What is Financial Modelling?

Financial Modelling is a process of developing a conceptual model and a numerical representation of the company’s operations and current financial position in an Excel spreadsheet with the help of a versatile set of financial models to assist decision-makers in anticipating the company’s financial performance and stock movements in the future.

Financial Modelling is a crucial activity used by bankers, public accountants, and institutions for their unique business needs. For example, it allows bankers to estimate the value of stocks, bonds, and real estate, and make informed decisions pertaining to Investment Banking. Public accountants use it for diligence and valuation purposes. Similarly, it assists large institutions with portfolio management, research, and asses & mitigates potential risks.

Top 10 Common Uses of Financial Modelling

Financial Modelling involves building a mathematical model that assists decision-makers in various scenarios and making crucial business decisions.

- Financial modeling is used for planning and forecasting of business activities

- Making data-driven decisions after a thorough analysis of the company’s financial statements

- Assessing the wealth of business to get insights into the company’s resale value

- Financial modeling is also used for securing funding for the business through equity & debt

- Acquisition of small & mid-sized businesses to increase the turnover & benefit from expansion

- Capital acquisition of new assets such as machinery, vehicles, furniture, and intellectual property

- Selling business assets as part of the cost-saving measures and reducing negative cash flow

- Financial modelling is an integral part of management accounting for budgeting

- Financial modelling is extremely useful in strategic planning and A&B Testing

- Allocating organizational resources for better & productive usage

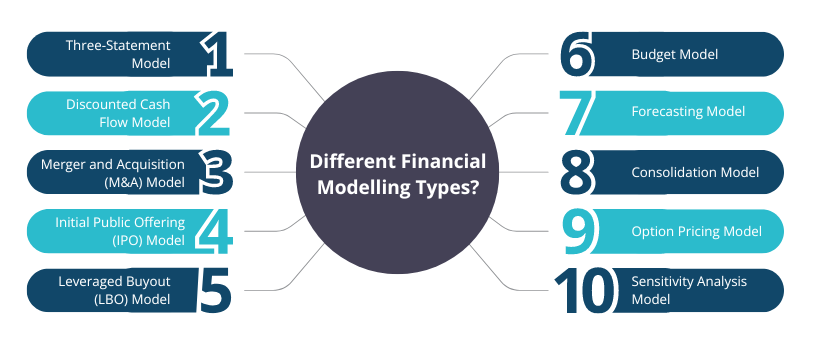

What are the Different Financial Modelling Types?

Now that we’ve understood what is financial modelling and what are its common uses, let us discuss ten financial modelling types.

1. Three-Statement Model

This model contains the most basic configurations. It dynamically interlinks Income Statements, Balance Sheet, and Cash Flow Statement in Microsoft Excel to make futuristic predictions. It requires solid Excel and analytical skills.

2. Discounted Cash Flow Model

This fin modeling type is built on the earlier Three-statement Model. It takes the Net Present Value (NPV) into consideration to forecast the value of an investment in the future. It is commonly used in the equity research firms.

3. Merger and Acquisition (M&A) Model

This is a comparatively advanced model. It is commonly used in corporate development and investment banking firms to determine the impact of future acquisition on the company’s cash flow & financial position.

4. Initial Public Offering (IPO) Model

Initial Public Offering (IPO) is the process of transforming a private entity into a public entity. The IPO Model thoroughly examines the potential investment in the company’s IPO. This helps decision-makers make strategic decisions beneficial for stock trading in the secondary market.

5. Leveraged Buyout (LBO) Model

The Leveraged Buyout (LBO) fin modeling type is complex in nature. It contains in-depth information and circular references about the company’s capital structure. The object of this model is to ensure higher returns on equity investments.

6. Budget Model

Financial modelling types also include a Budget Model. Supported by the Income Statement, the Budget Model ensures that decision-makers align their activities and decisions with their ultimate financial objectives. This model is based on both historical data and a set of assumptions.

7. Forecasting Model

As the name describes, the Forecasting Model gathers historical data about the company’s sales, revenues, and expenditures. It involves detecting new trends, anomalies, and external factors that can influence the pre-planned results.

8. Consolidation Model

The Consolidation Model consolidates data from multiple business units into a single model for further analysis. The nature of this model makes it deeply complex where the data is stored in a structured format, and categorized by the name of the business unit, duration, and other factors.

9. Option Pricing Model

This model deals with the options (derivatives) in the financial markets. The Option Pricing Model plays an important role in helping decision-makers consider different probabilities and make strategic decisions to control highly-fluctuating derivatives segments.

10. Sensitivity Analysis Model

Decision-makers use this model to determine the impact of independent variables on the dependent variables. Apart from the finance field, this model is highly popular in other fields such as geography, biology, and economics.

What are the Components of Fin Modeling?

Now that we’ve define financial model and different fin modeling types, let us discuss the key components of Financial Modelling:

1. Income Statement

An Income Statement is a record of all the organizational revenues and expenditures for a specific duration such as a year or a quarter. It provides information pertaining to the source of the revenue generated and where the organization spends it during an accounting period. The Income Statement is concluded with either a Net Profit or Net Loss. Net Profit denotes that the organization’s income surpasses expenditure, and Net Loss denotes that the expenditures surpass income.

2. Balance Sheet

Balance Sheet is a statement that outlines fixed & current assets, fixed & current liabilities, and equities of the business. It is prepared either at the end of the year or every quarter. It helps shareholders and potential investors understand what the company owns and owes to others. As the assets are equal to liabilities and capital, the Balance Sheet must always tally. Besides, it must bear the signature of an Auditor to be considered valid.

3. Cash Flow Statement

Cash Flow Statement is a statement that tracks the inflows and outflows of cash. The cash inflows depict how the organization earns money from external investment sources and its day-to-day business activities. In contrast, the cash outflows depict how the organization incurs expenditures for its everyday activities and projects. This helps decision-makers optimize their cash flow and increase business profitability.

4. Debt Schedule

Simply speaking, a Debt Schedule is a table that shows monthly debt payments to enable tracking debts and debt obligations such as loans, bonds, and leases. It helps decision-makers understand the impact of debts on the business and whether there is sufficient working capital for the company’s everyday activities. Decision-makers use a variety of ratios to make strategic decisions pertaining to existing debts.

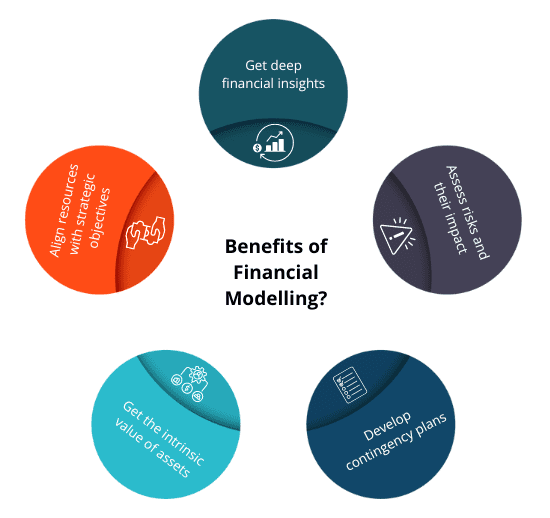

What are the Benefits of Financial Modelling?

As we’ve already discussed what is financial modeling and what are its types and components, let us now discuss how Fin Modelling offers a host of benefits for businesses of all types and sizes.

1. Financial Insights

Financial Modelling provides deep insights into the company’s record and performance. As a result, decision-makers get real-time insights into the cash flow issues, expenditures, incomes, operational profits, and other factors that can impact the company’s stability & growth.

2. Risk Assessment

Financial Modelling helps decision-makers sift through crucial financial data, evaluate different scenarios, and understand the potential impacts of their decisions. They can identify whether the benefits of their decisions outweigh the risks.

3. Develop Contingency Plans

The use of financial modelling helps businesses anticipate cash inflows & outflows, and gain quantitative information about the company’s financial health & performance. With access to the right information, they can identify pitfalls, and develop contingency plans.

4. Business Valuation

Fin Modeling is a useful tool to ascertain the intrinsic value of organizational assets and determine whether an asset is under-valued or over-valued. A financial model helps make informed decisions during acquisitions and mergers.

5. Foster Growth

Fin Modeling empowers businesses with quick formulas. Decision-makers can identify high-growth areas, analyze market conditions, and align their resources to improve productivity & reduce inefficiencies.

Transformative Role of ERP in Fin Modeling

ERP Solution is a tailored application that transforms traditional business processes and provides automation & advanced algorithms to streamline business processes including financial activities.

Businesses across the world are adopting ERP to benefit from analytical tools. Now, let us understand how ERP streamlines the Fin Modeling process.

1. Auto Generate Financial Reports

ERP simplifies the complex, error-prone, and time-consuming task of financial report generation. It reduces discrepancies in creating Cash Flow Statements, Income Statement, and Balance Sheet. By reducing discrepancies, a business can prevent fines, penalties, and legal proceedings.

2. Financial Visibility

Other benefits of ERP include complete financial visibility. It provides decision-makers with a 360-degree view of financial models and business operations. It comes with powerful data filtering capabilities so that businesses can filter and format their data.

3. Ratio Analysis

ERP automates the process of monitoring important financial ratios to get up-to-the-minute information about a company’s financial health & performance. For example, the Operating Profit Ratio enables businesses to measure the profit earned after bearing all operating expenditures.

4. Data Integration

ERP implementation pulls data from different sources and shows a Single Source of Truth that helps decision-makers understand the functional areas of the business that are driving the performance. They get access to several reports at their fingertips.

5. Data Analysis

With a dedicated ERP, decision-makers can develop budgets, and forecasts and visualize trends. Finding potential variances in the data becomes easier than ever. ERP transforms the traditional long & complex process of planning activities involved in a financial model.

Final Words

Financial Modelling is a complex process that takes significant time and requires access to current & historical data to analyze different scenarios and make futuristic assumptions. Given the complexity of today’s business environment, increasing competition, and economic uncertainties, decision-makers rely on ERP to better identify & mitigate risks, make informed capital-centric decisions, and achieve sustainable growth.

Sage X3 is an exceptional solution that streamlines financial modelling, credit management, and revenue tracking, among others. It is a full-fledged business planning & management tool that encompasses various modules for assisting decision-makers define budgets, analyzing the costs, and allocating organizational resources for optimum productivity & performance. By deploying it in your company, you can benefit from automation, data consolidation, and powerful financial and advanced analytical capabilities.

FAQs

1. What is the Financial Model Definition?

Financial Modelling meaning is that it is a process of forecasting the company’s financial health & performance and making futuristic assumptions about acquisitions, cash flow position, and valuation of business assets, through a structured framework.

2. What are Financial Modelling Examples?

Companies deploy financial models that suit their unique industry requirements. Here are some financial modelling examples:

a. Three-Statement Model

Purpose: The purpose of this financial modeling model is to make predictions pertaining to Profit & Loss A/c, Balance Sheet, and Cash Flow Statement.

Use Case: It is mostly used to anticipate the financial performance in the future.

b. Discounted Cash Flow (DCF) Model

Purpose: Analyze the worth of an investment and predict its future value

Use Case: Make data-driven decisions pertaining to new investments & projects to minimize losses and ensure optimum cash flow

c. Merger and Acquisition (M&A) Model

Purpose: Make predictions pertaining to business acquisitions & mergers to understand their potential impact on the company’s financial position

Use Cases: As per our financial modelling meaning, this model enables predicting the benefits of future acquisitions & mergers.

d. Initial Public Offering (IPO) Model

Purpose: Other financial modelling examples include IPO model that predict the financial performance of a private entity before it goes public

Use Cases: When the company is ready for an Initial Public Offering (IPO), it may help set up the correct Offer Price.

e. Leveraged Buyout (LBO) Model

Purpose: This financial modeling model assesses the company acquisition using borrowed funds as part of financial modeling

Use Cases: Determines the returns expected from a buyout

f. Budget Model

Purpose: This is a very useful financial modeling model that allows decision-makers to allocate a company budget for capital expenditures and general expenses.

Use Cases: It is helpful in analyzing company performance, decision-making, and planning activities.

g. Forecasting Model

Purpose: The purpose of this financial modeling model is to perform a thorough analysis of the historical data and make futuristic predictions.

Use Cases: Predict future revenue, expenditure & profitability of investments

h. Consolidation Model

Purpose: The purpose of this financial modeling model is to assess the financial performance of different units or departments within the organization.

Use Cases: Largely used for stock valuation & derivatives valuation

i. Option Pricing Model

Purpose: This financial modeling model deploys a range of mathematical formulas such as the Black-Scholes Model to calculate the value of the Options (Derivatives).

Use Cases: It is a critical financial modeling model used in the valuation of Stock Options and derivatives.

j. Sensitivity Analysis Model

Purpose: This financial modeling model helps decision-makers understand how the changes in key assumptions impact the performance of the company.

Use Case: Largely used for risk management & mitigation and to ensure regulatory compliance

3. How is Financial Modelling Done?

Traditionally, businesses used Microsoft Excel for financial modelling due to its versatile feature set. It is still highly popular, customizable & reliable because it offers an amazing ability to handle large datasets without freezing or crashing. However, there is a growing trend among businesses to adopt ERP due to its extensive capabilities and robust financial & analytical features. It enables them to perform Cash Flow Analysis, evaluate financial metrics of their projects, and prepare financial statements with a unified system of information management.

4. How to Ensure Your Financial Modelling is Audit-friendly?

There are several measures you can take to ensure your financial modelling is audit-friendly:

- Add Data Sources: For audit-friendly fin modeling, it’s always a good idea to add comments and relevant data sources (such as links to research reports) to your spreadsheet.

- Activate Error-trapping: Error-trapping feature (IFERROR) in Excel is useful to identify, trap and handle errors, and improve accuracy.

- Avoid Hard-coded Numbers: Avoid embedding hard-coded numbers and follow the “One Row = One Formula” formula to avoid common errors.

- Data Presentation: Specifying red, purple, blue, yellow, and grey color in your Excel cells is a good way of presenting the information. You can also automate this task using macros.

- Check for Duplication: Duplicate data can not only create confusion but also lead to discrepancies in the reporting & strategic planning. Remove it to preserve data integrity.

5. How Significant are Financial Modelling and Valuation Skills in the Finance Industry?

Financial modelling and valuation skills hold prominent importance in the finance industry for optimal model designs, understanding & mitigating financial risks, and following the best industry standards. It requires proficiency in accounting principles, valuation methods, and a deep understanding of fin modeling concepts.