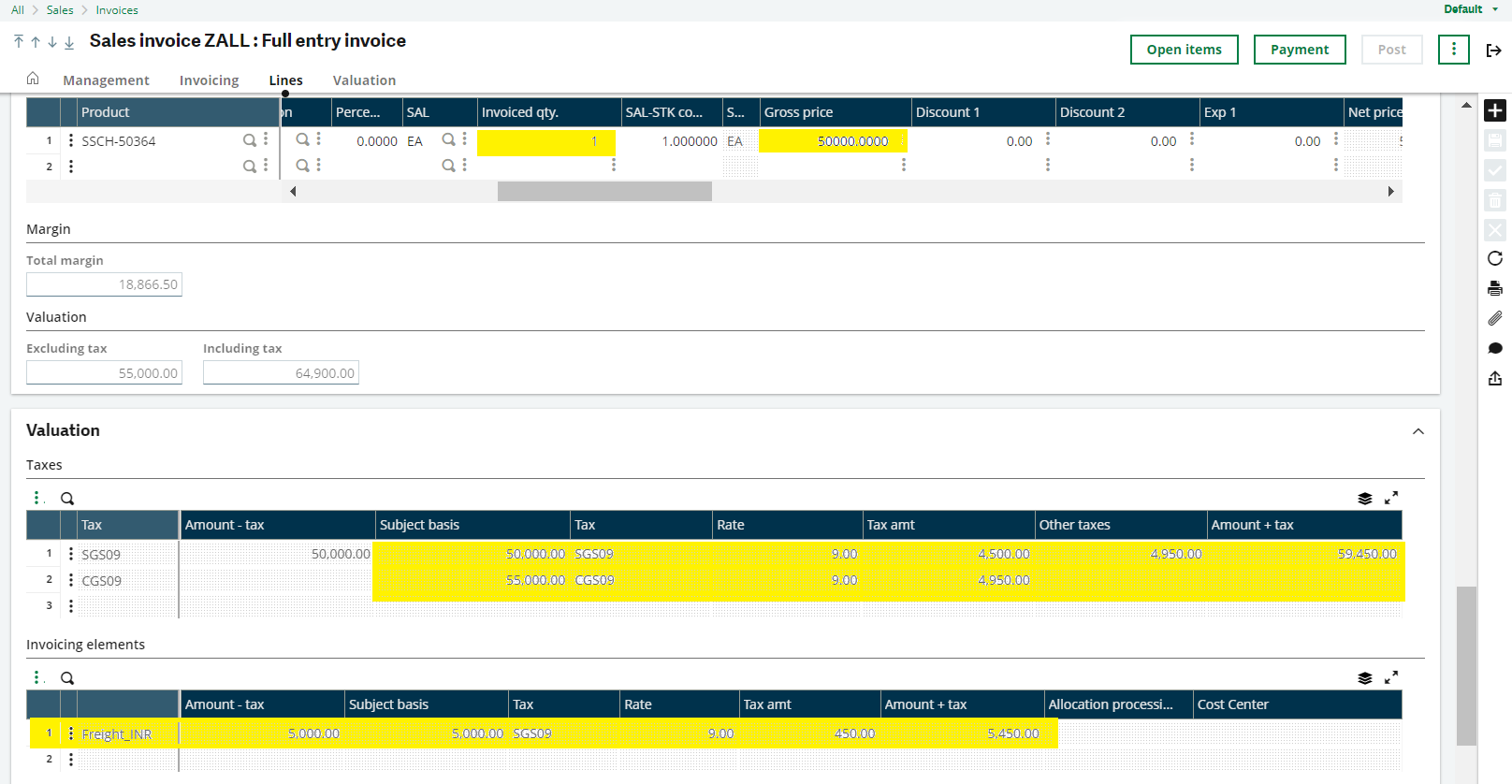

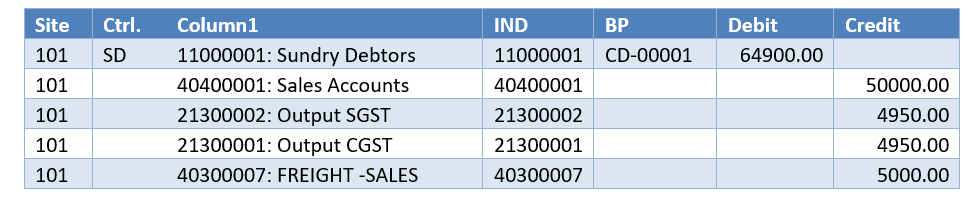

⇒ INVOICE SCREEN & IMPACTS: