TDS is an add-on (part of Indian Legislation) that helps users deduct TDS in a few clicks. In this blog, we will see how the TDS is deducted on Purchase Invoices & Supplier Advances in Sage X3. After the required configuration is done, which includes defining the TDS party and assigning TDS sections, TDS is automatically deducted from the TDS applicable transaction in Sage X3.

TDS is deducted in the below-mentioned transactions in Sage X3:

- Purchase Invoice

- Supplier BP Invoice

- Advance Payment transactions

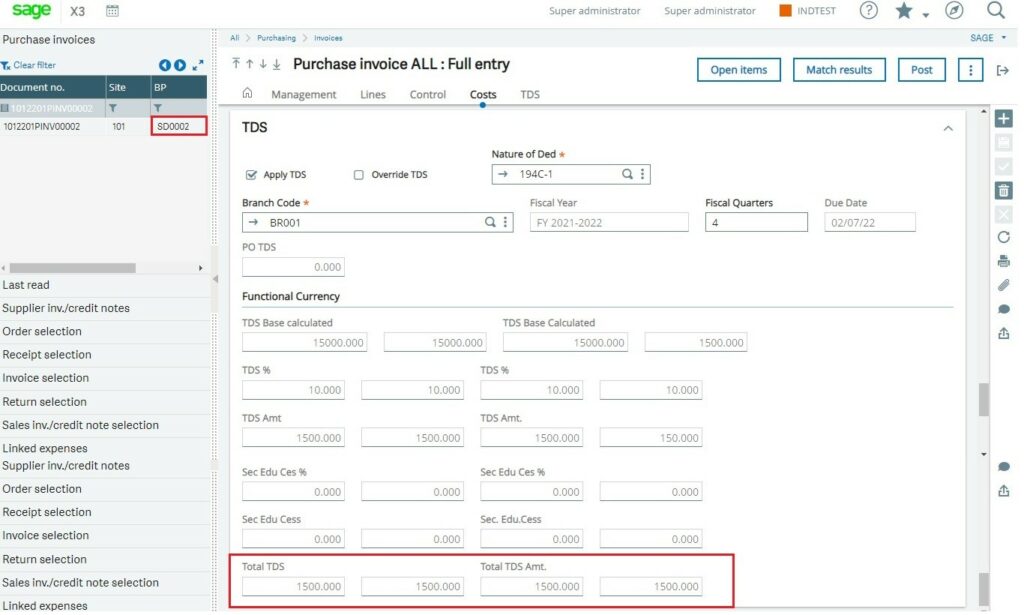

TDS Deduction on Purchase Invoices:

Path: Purchasing -> Invoices -> Invoices

[TDS Deduction in Purchase Invoice]

As you can see in the above screenshot, TDS is an additional tab added on Purchase Invoice screen. So, based on the configuration done in the TDS module, all the relevant information gets automatically flown to the TDS tab, including TDS branch, Nature of deduction, Fiscal Year, Fiscal Quarter. So, in the above example, the invoice value for supplier SD0002 is 15000 with a 10% TDS deduction. Therefore, the final TDS amount is [(15000*10)/100], i.e., 1500. Also, here is an option to override the TDS base if there is any additional deduction the user wants to deduct.

Once the invoice gets posted, TDS deducted amount gets credited to the TDS payable account. As a result, an additional TDS line gets created in invoice JV with the TDS amount as in the credit section. Similarly, TDS transactions work for Supplier BP invoices.

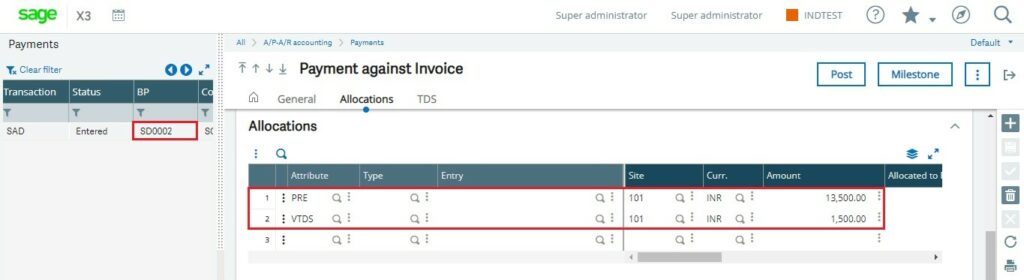

TDS Deduction on Supplier Advance Payment:

TDS deduction on Supplier advances is also similar to Purchase Invoices, but there is a slight difference in the transaction.

Path: A/P-A/R Accounting -> Payments -> Payment/Receipt Entry

[Supplier Advance – VTDS]

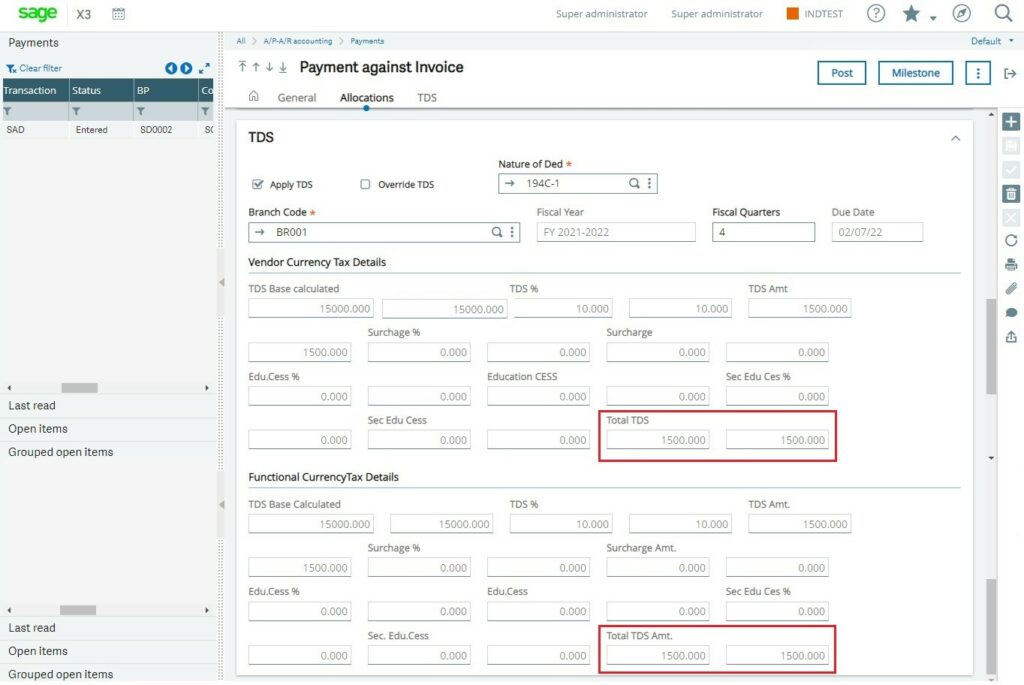

In the Net Payable field inside the Supplier Advance entry, we will enter 15000 amounts for the supplier SD0002. Then in the first line, the user will use the PRE attribute for advance amount and press the ‘Tab’ key. After that Amount (after TDS deduction, i.e., 15000-1500) will be populated automatically in the grid, i.e., 13500. Then in the second line user has to enter the VTDS attribute for TDS Amount, i.e., 1500, manually (Refer to above Screenshot). But in the TDS tab, the TDS amount will be automatically calculated as it was calculated in the Purchase Invoice and Supplier BP Invoice Transactions (Refer below Screenshot).

If you have observed, TDS amounts are getting displayed in both the currencies – Vendor Currency and Functional Currency in the TDS tab. And only after posting the invoices and advance payments, TDS amount (which is getting displayed in the TDS tab) will be deducted for those entries.

In this way, TDS deduction process for Purchase Invoice, Supplier BP Invoice and Supplier Advance Transactions in Sage X3.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.